Telecom industry hobbled by high taxes

The telecom industry of Bangladesh is caught in a paradox. It is indispensable to the country's digital ambitions, yet weighed down by regulatory complexity, high taxation and market fragmentation, according to Johan Buse, chief executive officer of Banglalink.

"If you look at what the regulator is doing and some of the proposed changes, it actually really looks like people are trying to make a change," he said in an interview with The Daily Star.

"But if you take a few steps back, history will tell you it is a highly fragmented, complicated market, highly taxed," added the CEO of the country's third-largest operator. "Basically, not a place you want to be, I guess. Which is sad. That is the word I always use, it is sad and it is unnecessary."

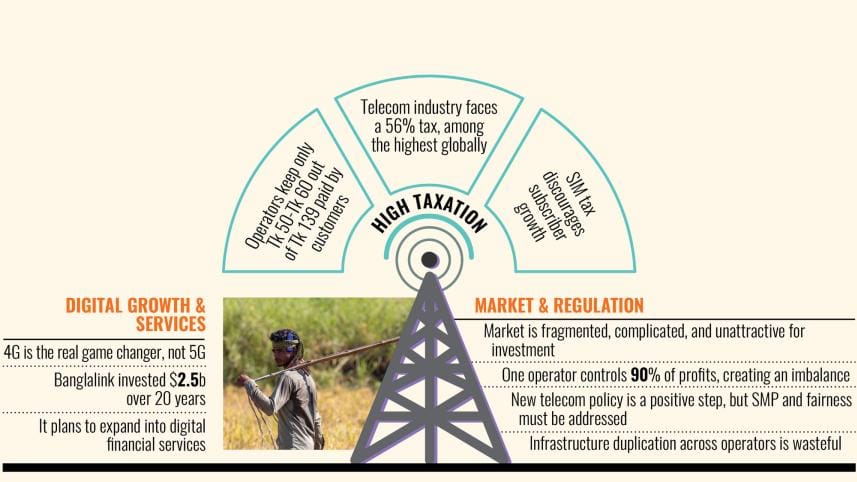

The telecommunications sector in Bangladesh now faces a tax rate of 56 percent. This rate far exceeds that of neighbouring India, where the tax is around 25 percent. The rate is 35 percent in Sub-Saharan Africa, 24 percent in the Middle East and North Africa, and 24 percent in the Asia Pacific region. The average rate is 21 percent in Europe and 18 percent across Latin American countries.

Buse, who joined Banglalink from Singapore's StarHub where he led the Consumer Business Group, has decades of experience across Europe, Asia and the Middle East. He previously worked at Ooredoo Oman as chief commercial officer and held senior roles at Deutsche Telekom Croatia, AXIS and Singtel.

Now at Banglalink, he said he faces the challenges of a market in transition, shaped by political shifts and regulatory change. "I think the telecom landscape here is in transition."

According to him, the role of telecommunications is no longer just about being an industry in its own right but enabling broader communication.

"In the good old days that was just 'hello, hello'. But today that is much more, we facilitate data connectivity. The real role has expanded from just connecting people via voice to connecting businesses, connecting devices. Because if you connect telco, data, cloud and AI, all of a sudden, the world starts looking very different."

Drawing a comparison with Singapore, he said the country had little to offer except for its fish industry 50 years ago. Today, it is a paperless digital hub where everything is app-based.

This digital transformation, he said, creates efficiency, ensures traceability and ultimately generates more taxable income.

Buse said Banglalink has invested heavily in building the digital backbone of Bangladesh.

"Over our past 20-year journey, Banglalink has made an overall investment of $2.5 billion," he said, adding that $300 million went into expanding the 4G network in the last four years.

For him, 4G is the real game changer. "…Because it provides the kind of speed and latency that enables people to do everything on their smartphones today."

The company's commitment, he said, is to bridge the digital divide. The CEO cited the role of technology in classrooms abroad.

"In South Korea and northern China, a lot of classrooms are fully digital. No chalkboard anymore, just whiteboards, cheap tablets, everything centralised and traceable. The teacher communicates directly with the child through devices. That is the future. And that is why we are here, to make sure anyone has access to the internet and data connectivity for a better life."

He said the reality for operators in Bangladesh is currently challenging. The first quarter of this year was "gloomy", Buse said, as customer numbers fell.

"The total sector has been declining in revenue since last year. That is partly due to changes in taxation and regulatory issues, which pushed us down as an industry," he said.

Still, he believes confidence is returning. "There are some positive trends coming to the industry."

On the shrinking customer base of Banglalink, Buse said the company chose to focus on quality subscribers rather than chasing inflated numbers.

"There is this myth that we have 180 or 190 million subscribers. We do not," he said.

"The real number of users is more between 70 and 90 million. Last year, we consciously decided not to go after what we call rotational churn, the washing machine. This is the only country I know that has a SIM card tax. No other country charges for a SIM. It is unbelievable."

Taxation, Buse believes, is the biggest obstacle.

"The total tax burden for the industry is around 56 percent. If a customer pays us Tk 139, we are left with between Tk 50 and Tk 60. That is a world record high for tax and a world record low for operators. That is an issue."

The CEO said such burdens make investment difficult.

Expanding a 4G network usually costs $300-$400 million a year, which the CEO called a "serious" commitment. "But regulatory imbalance has left one operator dominating profits."

"In every country, there is always a number one operator with around 50 percent of the market. But never have I seen before that they have 90 percent of the profit. That is the issue here."

Buse said, "If that persists, the other operators have a very difficult conversation with their investors. We are all part of international groups. Investment goes where returns are best. Bangladesh needs to make itself more attractive as an investment destination."

On the government's new telecom policy, Buse was cautiously optimistic. "The positive baseline is that, finally, there is action taken. There are initiatives going in the right direction, reducing fragmentation, improving quality, and recognising that telco is a scale business. That is positive."

On significant market power (SMP) regulation, he called for fairness.

"SMP should be tackled first. Number one, get the whole taxation regime sorted in a way that is attractive. Second, SMP is linked to fragmentation again. Create a framework where the smaller telcos have a viable chance to dip into the profit pool. It is not good for the country that one operator has 90 percent of the profit pool if you want to create competition."

Turning to Banglalink's digital ambitions, the CEO said they are certainly planning to venture into digital financial services.

"Half of Bangladesh is not banked. In our group, we have a proven track record in three countries, including Pakistan, where it even helped the government increase tax collection. So yes, we will pursue it."

He pointed to Banglalink's existing digital platforms.

"Toffee is today the leading local OTT platform. We invested a lot in acquiring sports rights. My strong plea to linear channels is to wake up. Entertainment needs eyeballs. Look at people below 25, they do not watch linear channels anymore. They are on apps, YouTube, TikTok. If you protect your turf instead of sharing, you will get yourself out of business."

The company has also launched RYZE, an AI-powered youth-focused lifestyle app.

"This generation aged between 15-29 years makes up nearly a third of Bangladesh's population, an incredible source of energy, creativity, and potential. At Banglalink, we believe the youth deserve more than just connectivity, they deserve access to the right tools to thrive in a digital world. That is why we launched RYZE, a youth-focused brand that empowers young minds with AI-powered solutions and seamless digital access."

On infrastructure, he argued against duplication.

"It is ridiculous that every telco builds its own infrastructure. It is like every airline building its own airport terminal. Pan American World Airways did that once in the 60s, and it failed. The same logic applies here," added the CEO.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments