Non-banks’ default loans hit record high

Non-bank financial institutions (NBFIs) in the past fiscal year saw their defaulted loans reach a record 33.15 percent of all disbursed loans, according to the central bank, indicating a fragile situation in the sector thanks to widespread loan irregularities and scams.

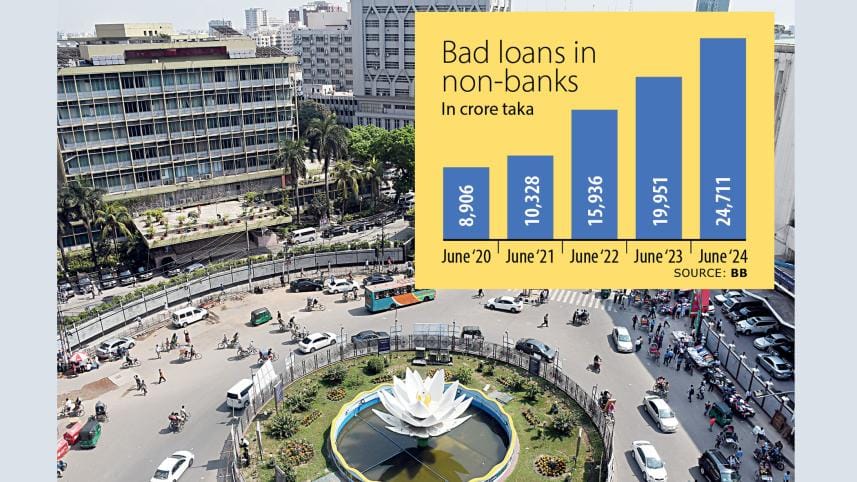

At the end of June 2024, soured loans at the 35 NBFIs in the country totalled a record of Tk 24,711.28 crore against their total disbursed loans of Tk 74,533.74 crore, according to the latest data from the Bangladesh Bank (BB).

In the past one year till June, bad loans at the finance companies increased by Tk 4,760.11 crore, or 24 percent.

As of June last year, default loans in the sector stood at Tk 19,951.17 crore, central bank data show.

Up until March 2024, bad loans at NBFIs amounted to Tk 23,889 crore.

However, a senior BB official said that the actual amount of bad loans in the sector is much higher than what is reported to the central bank.

The official, requesting anonymity, said some NBFIs' defaulted loans tend to increase after central bank inspections.

According to BB data, of the total Tk 24,711.28 crore NBFI bad loans, Tk 21,033.33 crore has been classified as "bad and loss" -- which means a low chance of recovery.

The figures come at a time when development partners and economists have expressed concerns about vulnerabilities in Bangladesh's financial sector due to rising distressed assets, including non-performing loans, and a lack of corporate governance.

There are two main reasons behind the growing trend of non-performing loans, according to Kanti Kumar Saha, chief executive officer of Alliance Finance.

He said that these toxic assets are "legacy loans" from the large scams and irregularities that dealt a severe blow to the sector a few years ago.

On the other hand, the July- August mass uprising caused business closures and financial difficulties for small and medium enterprises, making loan repayments difficult for them, Saha said.

He added that even some large corporations are facing similar problems.

"Not only the NBFIs, but the overall economy is currently facing multiple challenges, which have contributed to the rise in bad loans within the sector," said Md Golam Sarwar Bhuiyan, chairman of the Bangladesh Leasing and Finance Companies Association.

Industry insiders said that the central bank was largely responsible for the ailing NBFIs.

They said that the central bank's supervision of NBFIs was not up to the mark, as reflected by frequent reports of scams and loan irregularities in the sector over the last few years.

SMART formula scrapped for NBFIs

The Bangladesh Bank yesterday scrapped the SMART (Six month Moving Average Rate of Treasury Bill) formula for the non-bank financial institutions sector (NBFIs) in order to make interest rates in the NBFI sector fully market-based.

This move follows the removal of the SMART formula from the banking system in May of this year.

Now the interest rate will be fixed based on the demand and supply of loanable funds in the NBFIs sector.

The central bank, however, imposed some conditions, such as the finance companies will have to publish the interest rates of deposits and loans on their website; the interest rates can vary at 1 percent based on the clients; NBFIs cannot able to impose interest rate out of the market rate; and they have to mention the fixed rate or floating rate in the loans approval paper.

NBFIs will not be able to change the interest rate within the six months of approval, but after the six months they can re-fix the interest rate every six-month based on the market rate.

The SMART formula was introduced on June 20 last year.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments