Money transfer across MFS platforms finally a reality

Users of a mobile financial service (MFS) provider can now transfer money to their counterparts registered with other operators and banks as interoperability among the financial service providers comes into a reality today.

Until yesterday, if you were registered with bKash, an MFS operator, you could not send money to someone who has an account with Rocket or any of the dozens MFS providers in Bangladesh. Their scope to send money to bank accounts had been even more limited.

Similarly, if you had a bank account, you could not make digital transactions with the account holders of every bank.

But these bars have been eliminated thanks to the introduction of Binimoy, an interoperable digital transaction platform (IDTP), operated by the Bangladesh Bank.

The new system, which comes more than a decade after MFS was launched in Bangladesh, will facilitate money transactions across MFS, banks and payment service providers, boosting cashless transactions in a country that relies heavily on cash.

"It is great news for me. This will benefit me a lot," said Azizul Hayat, who maintains multiple MFS accounts.

Now, thanks to the interoperability, Hayat will be able to send money to other MFS accounts.

"Even if I want to buy a product but do not have enough balance in one MFS account, I would be able to transfer money from other MFS providers," he said.

Bangladesh rolled out MFS in 2011 but account holders had to wait until November 12 to transfer and receive money from other operators and platforms, limiting their use.

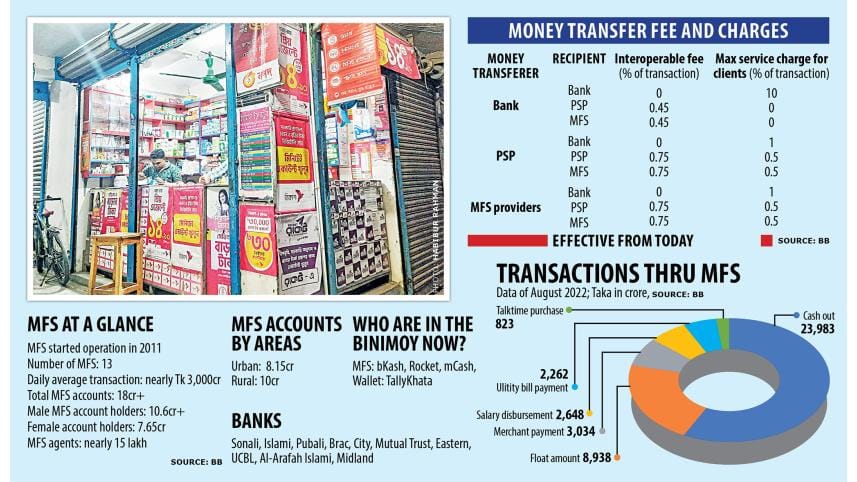

At present, 13 MFS operators are providing services to more than 18 crore account holders who are transferring nearly Tk 3,000 crore daily.

Yesterday, the IDTP began its journey with three MFS operators -- bKash, Rocket and mCash, and one wallet Tallykhata along with 10 banks: state-run Sonali Bank, Islami Bank, Pubali Bank, Brac Bank, City Bank, Mutual Trust Bank, Eastern Bank, UCB, Al-Arafah Islami Bank, and Midland Bank.

The rest are expected to join gradually, said officials of the Bangladesh Bank after the launch of the interoperability by Prime Minister's ICT Affairs Adviser Sajeeb Wazed Joy at the Radisson Blu Dhaka Water Garden hotel.

Velwire Limited, Microsoft Bangladesh, and Orion Informatics Limited collaborated on the development of the platform as part of the Innovation and Entrepreneurship Development Academy programme of the ICT Division and the Bangladesh Bank.

Speaking to The Daily Star, Kamal Quadir, CEO of bKash, said: "From the very beginning, bKash has worked closely for the implementation of Binimoy."

The largest MFS operator has participated in the pilot project of Binimoy as well.

"We believe this technological integration initiative of the Bangladesh Bank and the ICT Division will empower customers and give more freedom in their financial transactions," Quadir said.

Sending money from MFS to MFS will cost Tk 5 per Tk 1,000. It will cost Tk 10 to transfer the same amount to banks.

Transferring funds from an MFS provider to a payment service provider account will cost Tk 5.

HOW IT WORKS

In order to use the platform, customers will have to make registration with Binimoy through their banks, MFS or financial institution accounts.

Once registered, they will receive a virtual ID (VID) such as karim@binimoy. There is an option to get a merchant (VID) as well.

Binimoy will allow users to carry out two types of transactions. One is Direct Pay (DP), which allows a customer to send money to another account. The other is Request to Pay (RTP), using which a customer can receive money from other accounts.

Customers will be able to add multiple accounts to their Binimoy profile and will have to select one as a default account.

With the DP method, fund transfer (person-to-person or person-to-business), government fund disbursement (social safety net payments), salary disbursement (government and corporate salary), government dues payment (income tax, fees, duties and VAT), and utility bills payments and QR code-based payments can be made.

For every transaction, a customer has to use a six-digit PIN that the user would get during the registration process.

The Binimoy system will have three-level security during data movement: transaction security (multi-factor authentication), message security, and channel security.

According to the BB, transactions will only be made after identifying the authentic mobile device user, PIN and one-time password verification, making it technologically secured and encrypted.

Industry people welcomed the initiative.

AKM Fahim Mashroor, chief executive officer of Bdjobs and AjkerDeal, said: "It's the happiest moment."

The internet entrepreneur also raised concerns.

"The challenge will be to make it popular among users, particularly common users who transfer or pay a small amount."

He said a user needs to pay an additional Tk 5 for sending Tk 1,000.

"This additional fee should be withdrawn for at least one year to make transactions popular. Once the service is popular, fees on users can be introduced."

Under the system, both the sender and receiver must register with Binimoy. But Mashroor thinks it should apply to the sender alone.

Shahadat Khan, founder and CEO of TallyKhata and TallyPay, said: "Since we are digital wallets for small businesses and merchants, our merchants can receive payments from customers using any bank account or digital wallet, and make payments to all suppliers."

Md Mezbaul Haque, director of the payments service division at the central bank, described Binimoy as an important landmark, saying it would encourage digital transactions and discourage cash transactions, thus boosting financial incaution and paving the way for turning the country into a cashless society.

"Once digital transactions climb significantly, the cost of transactions will go down further," he said, at the inauguration.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments