Largest loan from IMF on the cards

The International Monetary Fund is expecting a formal request for a loan from Bangladesh soon to provide a buffer to the delicate foreign currency reserves amid global economic volatility even though the government remains in two minds about it.

"The authorities are expected to send a request letter to start the programme negotiation," said the visiting IMF mission in its concluding remarks yesterday after wrapping up its nine-day tour.

The finance ministry is now awaiting the green light from the highest authority to formally approach the IMF for the loan, The Daily Star has learnt from officials involved with the proceedings.

The loan amount that would be sought will be decided then, said a finance ministry official on the condition of anonymity due to the sensitivity of the matter.

Bangladesh can take up to $7 billion from the IMF as per its special drawing rights allocation, but the government would be seeking $4.5 billion.

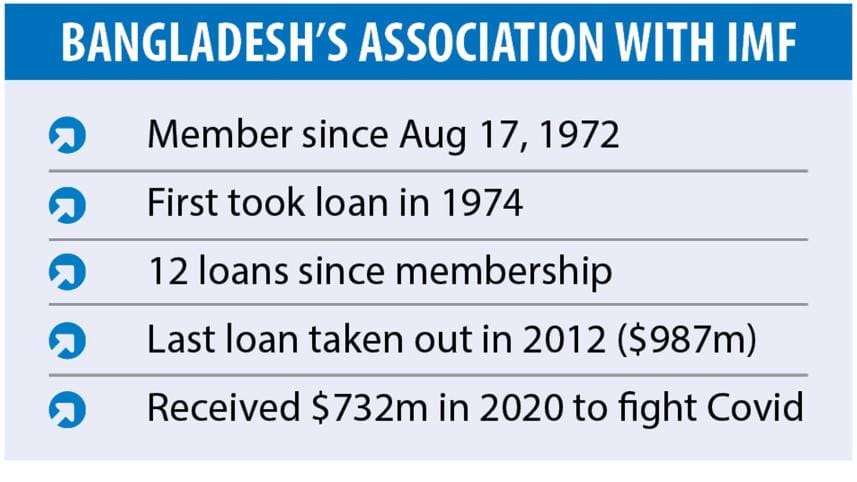

The $987 million loan taken in 2012 under the three-year Extended Credit Facility programme is the largest amount taken from the Washington-based multilateral lender as of now.

Loans from the IMF typically come with tough reform plans, which often end up being too exacting to implement for many countries.

The conditions that Bangladesh would be subjected to can be gauged from the mission's concluding statement.

According to documents seen by The Daily Star, implementing a fuel pricing mechanism, removing the interest rate caps on lending and borrowing, resetting the methodology to report on foreign currency reserves, increasing revenue base, and strengthening corporate governance in the banking sector top the recommendations made by the mission.

"Elevated global commodity prices, growth slowdown in major trading partners and normalisation of remittance inflows suggest that the balance of payments will be under pressure in the coming years, with net reserves declining further," the mission said.

As of July 13, Bangladesh's foreign currency reserves stood at $39.8 billion, enough to cover just about five months' import bills. In times of economic uncertainty, an import cover of 8-9 months is prescribed by multilateral lenders.

The IMF is in disagreement with the Bangladesh Bank's method of calculating foreign exchange reserves, which include the riskier local investment exposure.

"Going forward, the current account balance and the exchange rate will be assessed using the External Balance Assessment methodology," it said, adding that an outreach mission will be planned.

Given the heightened uncertainty stemming from the war in Ukraine and volatile energy, food and fertiliser prices, it would be prudent to safeguard and rebuild reserves as a buffer against shocks.

The mission called for withdrawing the interest rate ceilings of 6 percent and 9 percent for deposits and loans respectively, which would help control inflation and also ease the pressure on reserves.

In June, inflation hit a nine-year high of 7.56 percent.

Reprioritisation of expenditures, which is much needed given the high subsidy expenditure and weak revenue collection, would also ease the pressure.

Subsequently, the mission called for gradually adopting a fuel pricing mechanism in line with the global prices to bring down the subsidy expenditure on energy.

This will also help accommodate additional social spending in the form of targeted aid to protect the poor.

"In the absence of adequate revenue mobilisation, budget financing is increasingly relying on costly domestic debt, eroding fiscal space."

The mission recommended reforming the expensive National Savings Certificate programme by separating it from direct budget financing.

To increase revenue, which remains among the lowest in the world, a multi-pronged strategy -- including simplifying the value-added tax rate structure, modernising revenue administration and building compliance risk management capacity focusing particularly on large taxpayers -- is needed, the mission said.

"These recommendations are very pertinent to the problems facing Bangladesh at present. Regardless of where it came, these must be followed," said Zahid Hussain, a former lead economist of the World Bank's Dhaka office.

Recommendations such as reforms in revenue policy and administration and removing the interest rate caps are international best practices, said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

"Why does the government administer the petroleum price? Nowhere in the world would you find this. The price should follow the ebb and flow of the global market."

The interest rate cap should have never been imposed, said Mansur, also the chairman of Brac Bank.

"Nowhere in the world would you find this. Now is crunch time. Inflation is high, so the interest rates have been hiked everywhere. But in Bangladesh that scope is not there because of the interest rate cap. Is this approach reasonable and sound?"

A big portion of the imports is liquefied natural gas, petrol and fertilisers, according to Mansur, a former economist of the IMF.

"If their prices are not hiked, how would their demand go down? This is a policy failure. The government is rationing the use of electricity but where is the savings? People are using generators and charger lights and fans. Only by raising the price do you get savings. If you follow such policies, you will only face misfortune."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments