How to de-stress Eid shopping amid price hike

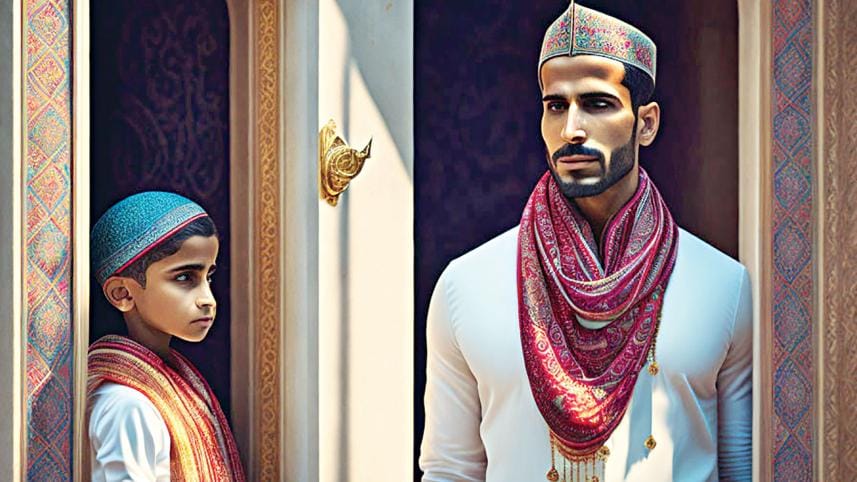

When a major festival like Eid knocks on the door, the memory of going to markets or shopping malls to buy new clothes and footwear items, eating sweets and receiving gift money from elderlies comes to mind.

But this year, many middle- and lower-income households in Bangladesh will find it difficult to carry out shopping for all of the family members and other relatives as they did in the past, owing to higher consumer prices.

However, households will still try to buy something within their means since Eid-ul-Fitr is one of the largest festivals in the Muslim-majority country and people look forward to celebrating it with near and dear ones.

Now the question is: how the budget will be managed for Eid shopping considering the recent price hike?

Personal finance experts recommend preparing the shopping list and keeping aside a budget for all of the items that would need to be purchased. They also ask the shoppers to stick to the plan and not to go past the budget to a large degree, if necessary.

"People should identify the major expenditures and allocate the amount for each of the items," said Shaikh Masrick Hasan, associate professor of the finance department at Jagannath University.

"A proper plan and its proper execution may be helpful at a time of higher inflation."

He said at least three significant additional expenses are incurred when it comes to Eid: buying clothes and footwear items, food arrangements and transportation costs.

"So, people should allocate funds for them and remain strict about it."

Rahat Mahmud, a private sector employee, says he will have to buy clothes for his three children and his wife.

But doing shopping would be quite tough for him., Still, he has decided to buy clothes for the children.

"If they don't get new clothes, they will be disappointed," said the 40-year-old.

In order to keep the purchases within the budget, Mahmud plans to procure non-branded clothing items since he can't afford branded ones at the moment.

He says the Eid shopping might prompt him even to take loans and he will feel the pressure next month.

"But the shopping will make my family happy."

Since the festival is a once-a-year-event, people can take up personal loans from financial institutions to manage expenditures if their budget comes under strain, according to a personal finance analyst.

"Ahead of the festival, the demand for personal loans usually goes up," said Arup Haider, head of retail banking at The City Bank.

The salaried employees usually think that it will be convenient for them to repay loans in the form of equated monthly instalments over a five-year period, the banker said.

Almost all banks offer personal loans.

The salaried people and professionals like doctors and engineers are preferred for personal loans as their income is predictable and the risk of repayment is low, he said.

"But people from all segments can borrow from banks to enjoy Eid and repay the loans in instalments."

A top official of a bank says some banks are not giving personal loans to people whose monthly salary is below Tk 40,000. "But this segment actually needs the personal loan."

Looking for bargains is okay but people should not fall into the trap of discounts with a view to buying something at lower prices, said one personal finance analyst.

"Low-quality products might spoil the joy that the festival is set to bring."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments