Govt moves to boost House Building Corporation’s lending capacity

- Government moves to amend BHBFC law

- Board autonomy proposed to boost lending

- Retained earnings, reserves allowed under draft

- Fund shortage hampers housing loan disbursement

The government is moving to strengthen the lending capacity of the Bangladesh House Building Finance Corporation (BHBFC), the country's sole state-run provider of long-term, low-interest housing loans, by amending the law that governs the institution.

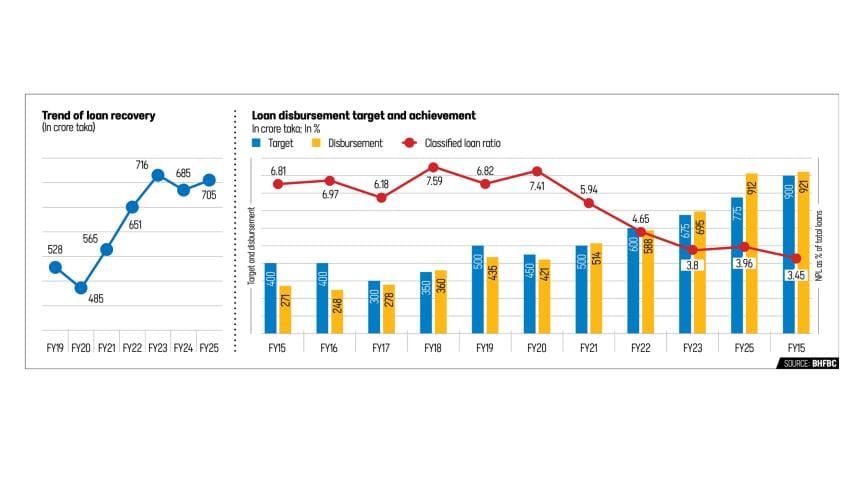

The move comes as the corporation is struggling to meet soaring demand due to a fund shortage. In fiscal year 2024-25, the BHBFC approved Tk 1,334 crore in loans but could disburse only Tk 922 crore, leaving Tk 412 crore undisbursed despite a 1 percent rise in disbursement compared with the previous fiscal year.

Under the proposed amendment, currently with the Cabinet Division, the BHBFC board would gain greater autonomy, reducing direct government control. It would set interest rates on loans and decide the annual dividend paid to the government, enabling the corporation to expand its lending base.

Currently, the BHBFC pays Tk 50 crore-Tk 80 crore annually in dividends, a senior BHBFC official said on condition of anonymity. Over the past two fiscal years, it has paid more than Tk 160 crore in dividends despite a paid-up capital of just Tk 110 crore.

The proposed draft, seen by The Daily Star, also states that the law, if amended, would allow the corporation to retain earnings, use the profits for making provisions against loans, depreciate assets, and establish reserve funds.

The existing law governing the BHBFC does not have a provision for retained earnings, a standard component of any financial statement under International Accounting Standards and International Financial Reporting Standards.

"In the absence of a retained earnings provision, any surplus after dividend and tax must be transferred to the government's account. This shrinks our capital base and limits the funds we would otherwise use to issue loans," said BHBFC Managing Director Md Abdul Mannan.

"If everything we earn is handed over to the government, the institution simply cannot grow. Without retained earnings, our lending capacity dries up," he added.

He also identified the lack of flexibility for the corporation to determine the interest rate on loans as another obstacle. The interest rates for loans given by the BHBFC are determined by the finance ministry.

Currently, the state-owned lender offers a lower interest rate of 8-10 percent with a maximum repayment period of up to 30 years. In contrast, the private sector offers loans at a higher interest rate of 13-14 percent with a maximum repayment period of 20 years.

"This is why the demand for our loans is higher," said BHBFC Managing Director Mannan.

To expand its capacity, the corporation has requested the government to provide Tk 1,000 crore in loans at 3 percent interest for 20 years.

Mannan expressed confidence that the fund would be sanctioned.

The corporation has a strong track record, he added. "We have never written off or waived a loan. Our non-performing loan ratio has improved over time."

The BHBFC's NPL ratio stood at 3.45 percent in FY2025.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments