Good corporate governance crucial for banks

Good corporate governance is critical for banks everywhere and at all times since it makes them transparent and accountable, helps attract deposits and investments and carry out business globally, said Sohail RK Hussain, managing director and chief executive officer of Meghna Bank Ltd.

Governance is especially important now for banks in the view of adverse events and media reports, which at times can be somewhat sensational but perhaps lack context, he said.

According to the noted banker, good corporate governance directs banks and makes them and their decision-making process transparent and accountable to stakeholders.

Banks with good governance will have greater access to depositors, confirmation lines from international banks and the capital market, and will be able to draw domestic and foreign investments, Hussain said during an interview with The Daily Star recently.

Hussain joined Meghna Bank in 2020 with a vision to transform the organisation's processes, introducing new products and delivery channels, strengthening management quality, and expanding into new customer segments, thus improving the overall performance of the bank.

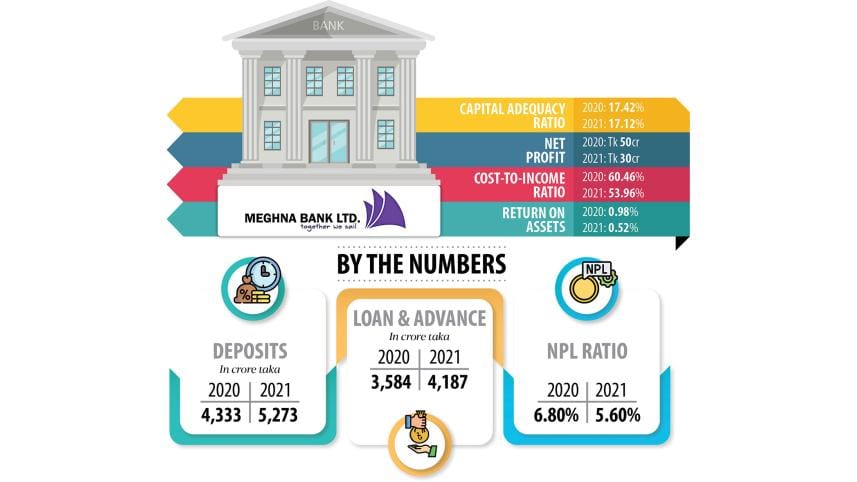

Currently, the bank's capital to risk-weighted asset ratio is around 21 per cent, comfortably higher than the minimum regulatory requirement of 12.5 per cent. The bank was a net lender in the interbank market in December 2022.

Meghna Bank's leverage ratio, which refers to the core capital to its total assets, is 10 per cent against the minimum requirement of 3 per cent.

Its operating profit shot up to Tk 104 crore in 2021, up from Tk 73 crore in 2020 and Tk 82 crore in 2019, according to the annual report of 2021.

Meghna Bank, which commenced its operation on May 9, 2013, is transforming in a number of ways. It has placed high emphasis on projects that ensure a high level of corporate governance.

For instance, it is in the process of introducing strategic domestic and international investors and partners.

"We are also working on obtaining an international credit rating along with high-quality foreign investments," Hussain said.

The bank is also working to secure a number of international certifications regarding its processes, which includes ISO (International Organisation for Standardisation) certification for its operating departments and IT and digital financial solution divisions.

The bank is introducing numerous new products and solutions for customers. "Some of the products are unique in the industry," said Hussain.

Hussain aims to turn Meghna Bank into one of the top 20 banks in Bangladesh in terms of funds under management and one of the top five banks in terms of governance.

He has already gathered vast experience on how to help a troubled bank to make a comeback.

Hussain started his banking career at Standard Chartered Bank. He, along with a group of experienced bankers, moved to Eastern Bank Ltd in 2001 to give the bank a new beginning.

Likewise, City Bank in 2007 recruited almost the same team with a view to improving its performance. Hussain led the bank as its MD and CEO from November 2013 to January 2019.

When he joined Meghna Bank in May 2020, in the midst of the coronavirus pandemic, the non-performing loan ratio of the bank was 7.8 per cent of its total loans. It declined to 5.60 per cent in 2021.

In the last couple of years, Meghna Bank introduced an Islamic banking window, offshore banking unit, agent banking, internet banking, account opening through electronic know-your-customer, rolled out a call centre and document archiving, and relaunched its card business.

It also began focusing on green lending.

In 2023, the bank plans to make large investments in IT, cyber security, agent banking, mobile financial services, digital financial services, branches, and sub-branches.

Meghna Bank is going to tie up with fintech companies and other partners to expand its product features and footprint and new offerings for both existing and new customers.

"These will enable us to reduce the cost of customer acquisition and expand into segments where a branch-based solution may be not cost-effective," said Hussain.

He said most of the older banks in Bangladesh have developed a branch-based banking system through the setting up of brick-and-mortar outlets and ATM (automated teller machine) networks.

But Hussain, who obtained his MBA from the Institute of Business Administration under the University of Dhaka, thinks setting up more ATMs would be wasteful.

So, Meghna Bank has partnered with other banks, allowing its customers to access more than 11,500 ATMs that they have established collectively across the country free of charge.

"As a result, our customers have much greater and easier access to ATM services than customers of other banks. In view of our traffic situation, this is a cost-effective solution for our customers," said Hussain.

The bank has launched a mobile banking app that is very robust and effective.

"We have relaunched MFS in a different manner so that we can widen our footprint in a viable way despite the presence of big players such as bKash, Nagad, Rocket and Upay."

The MFS has partnered with a large non-governmental organisation that is already serving farmers, small retail outlets, garment workers, and the service industry.

"Our partner organisation has a large network of offices and hundreds of thousands of clients. Many of the clients are involved in the agriculture sector," Hussain said.

"The Bangladesh Bank has directed banks to do more lending in the agriculture sector directly at much lower costs. The partnership will allow us to do this in a prudent manner."

Meghna Bank is working with fintech companies that have e-commerce sites and logistics to supply raw materials and goods to the agriculture sector.

"We will build an ecosystem of products around MFS, agent banking, digital wallet, e-commerce, and fintech companies. These activities will ultimately help us keep our costs down through lower physical infrastructure investment and fewer people and acquire customers at a lower cost than the industry."

Hussain said the bank was able to advise its customers towards the end of 2021 and in early 2022 to open more sight LCs (letters of credit) in a bid to reduce any possible exposure to a future currency volatility.

An LC at sight is a LC that is payable immediately.

"This helped our customers minimise losses," Hussain said.

The noted banker also touched upon the default loan issue in the banking sector.

He recommended increasing the number of court benches for the disposal of cases related to NPLs as there is a huge backlog.

"Another alternative solution would be to implement the distressed asset management company concept that the central bank is working on."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments