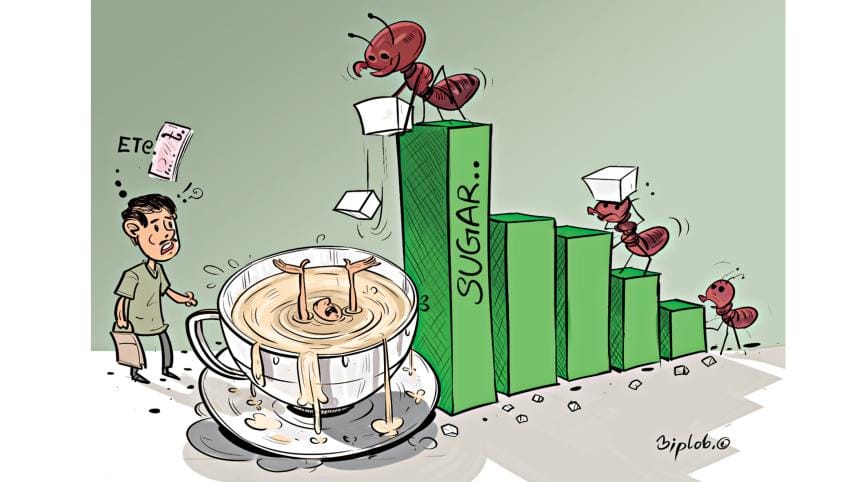

Food makers in a pickle for sudden sugar price hike

The sudden rise in the price of sugar, a key ingredient for popular items such as biscuits, juices, sweets and candies, has pushed up the cost of production, putting manufacturers in a tight spot.

The hike in the manufacturing cost means food processors would either have to go for the adjustment of the prices of their finished products or resize them.

Raising prices would be particularly hard since inflation in Bangladesh sat at a decade high of 9.1 per cent in September and shows no sign of cooling down, eroding the purchasing power of the consumers.

Yesterday, sugar was selling at Tk 100-110 a kilogramme in the retail markets in Dhaka, up from Tk 90-95 two weeks ago.

The jump came as sugar production in Bangladesh is facing disruption owing to the gas crisis, stemming from the inadequate domestic generation and suspension of the imports of the liquefied natural gas by the government amid persistently higher prices of energy in the global market.

A sharp climb in the US dollar price against the taka has already made the imports of crude sugar dearer.

"We are under a lot of pressure owing to the sugar price hike," said Eleash Mridha, managing director of Pran Group.

"We have been forced to increase the prices of many products. But people are spending very carefully owing to the rising cost of living. As a result, sales have dropped by 10-20 per cent recently."

Debasish Singha, head of export of Danish Biscuit, owned by Partex Star Group, said the cost of production has gone up about 30 per cent due to the rise in sugar prices.

The company uses sugar to make biscuits, candies and juices. It bought the key ingredient at Tk 77 per kg in June which is costing Tk 95 currently.

"Due to the hike in the manufacturing cost, the products will have to be resized now since prices can't be increased overnight," said Singha.

Danish Biscuit has reduced the weight of an 80-gramme product to 60 or 70 grammes to absorb the costs, for example.

"If you want to ensure quality, there is no other alternative but to reduce the size of products. If we increase the price, there will be a negative impact on sales," said Singha.

Well Group, which runs a food chain, is observing the situation.

"What can we do under the current circumstances? We are not a sugar producing country," said Syed Nurul Islam, chairman of Well Group.

Well Group plans to raise the price of sweet items by Tk 25-30 per kg from November 1.

Madad Ali Virani, executive director of Olympic Industries Ltd, said due to the increase in sugar prices, the cost of production has increased a lot and the margin has decreased.

"But common people do not want to buy a Tk 10 product at Tk 15 since their purchasing power has not increased. So, the size of the products has to be reduced."

SM Mujibur Rahman, head of accounts of Meghna Group of Industries, says the cost of production has gone up by 7-8 per cent due to the rise in sugar prices.

"Almost all raw materials are expensive now. Due to the increase in the price of sugar, there is additional pressure," he said.

At Khatunganj, a wholesale market in Chattogram, the prices of sugar shot up by Tk 100-150 to Tk 3,780-3,800 a maund (37.32 kg) in the last two days in the face of falling supply, said Anamul Haque, owner of Shah Amanat Trading.

Amid the squeezing supply, the Bangladesh Sugar Refiners Association, on October 20, urged the government to remove all types of import duties on unrefined sugar and allow commercial banks to open letters of credit without any restrictions.

In August, the Bangladesh Bank asked banks to inform it about the opening of LCs whose value is $3 million and above so that the import of non-essential items can be checked.

But a vessel can carry up to 55,000 tonnes of raw sugar valued $27 million to $30 million. As a result, the expenses related to opening of LCs have gone up, said the association.

It requested the government to take steps to help traders import the raw sweetener with deferred payments of up to 365 days and ensure uninterrupted gas supply.

Bangladesh's annual demand for sugar is 25 lakh tonnes. Domestic sugar mills can produce up to 1 lakh tonnes, while the rest is imported.

Mill owners import unrefined sugar from Brazil, India, Australia, the United Kingdom, and Malaysia.

According to the refiners' association, about 18 lakh tonnes of unrefined sugar have been imported so far this year.

Globally, sugar prices stood at $0.40 per kg in the third quarter of 2022, slightly down from $0.41 and $0.43 in the January-March and April-June quarters respectively, according to the October 4 data of the World Bank.

Spot prices for refined white sugar on the continent are trading at around 1,050 euros ($1,016.61) a tonne - their highest level yet. Prices in the world market, by contrast, are around half those levels, reported Reuters on October 13.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments