Default loan rescheduling falls to 7-year low

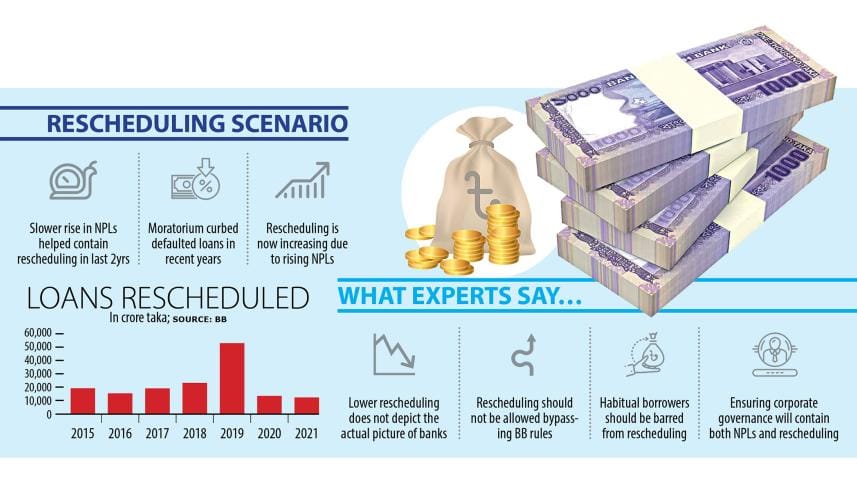

Rescheduling of default loans fell to a seven-year low in 2021, riding on a moratorium extended by the Bangladesh Bank to protect borrowers from the economic shocks arising from the coronavirus pandemic.

Last year, non-performing loans (NPLs) amounting to Tk 12,379 crore were rescheduled, the lowest since 2015, data from the central bank showed. Older data was not available.

Analysts describe the declining loan rescheduling as a welcoming trend for the banking sector but add that there is no scope to be complacent.

There are concerns that rescheduling may surge as all types of loan moratoriums, which were unveiled by the central bank throughout 2020 soon after the coronavirus pandemic struck Bangladesh, were withdrawn this year.

The temporary suspension of loan repayments had allowed borrowers to avoid slipping into the default zone by paying only 15 per cent of their instalments payable for 2021.

In spite of the facility, the NPLs went up 16.38 per cent year-on-year to Tk 103,274 crore last year. The NPLs would have increased to a large degree had the central bank not declared forbearance.

So, loan rescheduling is expected to go up in keeping with the rise in the NPLs.

"Loan rescheduling can be considered as a good tool to contain the NPLs if both banks and borrowers appropriately follow banking norms," said Shah Md Ahsan Habib, a professor at the Bangladesh Institute of Bank Management.

As per a central bank instruction, defaulters have to make a down payment between 10 per cent and 50 per cent of their bad loans to get rid of the default status.

But many influential borrowers have managed to regularise their loans in recent times by making a lower down payment as lenders allowed them to do so in violation of BB rules.

In 2019, the central bank also permitted the defaulters to reschedule loans by paying only 2 per cent as a down payment. Under the facility, NPLs amounting to Tk 52,769 crore were regularised, the highest on record in a single year.

Although the provision lasted only for a year, many delinquent borrowers are still enjoying the same facility under special consideration with prior approval from the central bank.

As a result, the default loans that are being rescheduled by unscrupulous borrowers violating the rules have turned into a crisis for the banking sector since lenders don't get the money despite extending the facility.

Habib said the NPLs might pile extra pressure on the banking sector as many businesses have not turned around.

Emranul Huq, managing director of Dhaka Bank, said the lower volume of default loans rescheduled in 2021 did not reflect the actual scenario in the banking sector.

"NPLs may increase this year, which will push up the loan rescheduling once again," he said, adding that borrowers were able to evade the default category in the last two years thanks to the loan moratorium and forbearance.

Md Arfan Ali, managing director of Bank Asia, says there is no scope to rely on the rescheduling figure of 2021 to assess the health of the banking sector.

"Both NPLs and loan rescheduling may return to the previous level in the absence of the moratorium."

Salehuddin Ahmed, a former governor of the central bank, urged the central bank to ensure corporate governance in the banking sector to contain NPLs.

"It is good that the economy is picking up from the pandemic-induced business slowdown. And a good number of borrowers have repaid their loans on time despite the crisis," he said.

But corporate governance has not improved in the banking sector in recent times, he said.

Ahmed says the financial health of some banks has worsened after they had allowed their defaulted borrowers to reschedule loans by ignoring BB rules.

"Banks should exercise due diligence in rescheduling loans."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments