Default Loans in Bangladesh

Tk 4 lakh crore default loans stuck in lawsuits

BB data show that as of June, 222,341 cases involving Tk 407,435 crore were pending across the courts

7 December 2025, 15:32 PM

A decade needed to get rid of bad loan crisis

BB governor says as businesses demand action

29 November 2025, 20:12 PM

Defaulted loans double to a record Tk 6.44 lakh crore in a year

This is the highest bad loan ratio since 2000

26 November 2025, 09:31 AM

A staggering increase in default loans

Central bank must strive to improve banking sector’s health

17 June 2025, 10:00 AM

Default loan reaches record high of Tk 2.85 lakh crore

This accounts for around 17 percent of total outstanding loans.

17 November 2024, 10:24 AM

Can we change the story of our ailing banks?

Restoring trust in the banking sector is crucially important

9 September 2024, 15:05 PM

Default loans hit record Tk 211,000cr

Default loans in the banking sector hit an all-time high of Tk 211,000 crore at the end of June of this year, as per the latest Bangladesh Bank data.

3 September 2024, 12:19 PM

Bangladesh Bank has to provide info that people have right to know: Arafat

Bangladesh Bank will have to provide all information that public has a right to know, State Minister for Information and Broadcasting, Mohammad Ali Arafat, said today

4 May 2024, 09:33 AM

The concept of a public institution eludes our central bank

BB has recently restricted the journalists’ access for no reason in sight.

30 April 2024, 15:00 PM

BB to bring default loans to below 8% by June 2026

Action plan has already been taken, the central bank says

4 February 2024, 11:09 AM

Falling reserve, rising bad loans worrying

The falling foreign exchange reserves and the ever-rising defaulted loans are very concerning for the economy, and the government should respond fast to avoid a looming crisis, eminent economist Prof Rehman Sobhan said yesterday.

9 October 2023, 18:00 PM

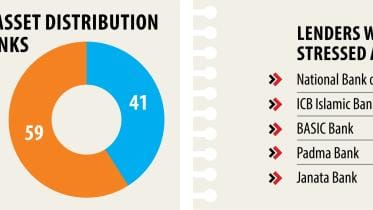

Big rise in 10 banks’ bad loans

The defaulted loans in 10 banks, including four state-run lenders, increased at an alarming rate in fiscal 2022-23, indicating their worsening financial health.

7 October 2023, 18:00 PM

Default loans reach record Tk 1.56 lakh crore

The bad loans rose by Tk 24,419 crore in the last three months to June

1 October 2023, 14:20 PM

2023 will be the year of inflation and financial turpitude

While the government is distracted by elections, the financial economy will suffer

1 January 2023, 02:00 AM

Financial sector reforms necessary to get rid of default loans

Even though the amount of our default loans is over Tk 130,000 crore, according to the government accounts, IMF suggests it is almost over Tk 300,000 crore.

29 November 2022, 13:00 PM

Reforms in the financial sector necessary to get rid of default loans

Why is the amount of default loans increasing day by day?

21 November 2022, 17:30 PM

Default loan rescheduling falls to 7-year low

Rescheduling of default loans fell to a seven-year low in 2021, riding on a moratorium extended by the Bangladesh Bank to protect borrowers from the economic shocks arising from the coronavirus pandemic.

25 April 2022, 18:00 PM

Risky loans soaring. BB’s plan? Hide figure.

The central bank is planning to sweep the bulging stressed assets under the rug when it publishes its annual financial stability report in April such that it can paint a rosy picture of the banking sector.

19 January 2020, 18:00 PM

Default loans at all-time high

Banks' non-performing loans hit nearly Tk 1 lakh crore at the end of September -- the largest yet in Bangladesh's 48-year-history.

5 December 2018, 18:00 PM

Most listed banks' profits tumble in Q3

As many as 60 percent of the banks listed on the stock exchanges have seen their profits tumble in the third quarter of the year

3 November 2018, 18:00 PM