Budget support: Govt hunts for $8b from IMF, other lenders

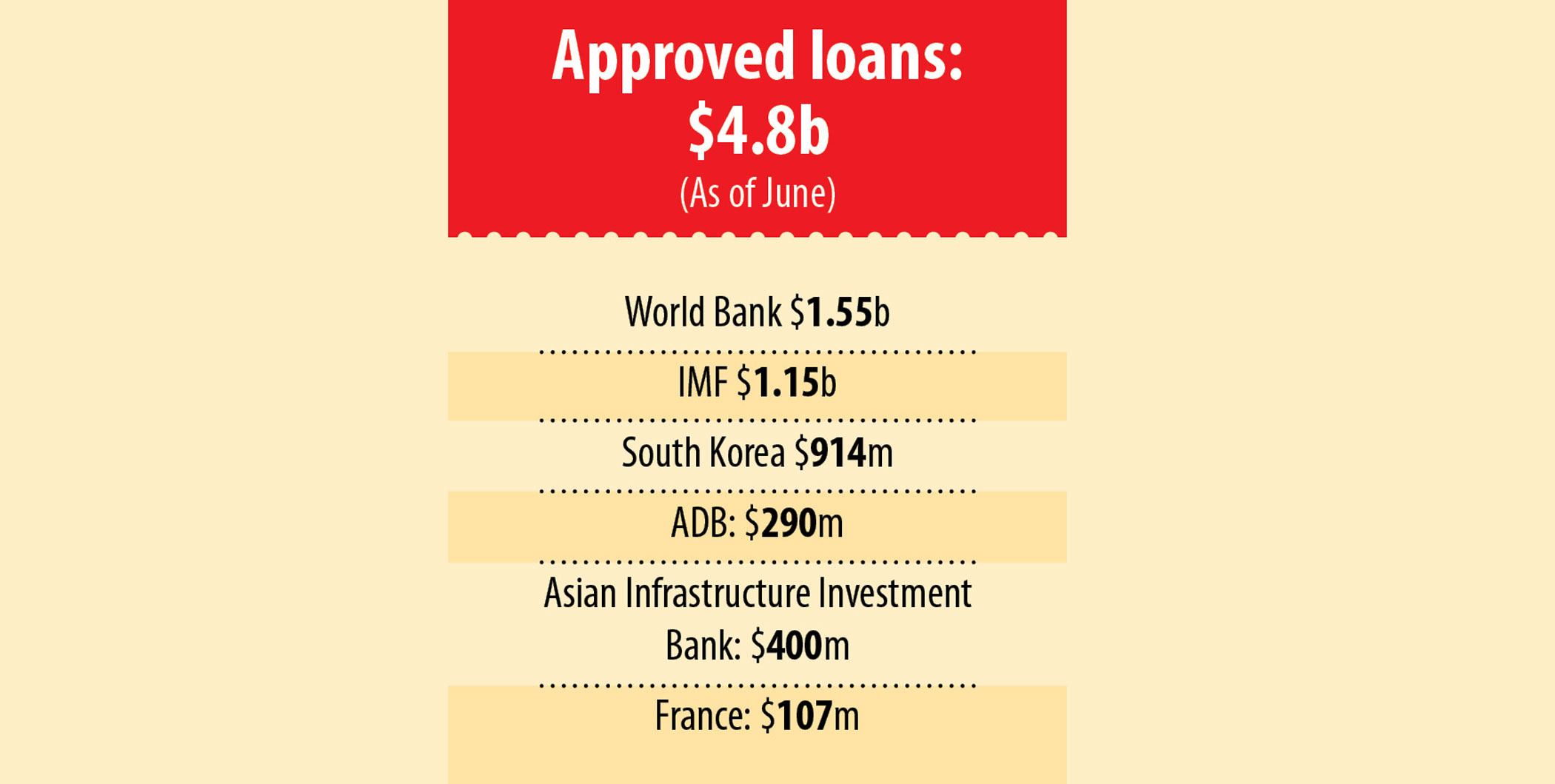

The government is seeking as much as $8 billion in budget support by December from the development partners, including the International Monetary Fund (IMF), to pay back foreign liabilities and boost foreign exchange reserves.

It is also working to get immediate funds from the Asian Development Bank (ADB) and the World Bank for rehabilitation programmes in areas recently devastated by floods.

Based on a primary assumption of loss and damage, the government has already sent a letter to the ADB, requesting $300 million for flood rehabilitation. It will seek a bigger amount from the World Bank, but a formal request has not been made yet.

Of the budget support, $3 billion is expected to come from the IMF on top of the global lender's existing $4.7 billion loan programme.

The government will seek as much as $5 billion from other development partners like the World Bank, ADB, Japan International Cooperation Agency (JICA) and the Asian Infrastructure Investment Bank (AIIB), said officials of the finance ministry and the Bangladesh Bank.

Recently, Bangladesh Bank Governor Ahsan H Mansur told foreign media that they would seek $3 billion from the IMF. A finance ministry official said they have already started talks with the IMF for the funds.

The official said an IMF staff mission is likely to visit Bangladesh to discuss the loan towards the end of next month. After the visit, Bangladesh will formally send a letter to the IMF, seeking the additional loan.

IMF officials informed the finance ministry and the central bank that it was assessing how much it could lend Bangladesh, going beyond the existing quota for the country.

The officials said a meeting on the loan arrangement could be held on the sidelines of the World Bank-IMF Annual Meetings in Washington in October. Finance Adviser Salehuddin Ahmed and the central bank governor are likely to take part in the meeting.

The IMF has so far released $2.3 billion under the $4.7 billion loan programme since its approval in January last year.

After the interim government took charge, the World Bank and the ADB held separate meetings with the finance adviser, the energy adviser and the central bank governor. Bangladesh sought more budget support from them during the meetings but did not specify any amount.

The energy adviser during meetings with the World Bank and the ADB sought $1 billion as immediate budget support, according to officials familiar with the development.

Officials at the Economic Relations Division said they could get funds from the World Bank under three arrangements -- a policy-based loan, diverted regional funds or from slow-moving projects.

Besides, Bangladesh could quickly get $1 billion to $1.5 billion from the ADB under two arrangements -- a policy-based loan or countercyclical support. Both JICA and AIIB could join the ADB arrangement, according to officials.

The interim government took charge amid pressure of high inflation and bleeding of foreign currency reserves which have been prevalent for almost two years.

The reserves stood at $20.5 billion on August 21 in line with the IMF's BPM-6 after the new government headed by Nobel laureate Professor Muhammad Yunus had taken charge earlier this month following the downfall of former prime minister Sheikh Hasina's government through a student-led mass uprising.

Inflation remained high last month, with the consumer price index rising by 1.94 basis points to 11.66 percent from the previous month. Food inflation crossed 14 percent in July for the first time in 13 years.

When Hasina fled the country, the Awami League government left $156 billion in local and foreign loans for the country to carry. These included $88 billion from domestic sources and the remaining $68.33 billion was external debt.

The country is also struggling to deal with a fragile banking sector hit by scams and defaults caused by people with direct or indirect links to the previous government.

The interim government has taken some quick and drastic measures to tackle the situation surrounding finances while bringing reforms to all the sectors as promised by Yunus.

Policy rates against both local and foreign currencies have been increased, while strict measures have been taken for the banking sector which are longtime suggestions from the development partners for providing budget support.

Finance ministry officials said because of the reform measures taken by the interim government, development patterners are ready to provide more support.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments