Govt overestimating revenue and budget targets for 11 years

The government has been overestimating its annual revenue collection targets and associated future expenditures over the past 11 years, according to a finance ministry document.

This has been posing many risks to the economy and the management of public resources, according to experts.

The revelation came in the finance ministry's medium-term macroeconomic policy statement for fiscal years (FY) 2024-25 to 2026-27, which was made public when the national budget was proposed in June.

It included a fiscal risk statement (FRS), incorporated for the first time under the guidance of the International Monetary Fund.

"The risk associated with this pattern of estimation is that if the line ministries implement their budget allocations fully and revenue authority fails to achieve their target, then there will be an abrupt escalation of unplanned budget deficit," said the FRS.

Between FY13 and FY23, the average revenue collection and expenditure forecast error has been found to be 2.4 percent of the gross domestic product, said the document.

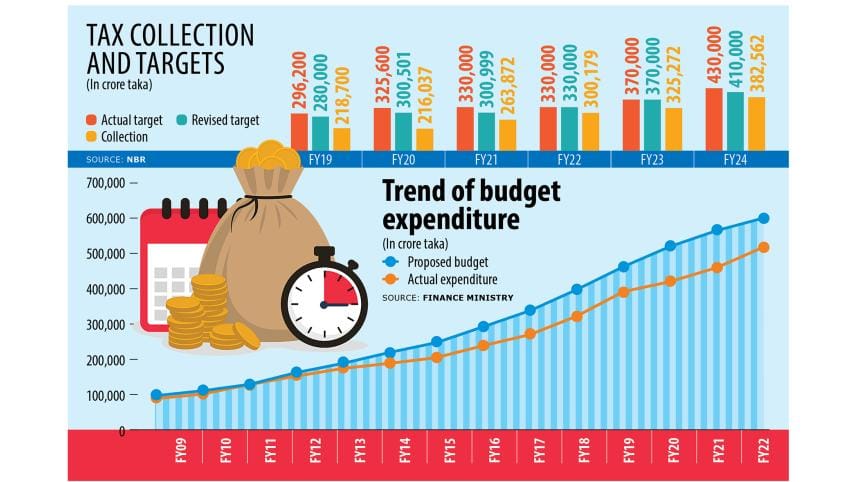

In tune with this, the National Board of Revenue (NBR) in FY24 missed its tax revenue collection target for the 12th consecutive year.

The tax administrator logged Tk 382,562 crore in overall receipts, falling Tk 27,438 crore short of the revised target.

Revenue collection and expenditure targets are proposed in budgets at the start of the year and revised after around six months.

Government expenditure is comprised of an operating budget and a development budget.

In the case of the latter, meaning the annual development programme, the ministries and divisions were able to spend around 90 percent of their revised allocations in the last 11 years.

If the initial allocation is taken into consideration, the implementation rate stands at nearly 80 percent.

The medium-term macroeconomic policy statement usually generates forecasts for three successive years from the current budget year.

The forecasts have often been observed to have been significantly different from the actual outcomes. Such deviations have profound impacts on the budget allocations.

For example, if the expenditure forecast is optimistic, it may result in excess borrowing for the financing of the budget deficit.

Towfiqul Islam Khan, an economist and senior research fellow at the Centre for Policy Dialogue (CPD), said the government has not been considering on the ground realities when setting revenue targets for the last 10 to 15 years.

"The frequent failures in meeting the revenue targets spoil the credibility of the fiscal framework," he said, adding that the expenditure side also suffers for it.

"If the government's revenue target remains 'artificial', then the government faces a fiscal pressure to meet the budget deficit, that leads to borrowing or printing of money," said Ashikur Rahman, principal economist of the Policy Research Institute (PRI) of Bangladesh.

"If we want to ensure effective macroeconomic management, this estimation must not have a very high margin of error," he said.

"The government should be more careful with data governance and set realistic targets. We have to become vigilant to set our revenue and expenditure targets," he suggested.

In this regard, he also cited the example of a recent export data mismatch.

Bangladesh Bank recently corrected anomalies in export figures, revising down actual exports in the July-April period of fiscal 2023-24 by nearly $14 billion compared to data the Export Promotion Bureau had published earlier.

The government can neither fully spend its development allocations nor reach revenue collection targets, said Khan of the CPD.

"When you come to accept that the revenue collection target will inevitably remain unachieved, you don't have the moral and professional grounds to hold anyone accountable," he said.

"It's kind of like cheating with oneself. It's not good from the accountability and transparency standpoints," he added.

Ultimately, this kind of overestimations create various risks for the country's institutions alongside of a budget deficit, he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments