ADB to cancel or redirect $408m amid project delays

The Asian Development Bank (ADB) will cancel or redirect around $408 million from projects in Bangladesh this year due to prolonged implementation delays, even as several ADB-funded schemes made progress.

The Manila-based lender announced the decision at a project implementation review meeting in Dhaka on Tuesday, attended by officials from the ADB, the Economic Relations Division (ERD), and other ministries. Such reviews are held twice a year to speed up project execution.

"Some projects have faced significant delays in implementation," the ADB noted in its report.

"Taking into consideration the country's risk appetite and tolerance under the ADB exposure limits framework, partial cancellation of poorly performing loans can create more headroom for new lending opportunities that support the government's priorities," it also stated.

According to the breakdown, $135 million was already cancelled earlier this year due to unused balances at project closing, stemming from procurement savings and favourable foreign exchange rate changes. Another $166 million is set to be cancelled by December, while $107 million will be repurposed for other programmes, bringing the total to $408 million.

This comes as Bangladesh struggles with weak public investment spending. In fiscal year (FY) 2024-25, development expenditure reached only 68 percent of the revised annual development programme (ADP) — the lowest in nearly 50 years. In the first two months of FY2026, implementation was just 2.39 percent, the poorest in 16 years. Earlier this year, the World Bank also repurposed $670 million from 11 ongoing projects for similar reasons.

A senior ERD official said the stalled projects had remained inactive for a long time. "With the cancellation and repurposing, this fund can be diverted to other priority projects, relieving Bangladesh from paying project commitment charges," the official said.

The ADB argued that such steps would strengthen portfolio management and ensure more effective use of public funds. "These steps will enhance portfolio performance and quality," it added.

The lender also highlighted project readiness as a critical factor behind delays, urging ministries to meet new preconditions before taking foreign loans. The government has already tightened requirements — such as securing land, preparing resettlement plans, and finalising tender documents — before projects receive approval.

"The ADB will keep working closely with executing agencies to make projects fully ready for procurement, approvals, safeguards, land acquisition, and manpower," it said.

The bank also acknowledged that 2025 is a challenging year for Bangladesh, with the national election and electoral code of conduct expected to disrupt project activities later in the year. In anticipation, the ADB has set conservative targets for contract awards and disbursements.

"More than half of the current year has passed. So far, implementation performance has been satisfactory, but to maintain this, some areas require greater focus. We still have to achieve another $150 million in contract awards and $661 million in disbursements," the report noted.

To facilitate timely processing, the cut-off date for receiving withdrawal applications and supporting documents has been set for 10 December 2025. Only the next two months — until the end of November — remain available for civil works, procurement of goods, and consultancy services, for which agencies can claim reimbursements or direct payments.

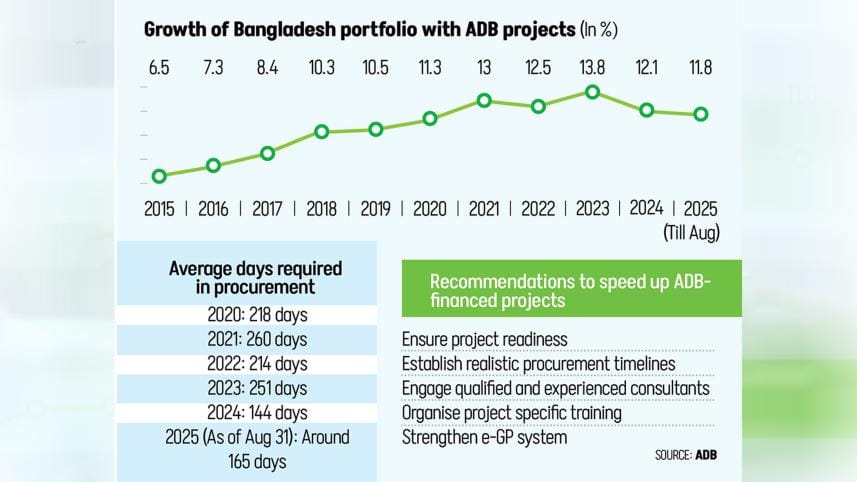

As of August 2025, Bangladesh's ADB-financed portfolio stood at $11.81 billion across 50 projects in seven sectors, alongside 37 ongoing technical assistance projects worth $61.2 million.

Procurement, a major bottleneck in implementation, has shown gradual improvement.

Low-value packages ($1–10 million) took an average of 165 days to process in 2025, down from over 235 days between 2020 and 2023. Last year, the figure had already improved to 144 days.

Still, the ADB noted sectoral gaps, with the energy sector taking significantly longer. It traced delays to poor project design, inadequate preparation, and prolonged government approval timelines. To address these, it recommended strengthening procurement planning, setting realistic timelines, and engaging qualified consultants, as well as expanding training for project-specific procurement and bid evaluation. Enhancing the government's e-GP system and extending it to service procurements were also advised.

On financial management, the ADB rated performance as "satisfactory" as of September 10, with 91 percent of projects "on track," 2 percent "at risk," and 6 percent "for attention." Timely submission of audited financial statements was seen as a positive.

However, concerns persist over a large backlog of audit issues. As of September, there were 1,028 unresolved audit observations for active projects, including 658 carried over from the previous year. The ADB flagged a shortage of qualified financial management staff, weak internal auditing, incomplete records, and direct payments not captured in the government's IBAS++ system as recurring problems.

The lender urged Bangladesh to strengthen financial management and audit capacity alongside procurement reforms to ensure faster, more transparent, and more efficient implementation of development projects.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments