70% listed firms incur profit drop, losses

Around 70 per cent of listed companies in Bangladesh either suffered losses or witnessed lower profit in the July to December period of the current financial year due to the surge in production costs, the sharp depreciation of the local currency and lower consumption.

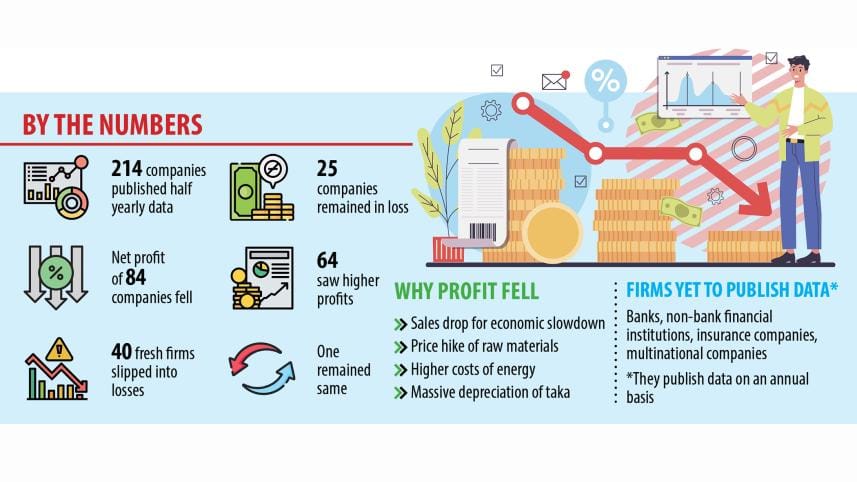

Among the 400 companies that trade on the Dhaka Stock Exchange, 214 have published their financial reports for the first half of 2022-23. Of them, the profits of 64 companies rose year-on-year and it dropped for 84.

Forty companies posted losses and 25 firms continued to be in the red. The profit for one remained unchanged, according to the data compiled by Sandhani Asset Management Company.

Banks, financial institutions, insurance companies and most multinational companies are yet to reveal their earnings as they follow the calendar year as their financial period.

The sharp depreciation of the local currency and the escalated input costs and energy prices driven by the fallout of the Russia-Ukraine war and the coronavirus pandemic have dragged profits down for the listed companies.

The taka lost its value by about 14.5 per cent in the July-December half of FY23 because of US dollar shortages. Since the war began, the currency has weakened by about 25 per cent, making imports expensive.

In another blow, the prices of diesel and kerosene were raised by 42.5 per cent in August. Petrol price saw a 51.16 per cent jump and octane became dearer by 51.68 per cent, driving up transportation costs.

"The earnings of the listed companies dropped mainly due to the recent economic slowdown that hit demand and thus sales," said Mohammad Emran Hasan, chief executive officer of Shanta Asset Management.

Asset management companies invest in stocks using the funds they manage. Shanta manages funds worth Tk 230 crore.

Since the onset of the Ukraine war in February last year, the price of most products has rocketed in Bangladesh like in most countries amid supply disruptions and the higher cost of production, Hasan said.

Inflation has remained at an elevated level since the conflict began.

In August, the Consumer Price Index rocketed to a 10-year high of 9.52 per cent, according to the Bangladesh Bureau of Statistics. It declined to 8.71 per cent in December, still higher compared to historical trends.

According to Hasan, the prices of raw materials have gone up in two ways: first, in the sourcing countries owing to supply bottlenecks and higher freight costs, and second, in Bangladesh because of the fall in the value of the local currency against the US dollar.

"Most companies are dependent on other countries for raw materials. As a result, their expenses surged. Although the operating cost of the listed companies rose for the higher cost of production, they could not pass the burden onto end-consumers entirely."

Europe is the major market for most of the export-oriented listed companies. Since the continent is struggling for higher energy prices driven by the disruption caused by the war and is going through an economic slowdown, the shipment of the companies has fallen.

The profit decreased due to an increase in costs pushed higher by the currency depreciation and higher prices of energy, imported raw materials and financing costs, said Kamrul Islam, executive director for finance and business development at GPH Ispat Ltd.

The freight cost rose for the imported goods while the transportation costs climbed locally for the hike in petroleum prices, he added.

The steel manufacturer incurred a loss of Tk 84.79 crore in July-December of the current financial year, way down from a profit of Tk 94.93 crore in the identical half of the previous financial year.

Still, some companies logged double-digit growth in terms of profits. They include Marico Bangladesh, Berger Paints, Square Pharmaceuticals, and Bangladesh Submarine Cables Company Ltd.

"Under the current circumstances, some companies were able to continue business in a sustainable way while others faced the pinch of the crisis," said Ali Imam, CEO of Edge Asset Management.

"If a company is competitive and has a favourable cost structure and healthy balance sheet, it will come out even stronger. Good governance and efficient management are helpful to attract more market share during tough times."

According to Imam, if the supply of raw materials is import-dependent, companies will be impacted by foreign exchange volatility.

"Similarly, if listed companies' balance sheet is debt-dependent, they will be impacted by the higher interest rates and their earnings will be hit."

A broker says the profits of most of the mutual funds fell in July-December due to the ailing stock market.

The DSEX, the benchmark index of the Dhaka Stock Exchange, dropped 4 per cent to 6,195 during the period, data from the premier bourse of the country showed.

Of the 64 companies that posted profits, around 40 per cent were small capital-based firms, the broker pointed out. "Their financial reports don't match economic trends most of the time. If they report earnings properly, their performance will be found to be weaker."

"This means the companies with weaker performance would be much higher than the financial statements depicted."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments