Too many weak firms get through IPO net

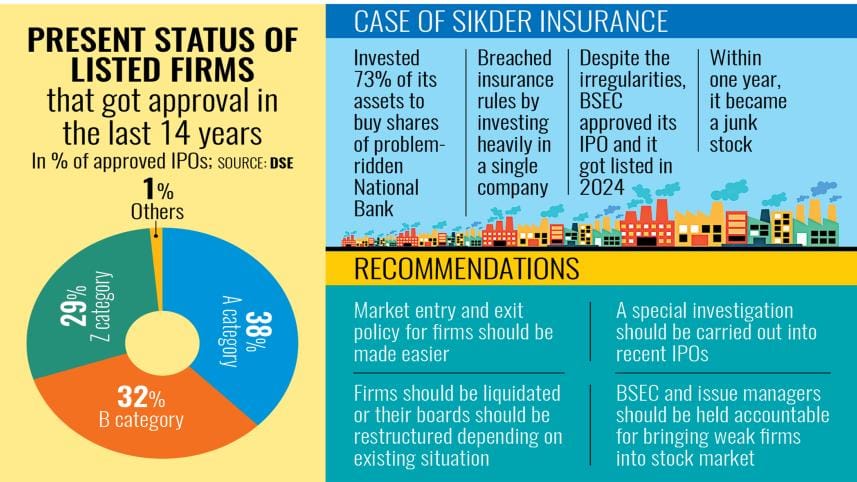

More than two-thirds of companies that got listed on the stock market in the last 14 years were subsequently downgraded to lower categories, with many turning into junk stocks soon after listing.

This has led market analysts to question their motivation for listing: were these decisions sound, or did they go public when they were already on the brink of financial meltdown?

For a better understanding, consider the case of Sikder Insurance -- the non-life insurer that holds the record for being downgraded to junk status within just one year of its market listing.

The Dhaka Stock Exchange (DSE) expressed reservations about the listing of Sikder Insurance.

The objection was well-founded, given factors such as the insurer's heavy investment in the loss-making National Bank -- a company owned by its sponsors, and its lower-than-required investment in government T-bonds.

Both actions violate respective laws.

In 2022, Sikder Insurance invested Tk 132 crore, or 73 percent of its total assets, in National Bank, which was already classified as junk stock.

However, Insurance Development and Regulatory Authority (Idra) rules prohibit non-life insurance companies from investing more than 5 percent of their assets in a single stock.

In the same year of 2022, National Bank reported a record loss of Tk 3,260 crore, with 25 percent of its total loans classified as non-performing.

In contrast to National Bank, Sikder Insurance invested only Tk 2.5 crore, or 1.37 percent of its assets, in government treasury bonds -- far below the required minimum of 7.5 percent.

The DSE flagged in its report to the Bangladesh Securities and Exchange Commission (BSEC) that it was not convinced about the listing.

But the company was approved to go public in 2023.

After its listing in 2024, Sikder Insurance announced a 3 percent cash dividend in June, but failed to disburse it. As a result, its stock was downgraded to Z-category.

Even if the company manages to distribute the dividend, it will only be upgraded to B-category, as a minimum 10 percent cash dividend is required for A-category status.

An analysis of the insurer's 2023 financial report showed that its problematic investment in National Bank remains unchanged.

Since National Bank has not paid dividends for four years, Sikder Insurance's earnings from its primary investment source remain zero.

Besides, the company has not increased its investment in treasury bonds, continuing to flout regulatory requirements.

The Sikder case is not an isolated incident. Many other companies show similar IPO-related issues, raising questions about the stock regulator's due diligence in approving listings.

For instance, Apollo Ispat, whose flagship product "Rani Marka Dheu Tin", had already lost market relevance before its listing on the DSE.

Despite this, BSEC approved its IPO at a premium of Tk 12 per share, only for the company to decline into junk status within a few years.

On Thursday, the stock of Apollo Ispat traded at Tk 3.80.

'ROTTEN STOCKS'

Former BSEC chairman Faruq Ahmad Siddiqi said that these companies should never have been approved for listing, as their financials clearly indicated their businesses were in trouble.

According to DSE data, BSEC has approved 132 companies for listing, transitioning them from private to public entities over the last 14 years. However, nearly one-fourth of these companies have since become junk stocks.

Of the 132 companies approved, only 50 remain in A-category, while 43 have been downgraded to B-category and 38 have fallen to Z-category. One company was merged with another listed company.

Siddiqi said that the BSEC should be held accountable for approving so many questionable IPOs over the past decade.

"This is the right time to do it," he said.

He suggested that regulators should conduct case-by-case inquiries to assess whether struggling companies are failing due to genuine business challenges or mismanagement and poor financial decisions.

Companies with no recovery potential should be liquidated, he added.

Saiful Islam, president of the DSE Brokers Association, said that "the impact of these types of rotten stocks is long-term."

Even if some of these IPOs were approved under political pressure, now is the time to delist underperforming companies, he commented.

According to Islam, flawed listing regulations make delisting a lengthy and complicated process.

He called for easier listing and delisting procedures to prevent poorly performing companies from dragging down the market for years.

He added that although delisting such companies may cause losses for some investors, there is no benefit in holding stocks where major assets are at risk.

WILL THE REGULATOR TAKE NOTE?

The value of Sikder Insurance's investment in National Bank has already dropped by 50 percent since 2022.

Md Jakir Hossain, a stock investor, admitted that he did not analyse the company's financials before investing in its IPO.

He assumed that a company wouldn't become junk overnight and that it should take at least a few years to be downgraded.

Contacted, BSEC spokesperson Rejaul Karim said that insurance companies are required by law to be listed and that Sikder Insurance met the public issue rules at the time of approval.

"In IPO approval, the regulator sees whether the company followed the public issue rules properly," he said.

However, he admitted that BSEC is now more cautious to prevent poor-performing companies from receiving IPO approvals.

In 2021, BSEC intervened by restructuring the boards of several underperforming companies, but none of them have fully recovered.

Karim said if the stock market taskforce formed by the interim government makes recommendations regarding these struggling companies, the regulator will analyse the cases and take action.

Abdur Razzak, company secretary of Sikder Insurance, said the insurer has already paid most of its announced dividend and expects to be upgraded to B-category soon.

He admitted that the company -- whose stock traded at Tk 21.90 on Thursday -- has not received any dividends from its major investment in National Bank but defended the decision not to sell its shares, citing the current low market price.

He also said that their buying price was around Tk 10 per share, while National Bank shares are now trading below Tk 5.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments