Loan recovery from top 20 defaulters stalls

Financial authorities are focusing on the country's top 20 loan defaulters, who account for more than half of the toxic assets in six state-owned banks, as recovery efforts slow and capital shortfalls deepen.

As of December 2024, the top 20 borrowers owed Tk 85,444 crore, representing more than 57 percent of all non-performing loans (NPLs) in state-owned banks. Yet by mid-2025, the banks had clawed back just Tk 128 crore -- barely 1.6 percent of the annual recovery target of Tk 8,077 crore, according to a finance ministry report.

The exposure is dangerously concentrated. Janata Bank alone holds 63 percent of loans to these top defaulters, leaving it reliant on a handful of distressed conglomerates.

The dismal recovery record comes as state-owned banks grapple with widening capital shortfalls and deepening losses. Janata Bank's capital deficit has soared from Tk 12,400 crore in June 2023 to Tk 57,330 crore by June 2025, while its capital adequacy ratio has plunged to –84 percent, which the finance ministry marked as "critically insolvent". The government has placed Janata Bank under special attention, with the Financial Institutions Division holding monthly meetings with the lender to review its condition.

Rupali Bank has seen its capital deficit nearly triple in two years. Over the same period, its capital adequacy ratio collapsed from –1.08 percent to –20.21 percent, reflecting the sharp deterioration in its performance.

Agrani Bank slipped back into heavy losses after a fleeting rebound in early 2025. By contrast, Sonali Bank, the largest state-owned lender, has staged a modest recovery, posting a net profit of Tk 591 crore in June 2025. Bangladesh Development Bank Limited stands out as the only state-owned lender to remain consistently well-capitalised, maintaining capital adequacy ratios above 20 percent.

Meanwhile, BASIC Bank continues to haemorrhage, with mounting losses and one of the worst NPL ratios in the sector.

LOAN RECOVERY STRATEGYY

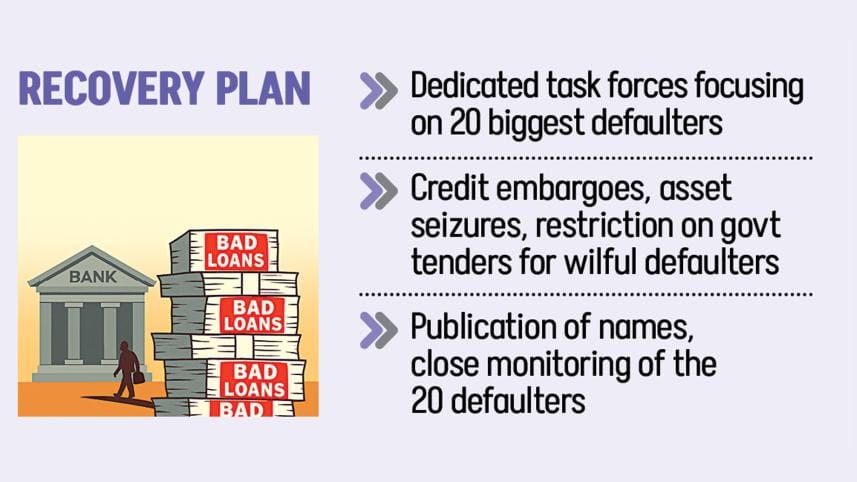

Faced with rising risks, the Financial Institutions Division has unveiled a sweeping recovery strategy aimed at targeting the largest and most wilful borrowers.

Nazma Mobarek, secretary of the Financial Institutions Division, said, "We have identified a group of major defaulters across all six state-owned banks, representing a significant portion of the total Non-Performing Loans.

"All banks have been instructed to form dedicated recovery teams to address these accounts with urgency."

Officials plan to publish the names of the 20 biggest defaulters and closely monitor them, while setting up dedicated task forces to focus exclusively on these accounts. For wilful defaulters, tougher measures are being readied: credit embargoes across all banks, asset seizures and digital auctions to ensure transparency, and restrictions on access to government contracts, tenders and facilities.

The roadmap also addresses the vast backlog of cases clogging the courts. "A very large number of cases remain pending across the six banks, constituting the majority share of their NPL burden," Nazma said, adding that 100 priority cases have already been identified based on the highest financial involvement.

"Banks have been directed to intensify efforts toward resolving these cases by ensuring the presence of representatives at every hearing, conducting monthly review meetings chaired by the heads of the respective banks, and taking stronger measures to address writ petitions," she said.

The government plans to establish special loan recovery tribunals with six-to-twelve-month deadlines to fast-track 77 percent of default loans currently tied up in court, according to the finance ministry's report. In parallel, officials are exploring alternative dispute resolution for mid-tier borrowers. The plan draws on practices in India and Sri Lanka, where arbitration and mediation have been deployed to speed up settlements and ease pressure on overburdened courts.

Alongside loan defaults, thousands of audit objections remain unresolved across the state-owned banks. Then there are weak internal controls, politically influenced lending and poor risk oversight.

"To address this challenge, banks have been instructed to establish stronger monitoring and enforcement mechanisms to ensure timely resolution and effective recovery of audit-related issues," Nazma said.

Rupali Bank Chairman Nazrul Huda, who was appointed in August 2024, "Loans were given in the past without due diligence to bad borrowers who misused or diverted funds, or siphoned money abroad. Many projects are non-existent, and borrowers are not traceable. The recovery of such loans is almost impossible."

The finance ministry has also directed banks to establish "independent audit compliance cells" to clear objections under strict deadlines, while holding boards and senior management personally accountable for recurring lapses. Plans also include new real-time monitoring dashboards to track audit issues and prevent repeat failures.

Sector-wide, the picture is bleak. Total classified loans at state-owned commercial banks reached Tk 149,140 crore by the second quarter of 2025, with provisioning shortfalls of nearly Tk 640 billion.

To contain the damage, the government is weighing the creation of a state-backed Asset Management Company to isolate toxic assets and manage them professionally. Bank recapitalisations, long a drain on the public purse, are expected to be made conditional on measurable recovery targets, including reductions in NPL ratios.

Nazma said banks have also been ordered to keep the finance ministry fully updated: "All banks have been directed to provide us with regular updates on their recovery progress, covering defaulters, pending cases, and audit objections."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments