Tax exemption in FY25 rises to Tk 163,000cr

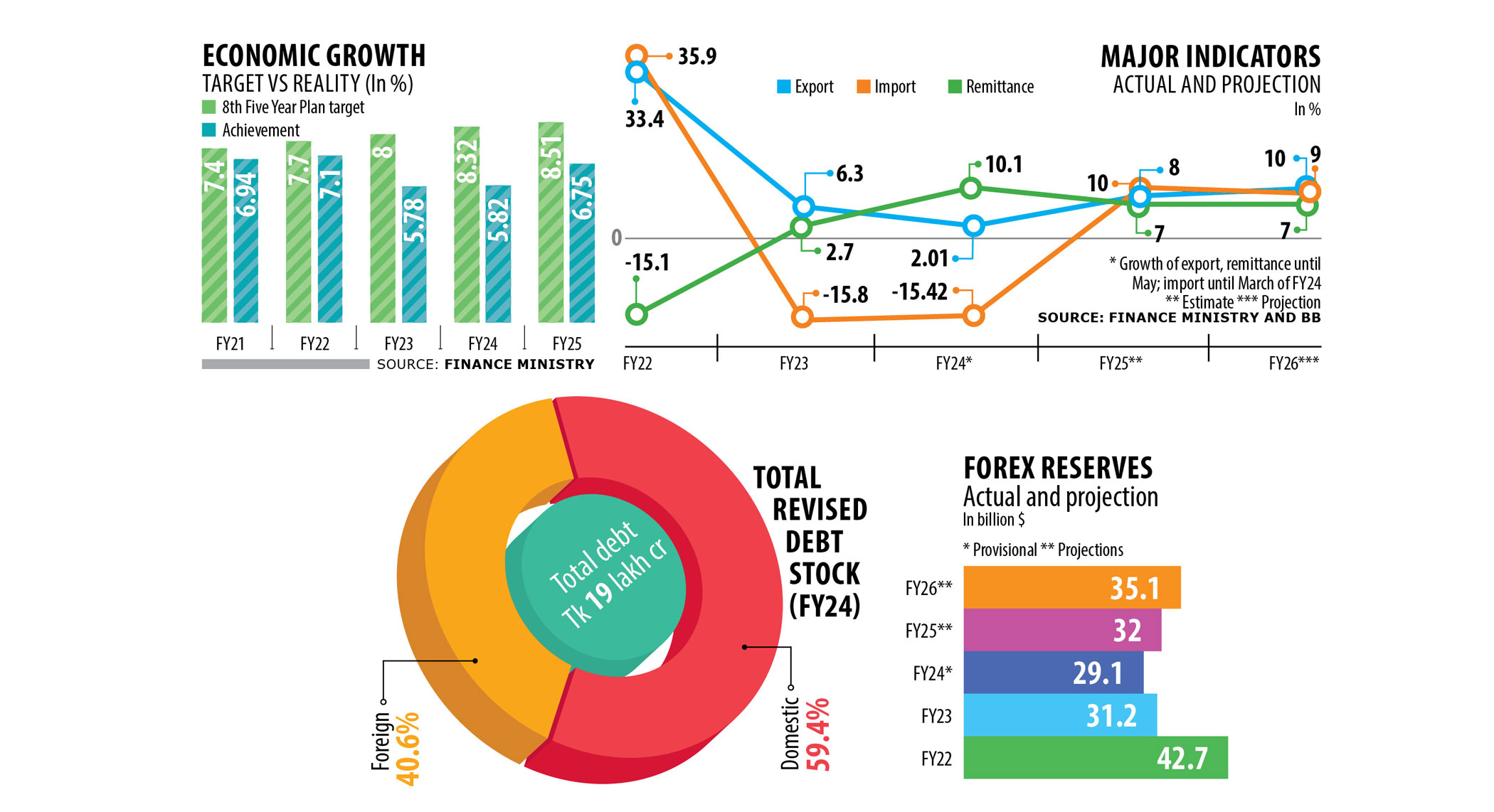

Tax exemptions provided by the National Board of Revenue (NBR) are estimated to rise to Tk 163,000 crore in fiscal 2024-25 as the tax administration looks to ease the pressure on individuals and facilitate higher economic growth.

If the amount of exemption, also termed direct tax expenditure, were added to the total tax collection, the tax-GDP ratio would have increased. Then it would have cut the state's dependence on borrowing to finance expenses.

Direct tax expenditure is a form of tax subsidythat includes rebates, discounts, exemptions and reduced rates of taxation while excluding untaxable income when calculated.

The estimated tax expenditure for FY25 is 11 percent higher from roughly Tk 147,000 crore in 2023-24, which accounted for 2.91 percent of gross domestic product (GDP).

This is the second year the NBR has provided an estimated tax expenditure as part of its exercise to measure the volume of revenue forgone to promote industrialisation, create jobs and foster economic growth.

The tax authority took the initiative after the International Monetary Fund (IMF) asked Bangladesh to calculate its revenue expenditure as a part of the conditions for its $4.7 billion loan.

The IMF also advised rationalisation of tax exemptions targeting Bangladesh's graduation from the list of least-developed countries (LDCs) in November 2026.

Economists have also been recommending the government estimate the amount of tax and duty benefits given to various sectors and assess the impact of the tax waiver.

In its first attempt, the NBR estimated the amount of income, direct tax expenditure or revenue forgone stood at Tk 125,813 crore in 2020-21.

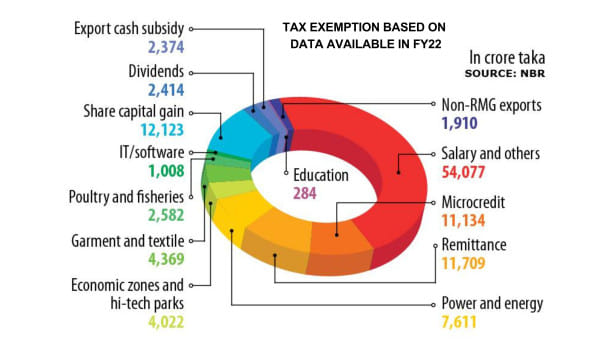

In the following year, the expenditure stood at Tk 115,616 crore, out of which Tk 71,954 crore was given to companies and Tk 43,662 crore to individual taxpayers. The sum of exemptions given in 2021-22 through VAT has been estimated at Tk 129,570 crore.

"This tax subsidy amount is very high," said Ahsan H Mansur, executive director of the Policy Research Institute (PRI) of Bangladesh.

"To reduce the tax subsidies, special attention from the government is needed."

However, the economist acknowledged, tax subsidies have made a positive impact on overall economic activities. "For instance, it has helped the domestic electronics sector expand fast."

Mansur said if the NBR could collect the exempted revenue, it would help the government cut the revenue deficit.

"So, considering the reality, the government will have to allow exemptions in some special cases."

On the other hand, everything should be brought under taxation except for some essential commodities, such as rice, pulses and wheat, he added.

Mohammad Abdur Razzaque, chairman of the Research and Policy Integration for Development Bangladesh, a think-tank, called for tax rationalisation.

"Tax benefits such as subsidies and exemptions shouldn't be set in general. It should be set on a priority basis."

The tariff rate in Bangladesh is one of the highest in the world and if this persists, the country will not be able to sign trade agreements after its LDC graduation.

Towfiqul Islam Khan, a senior research fellow at the Centre for Policy Dialogue, said tax exemptions are given without any sunset clause. As such, many sectors have been enjoying these facilities for decades.

"This is a big problem."

Out of the recipients of tax exemptions, almost half -- 47 percent -- went to salaries and other sectors.

The microcredit, remittance, and capital gain sectors each received 10 percent of the total tax expenditure in FY22.

"Hence, the government's ability to extend such strategic support to other sectors is curtailed. It is critical to analyse the impact of such facilities," Towfiqul said.

As policy decisions are heavily influenced by vested groups, these decisions are often not taken in an objective manner, he added.

The next highest recipients include the power and energy sector at 7 percent, the garment sector at 4 percent, and economic zones and hi-tech parks at 3 percent.

"Although tax exemptions have accelerated investment and employment, the tax base is shrinking to a large extent," Finance Minister Abul Hassan Mahmood Ali said in his budget speech on Thursday.

In this context, there is no alternative to increasing the tax-GDP ratio to sustain the country's ongoing development.

"Tax exemption is one of the major obstacles to improving the tax-GDP ratio. We should not issue special orders for exemptions unless there is an extraordinary situation. This will bring transparency in revenue administration and help manage the budget deficit," he added.

As a part of the move, the finance minister has proposed a tax on capital gains exceeding Tk 50 lakh.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments