s alam group

Govt hires international law firm to fight S Alam arbitration claim

Bangladesh has agreed to pay White & Case an hourly rate of $1,250 (Tk 152,691) to handle proceedings

3 February 2026, 20:58 PM

Adani deal pegged to S Alam’s flawed contract

When the lop-sided deal with Adani Power was signed, a newly inked deal with the controversial S Alam Group’s power plant was used as the pricing benchmark -- even though that contract’s pricing structure was itself unusually expensive and riddled with contractual anomalies.

27 January 2026, 02:17 AM

Phantom bank account linked to S Alam Group

In recent months, several groups allegedly linked to S Alam Group tried to withdraw funds from the account using fake vouchers and cheques.

26 November 2025, 18:22 PM

ACC to sue S Alam, associates over Tk 10,500cr graft

The Anti-Corruption Commission yesterday decided to file a case against 67 individuals, including the former chairman of S Alam Group, over allegations of loan fraud and embezzlement of about Tk 10,500 crore from Islami Bank through abuse of power and influence.

9 November 2025, 18:30 PM

When treaty shields collide with an asset recovery crusade

The S Alam Group owner, Mohammad Saiful Alam, has recently taken Bangladesh to the arbitration arm of the World Bank.

5 November 2025, 04:00 AM

Islami Bank fires 200, makes 4,771 OSD

Islami Bank has made 4,771 officials OSD (officer on special duty) and terminated another 200 for violating service rules.

29 September 2025, 18:04 PM

ACC files cases against 3 top businessmen

The Anti-Corruption Commission has filed cases against three leading businessmen in the country on charges of embezzling large sums of money and amassing illegal wealth.

18 August 2025, 18:00 PM

Janata Bank puts S Alam Refined Sugar’s land for auction

The S Alam Group concern owes Tk 1,777 crore to the state-owned bank

30 December 2024, 07:29 AM

S Alam-linked firms account for 56% of loans from First Security

Companies linked to the controversial S Alam Group took out 56 percent of the total disbursed loans of First Security Islami Bank (FSIB), one of six Shariah-based lenders controlled by the Chattogram-based business giant.

25 December 2024, 18:00 PM

Islami Bank MD forced out of office

Mohammed Monirul Moula, the managing director of Islami Bank Bangladesh, has not gone to his workplace since December 19 when he was forced to leave by a group of officials.

24 December 2024, 18:10 PM

Six factories of S Alam Group closed

Six factories of the controversial business giant S Alam Group in Chattogram were abruptly shut down yesterday until further notice.

24 December 2024, 18:10 PM

S Alam threatens int’l legal action against govt: FT

S Alam Group owner Mohammed Saiful Alam has initiated a legal effort as a Singaporean citizen to recover financial losses he claims were caused by the Bangladeshi government freezing his assets and harming his investments, The Financial Times reports.

23 December 2024, 18:09 PM

Tk 1,964cr defaulted loan: Janata Bank files case against S Alam Group

This is the first time the bank filed a case to recover a loan from S Alam

1 December 2024, 12:11 PM

S Alam says Singapore citizenship is a shield against central bank ‘intimidation’: FT

The letter and Saiful Alam’s threat to pursue international arbitration mark his most serious pushback yet against Bangladesh’s interim government.

20 November 2024, 02:31 AM

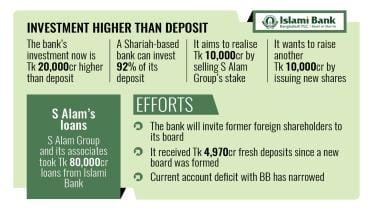

Islami Bank to realise Tk 10,000cr by selling S Alam Group’s stake

Islami Bank Bangladesh plans to sell the S Alam Group’s stake in the bank to realise dues of around Tk 10,000 crore from the controversial conglomerate.

18 November 2024, 18:00 PM

BB probe into Union Bank: ‘S Alam staffer’ took Tk 118cr sans approval

A “staffer of S Alam Group” took out Tk 118 crore from Union Bank without any approval or following any banking norms, indicating how the controversial business conglomerate used the bank.

28 October 2024, 20:33 PM

Two S Alam sons dodged Tk 75cr in taxes in 20-21

At least six tax officials, including the then tax commissioner, were involved in extending undue favour to two sons of controversial businessman Mohammed Saiful Alam to legalise undisclosed money worth Tk 500 crore, an investigation by the tax intelligence has found.

19 October 2024, 18:00 PM

S Alam took out 86pc of Global Islami Bank’s loans

S Alam Group and its linked companies account for more than 86 percent of the disbursed loans of Global Islami Bank (GIB), one of the six Shariah-based lenders that were controlled by the Chattogram-based business giant.

30 September 2024, 01:00 AM

S Alam’s tax file shows no foreign income

S Alam Group owner Mohammed Saiful Alam’s 2022-2023 tax file is a puzzle. In that tax year, he declared personal assets worth Tk 2,532 crore, but did not show any personal bank loans from Bangladesh or his foreign income.

29 September 2024, 01:00 AM

Globe Edible Oil Ltd: S Alam’s backdoor takeover attempt

S Alam Group’s takeover of the Islami Bank to drain the healthiest bank of the country had left investors and customers in shock. It did not stop there.

25 September 2024, 01:00 AM