National Budget 2018-19

JS passes national budget FY 2018-19

The Jatiya Sangsad passes the proposed Tk 4,64,573 crore national budget for 2018-19 fiscal year.

28 June 2018, 09:40 AM

Minister suggests lowering prices of liquor

Housing and Public Works Minister Engr Mosharraf Hossain suggests cutting down customs duty on liquor for the sake of flourishing tourism in the country.

18 June 2018, 14:12 PM

No VAT on remittance: NBR

No VAT or tax has been imposed on remittance in the proposed budget for 2018-19 fiscal year, the National Board of Revenue (NBR) says.

13 June 2018, 11:06 AM

MPs blast Muhith for bank scams

Opposition and some of the ruling party lawmakers in the parliament criticises Finance Minister AMA Muhith for not stating any measures in the proposed budget for fiscal 2018-19 against irregularities in the financial and banking sectors.

10 June 2018, 09:50 AM

No directions on SDGs in proposed budget: SANEM

The proposed budget for fiscal 2018-19 does not have any directions to meet the Sustainable Development Goals (SDGs), South Asian Network on Economic Modeling (SANEM) says.

9 June 2018, 09:55 AM

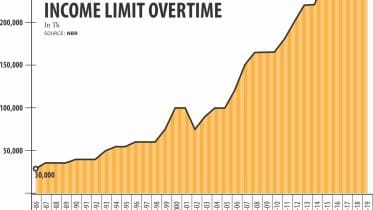

Tax measures to hurt middle class

The proposed budgetary measures for fiscal 2018-19 will benefit the high and low income people, leaving the middle- and lower middle-class, which form the majority of Bangladesh's population, strained, said the Centre for Policy Dialogue yesterday.

8 June 2018, 18:00 PM

New squeeze for middle class

Shifa Hosne and her husband have been saving up money to buy a small flat in the city, where property price is already way beyond the capacity of service holders with fixed income.

7 June 2018, 18:00 PM

Allocation of total government expenditure by sectors

Fy 2018-19...

7 June 2018, 18:00 PM

Supplementary Budget: Muhith says sorry for inadequate discussions

For the first time in Bangladesh, a finance minister apologised for his inability to create an opportunity to hold elaborate discussions on supplementary budget in parliament.

7 June 2018, 18:00 PM

History of Budget

National Budget 2018-19 ....

7 June 2018, 18:00 PM

Bowing to banks

The government is continuing to treat banks with kid gloves instead of going tough on them for the rampant financial irregularities and continued poor judgement.

7 June 2018, 18:00 PM

Digital marketing to come under tax net

The government plans following in Europe's footsteps to tap digital marketing's popularity, with Finance Minister AMA Muhith yesterday proposing introducing provisions on taxing earnings of networking tech giants such as Facebook, Google and Youtube.

7 June 2018, 18:00 PM

No cheers in tax measures

Every year when the budget is placed in the parliament, Taufiq Hasan, a 35-year-old private sector employee, gets all worked up about which products and services he would have to pay more the following fiscal year.

7 June 2018, 18:00 PM

Raising revenue an uphill battle: businesses

Chamber and trade body leaders yesterday said the government would struggle to generate higher revenue in the course of implementing the budget in the election year.

7 June 2018, 18:00 PM

Rich to be barred from buying savings tools

The government is going to connect the national savings certificate (NSC) buyers' database with that used in the creation of national identity (NID) cards to prevent the certificates from going into the hands of ineligible people.

7 June 2018, 18:00 PM

Budget not realistic: analysts

The proposed budget for the next fiscal year is unrealistic, as it lacks significant structural and policy changes, analysts said in their immediate reaction yesterday.

7 June 2018, 18:00 PM

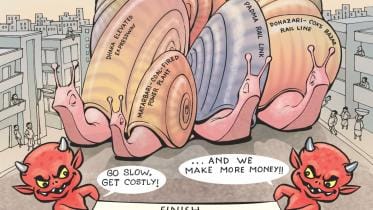

No prescription for 'slow' virus

Fast-track projects, as the title suggests, are supposed to be implemented at breakneck speed because they boost economic activities once they are complete.

7 June 2018, 18:00 PM

Jute mills to be revived by PPP initiatives

The government will bring an end to the vulnerable situation public jute mills are in by running those under the public private partnership (PPP) model.

7 June 2018, 18:00 PM

Corporate tax to rise for apparel

The proposed rise in corporate tax will hurt the flow of fresh investment into the garment sector as entrepreneurs will feel discouraged to inject fresh funds, said the top leader of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA) yesterday.

7 June 2018, 18:00 PM

Education lacks due attention

As the government had formulated National Education Policy immediately after coming to power in 2009, educationists started advocating for spending at least six percent of the GDP for education.

7 June 2018, 18:00 PM