Tax measures to hurt middle class

The proposed budgetary measures for fiscal 2018-19 will benefit the high and low income people, leaving the middle- and lower middle-class, which form the majority of Bangladesh's population, strained, said the Centre for Policy Dialogue yesterday.

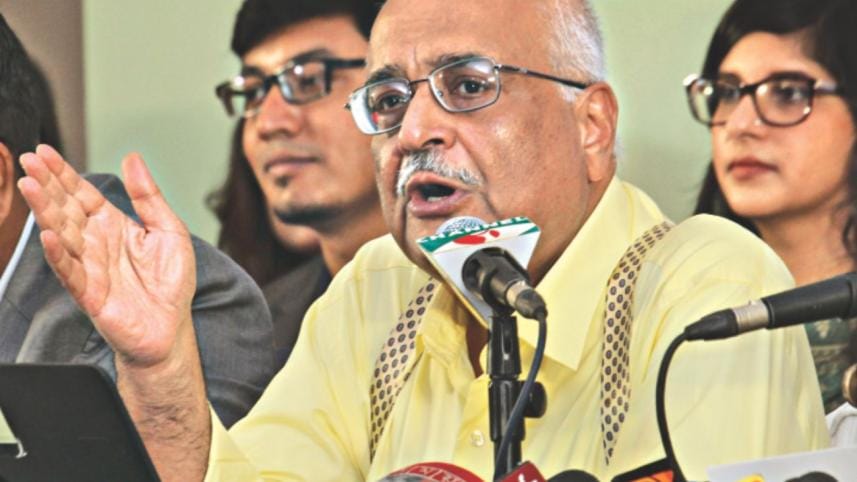

“Policymakers do not feel the need to hear the voices of the middle-class and the lower middle income people to the extent they feel necessary to pay attention to the poor for vote and affluent class for election finance,” said Debapriya Bhattacharya, distinguished fellow of the CPD.

Debapriya presented the think-tank's analysis on the proposed budget for fiscal 2018-19 at a discussion in the capital's Lakeshore Hotel.

Finance Minister AMA Muhith unveiled a budget of Tk 464,573 crore for the coming year on Thursday, proposing continuation of the existing tax-free income ceiling and tax rates for individuals and companies.

At the same time, VAT on various goods and services such as flats of up to 1,100-square feet, furniture and clothes have been increased while VAT was imposed for the first time on ride-hailing services and virtual businesses.

CPD Distinguished Fellow Mustafizur Rahman said, “The middle- and lower middle-class have a relation with the market. For this reason, the rise in indirect tax by way of VAT will create a burden on the shoulders of these people.”

The speakers, however, appreciated that social safety net programmes were upgraded for the poor.

Corporate tax for banks, financial institutions and insurance companies has been slashed and the perquisite allowance has been raised to Tk 5.50 lakh from Tk 4.75 lakh, both of which will please high income people.

Debapriya said, “We are giving benefits to low income people by increasing the social safety net coverage. At the same time, we are giving benefits to those who provide finance for election.”

He also pointed out that income inequality was on the rise -- a worrying trend conveniently overlooked in the proposed budget.

Between 2010 and 2016, the income of the bottom 5 percent of the population declined by 60 percent and that of the top 5 percent rose by 57 percent.

“The East-West divide in Bangladesh poverty scenario appears to have resurfaced during this period,” he said, adding that Chittagong, Dhaka and Sylhet were considered east, and Barisal, Khulna and Rajshahi west.

The social safety net coverage has been expanded in the proposed budget. “This will better address the issue of 'inclusivity of growth' in the budget, albeit mostly through short-term measures,” the CPD said.

But the medium- to long-term challenges such as inequality of both income and wealth, unplanned urbanisation and the other issues were ignored.

The budget's lack of sensitivity towards the existing and emerging concerns such as the pressure on balance of payment and exchange rate, inflationary expectations as well as scant attention to areas requiring reforms is upsetting.

The widening imbalance in trade and the current account is becoming a matter of grave concern: it is weakening the taka against other currencies and fuelling import-induced inflation.

Under the circumstance, a spike in VAT rates for goods and services, including advance trade VAT at the import and trading stages from 4 percent to 5 percent, will increase prices and thereby inflation, which is already creeping up.

Inflation is likely to rise in the incoming fiscal year and would not be stable at 5.6 percent as projected in the budget, the CPD said.

“The anticipated food and non-food price pressure will fall disproportionately on the low income people and worsen the consumption and income inequality situation.”

A large number of lower middle income people will come under the tax net for the first time next fiscal year as the tax-free income limit has been kept unchanged for the fourth year now -- without considering the added pressure of rising food inflation and decreasing average monthly real wage.

The tax-free income threshold should be increased to Tk 300,000 and the first slab of tax rate should be fixed at 7.5 percent instead of 10 percent to ease the pressure on the lower middle income families, the CPD said.

The civil society organisation opposed the government's move to lower the corporate tax rate for banks, insurance and financial institutions, saying the cuts will give the 'opposite signal' to the sector plagued by loan scams, high default loans, liquidity crunch and a complete lack of good governance.

“The government should not give such facility to the owners of banks and financial institutions without stopping the anarchy that is going in the banking sector,” Debapriya said.

He went to state that the corporate tax cut is unlikely to improve the liquidity situation and lower the interest rate for lending, both of which would have benefitted the entrepreneurs.

Subsequently, he called for continuation of the existing corporate tax rates for the financial sector: 40 percent for listed banks, non-bank financial institutions and 42.5 percent for the non-listed ones.

Mustafiz cited various measures taken by India to restrict risky lending. “In contrast, no step has been taken to discipline the sector. We are surprised to see this,” he added.

The research organisation said a number of laudable fiscal measures have been taken to strengthen the domestic-oriented industries and enhance revenue earnings.

“However, the budget for fiscal 2018-19 is overall one of maintaining the status quo. The budget statement builds more on a review of the past rather than a focus on future,” the CPD said.

Moderated by CPD Executive Director Fahmida Khatun, Research Director Khondaker Golam Moazzem and Research Fellow Towfiqul Islam Khan also spoke.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments