monetary policy

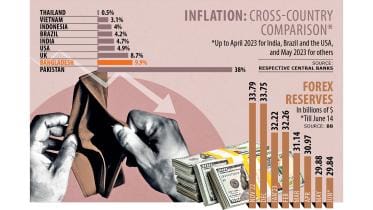

BB to intervene in forex market

Bangladesh Bank (BB) will intervene in the foreign exchange market to curb volatility in the exchange rate and rebuild the country's foreign exchange reserves.

31 July 2025, 22:55 PM

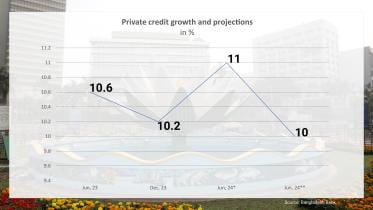

Private credit growth target lowered amid low appetite

Bangladesh Bank (BB) has lowered the target for private sector credit growth in its latest monetary policy, citing a lack of appetite arising from political uncertainties.

31 July 2025, 22:42 PM

Inflation, tariff risks keep Bangladesh on tight monetary path

Bangladesh Bank has held its key policy repo rate steady at 10 percent for the first half of the current fiscal year, reaffirming its commitment to a tight monetary stance aimed at curbing persistent inflation, weak private investment, and growing uncertainty over global trade.

31 July 2025, 19:07 PM

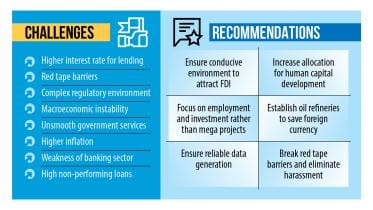

Tightened monetary policy undermines trade, investment growth: DCCI

The central bank should adopt a more supportive stance, the chamber says

31 July 2025, 11:11 AM

Banks to come under risk-based supervision: BB

The banking regulator unveils monetary policy statement for July-December 2025

31 July 2025, 10:18 AM

BB keeps policy rate unchanged

BB said the 10 percent policy rate would remain in place for the July-December period

31 July 2025, 09:11 AM

BB to keep policy rates unchanged as panel suggests shift from crawling peg

A high-powered panel of the Bangladesh Bank (BB) decided to maintain the policy rate at 10 percent until the inflation comes down to a desired level and also spoke about moving away from the crawling peg and letting market forces determine the US dollar exchange rate.

9 December 2024, 18:00 PM

Governor defends tight policy as cash-strapped firms struggle

Bangladesh Bank Governor Ahsan H Mansur said tightening monetary policy is the only globally practised remedy to heal inflationary pain, as businessmen opposed interest rate hikes for obstructing business expansion and job creation.

11 November 2024, 18:00 PM

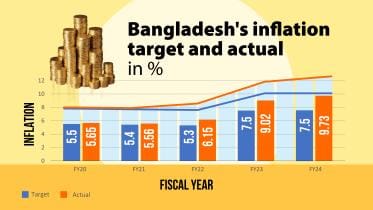

Stabilising prices is the immediate priority

Inflationary pressure is being felt severely in the face of wage growth declines.

27 August 2024, 02:00 AM

Private sector credit growth target lowered to 9.8%

The target for January-June was 10%

18 July 2024, 09:32 AM

Exchange rate mid-rate to remain unchanged at 117 per USD

The crawling peg and the mid-rate were introduced on May 8 this year

18 July 2024, 09:26 AM

Bangladesh Bank keeps policy rates unchanged

Kept repo rate at 8.5%, SDF rate at 7% and SLF rate at 10%

18 July 2024, 09:13 AM

Bangladesh Bank set to unveil monetary policy

The central bank is expected to maintain a tight monetary stance for July-December

18 July 2024, 08:43 AM

BB to adopt crawling peg to curb exchange rate volatility

The peg system would be linked to a carefully selected basket of currencies and operate within a predefined exchange rate corridor

17 January 2024, 09:51 AM

Private sector credit growth target lowered to 10% from 11%

Bangladesh Bank also raised the benchmark policy rate by 25 basis points to 8 percent

17 January 2024, 09:33 AM

Bangladesh Bank unveils monetary policy to tame inflation

The BB maintained a contractionary policy stance in the July-December of 2023-24

17 January 2024, 08:29 AM

Is monetary policy helping contain inflation?

The Federal Reserve of the US and the European Central Bank kept hiking policy rates in their fight against record inflation throughout last year and this year whereas the central bank of Bangladesh chose not to use the full force of the monetary policy.

13 September 2023, 00:00 AM

Monetary policy has been set free... but not really

While the government’s latest monetary policy for the first half of fiscal year 2023-24 shows an attempt to be rational for the market, it lacks vigour to solve inflation and the dollar crisis.

21 June 2023, 14:00 PM

Inflationary pains for common people to persist

Like in the outgoing financial year, the common people in Bangladesh will continue to suffer from higher consumer prices in 2023-24 as the factors behind the elevated level of inflation are unlikely to change dramatically.

20 June 2023, 02:00 AM

Tight monetary policy, but is it enough?

On the surface, the monetary policy appears to be tuned to the need of the hour: bring down inflation and conserve reserves. But it comes caving down on careful reading.

19 June 2023, 01:00 AM