Loans

Implementation of a banking commission to address challenges in the sector

It is unfortunate that the previous government fell short of its commitments to strengthen the banking sector.

19 August 2024, 13:00 PM

Generous exit policy offered to borrowers

Bangladesh Bank yesterday unveiled the latest iteration of its exit policy that offers borrowers the option to close off their loan account within three years by paying only 10 percent as down payment and no interest.

8 July 2024, 18:00 PM

State enterprises’ loan rising, so is govt guarantee

The government needs to provide guarantees against an increasing amount of loans of state-owned enterprises every fiscal year, especially for power generation, fertiliser and fuel imports, and aircraft purchases.

16 June 2024, 00:25 AM

BB allows new entities to assess credit worthiness of borrowers

These credit bureaus will work to determine credit standards by analysing borrower data before sharing it with banks, which will help financial institutions make informed decisions, said the central bank guidelines on the licencing, operating and regulating of credit bureaus.

10 June 2024, 01:02 AM

Defences against bank risks

Banks are an essential part of a nation’s economy. They facilitate the flow of funds from surplus units (depositors) to deficit units (borrowers) to fuel the growth of the economy.

8 August 2023, 18:00 PM

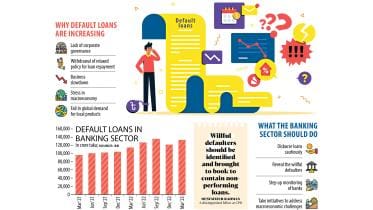

Tk 10,964cr loans turn sour in 3 months

Banks in Bangladesh witnessed an accumulation of default loans by Tk 10,964 crore in the first three months of 2023, highlighting the worsening financial health of the banking sector, official figures showed.

29 May 2023, 02:00 AM

Bangladesh Bank looked away as tycoons borrowed at will from 2 banks

On edge -- is what best describes the sensation surrounding the banking sector. But the Bangladesh Bank higher-ups were warned as early as October 2021 that such a situation might transpire. Yet, no definitive action was taken then.

18 December 2022, 01:00 AM

Why the reluctance to fund women's businesses?

SME loans to women entrepreneurs should be made easy to obtain

1 December 2022, 13:56 PM

Being a big loan defaulter pays!

THE recent circular issued by the Bangladesh Bank (BB) on loan restructuring does not seem to be equitable because it is giving a special facility only to a certain group of people.

9 February 2015, 18:00 PM