Liquidity Crisis

Default loans may exceed 30% by June

The banking sector continues to face challenges, including rising non-performing loans (NPLs), which are likely to exceed 30 percent of total outstanding loans by June this year, raising serious concerns, said Bangladesh Bank (BB).

10 February 2025, 18:00 PM

3 banks get Tk 12,500cr in emergency funds

Bangladesh Bank (BB) has extended a total of Tk 12,500 crore in emergency funds to three beleaguered banks to dress up their balance sheet ahead of the year’s end.

31 December 2024, 18:00 PM

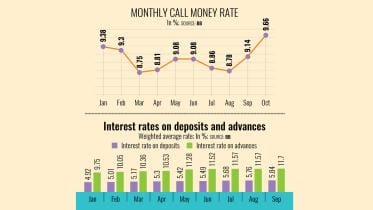

Banks reel from liquidity crisis despite rising deposit rates

Despite rising interest rates on deposits and various efforts by the central bank, Bangladesh’s banking sector continues to face a liquidity crisis that has hamstrung some lenders.

25 November 2024, 18:00 PM

Crisis-hit banks repaying depositors for emergencies, basic needs

As crisis-hit lenders have started getting liquidity support from the inter-bank money market, they are now repaying depositors for specific purposes, such as medical emergencies, and in the case of salary disbursement or remittance encashment.

10 October 2024, 18:00 PM

Six banks still in shortfall despite BB support

Six banks including four Shariah-based ones are still facing a deficit in their current accounts with the central bank despite special liquidity support.

18 August 2024, 21:00 PM

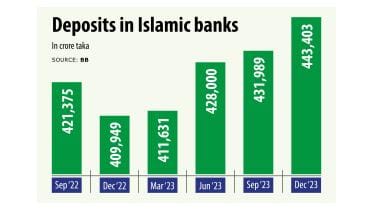

Islamic banks face liquidity challenges: Fitch

Islamic banks’ liquidity coverage ratio (LCR) tumbled to 58.7 percent at the end of last year compared to 87.7 percent in 2022 and 188.5 percent in 2021.

4 June 2024, 00:13 AM

ICB Islamic Bank struggling to pay back depositors

ICB Islamic Bank, which took shape from the ruins of Oriental Bank in 2008, is now failing to repay the depositors’ money due to severe liquidity crisis, indicating a vulnerable situation of the lender.

18 May 2024, 18:00 PM

Withdrawals put BASIC Bank in liquidity crisis

BASIC Bank is experiencing a deep liquidity crunch as depositors have been withdrawing money for weeks following news that the state-run lender is going to be acquired by a private commercial bank.

11 May 2024, 18:00 PM

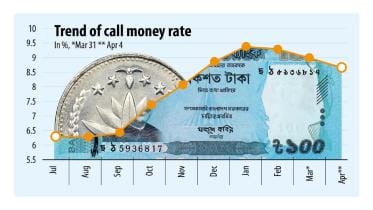

BB's support helping banks avert pre-Eid liquidity crunch

Although banks in the country normally face a liquidity shortage due to cash withdrawals ahead of Eid-ul-Fitr each year, a majority of them have sufficient funds on hand this time around thanks to continuous liquidity support from Bangladesh Bank.

7 April 2024, 01:30 AM

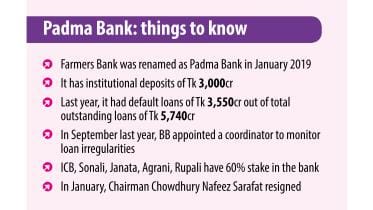

Padma Bank to turn institutional deposits into preference shares

In a rare move, Padma Bank PLC is going to convert institutional deposits into preference shares and provide them to customers seeking to withdraw funds, exposing how deeper its liquidity crisis is.

21 February 2024, 00:17 AM

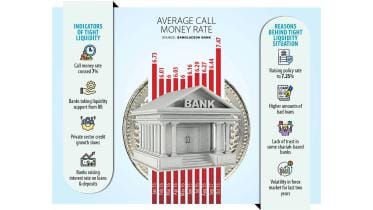

Funds get costlier as liquidity crisis drags on

Both the government and banks are facing a tight liquidity situation, which has pushed up the yield of treasury bills and bonds and the lending rate in the banking sector

28 January 2024, 00:27 AM

Liquidity crunch widens fault lines in banking system

An intensifying liquidity crisis is making a majority of Bangladeshi banks turn to call money market and central bank

5 January 2024, 01:30 AM

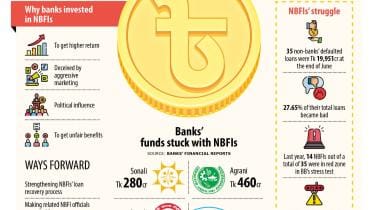

State banks’ Tk 1,600cr stuck in ailing NBFIs

Deposits of Tk 1,600 crore of four state-run commercial banks —Sonali, Rupali, Agrani, and Janata — have been stuck in several weak non-bank financial institutions (NBFIs) as the latter have repeatedly failed to repay despite maturity owing to a persisting liquidity crisis.

15 November 2023, 00:00 AM

Banks suffering for growing liquidity stress

A majority of banks in Bangladesh, including some Shariah-based ones, are facing difficulties to run their activities due to a liquidity crisis, according to industry people.

17 October 2023, 01:30 AM

Liquidity stress at Islamic banks shows no sign of abating

Liquidity in Shariah-based banks in Bangladesh remains tight due to a dip in deposit collection and the banks’ inability to make the most of the central bank support to overcome the situation, Moody’s Investors Service said in a report.

15 September 2023, 18:00 PM

Islamic banks face liquidity challenges

The Islamic banking sector in Bangladesh continues to face liquidity challenges because of weak governance and regulatory quality, Fitch Ratings said.

13 September 2023, 18:00 PM

BB asks 5 Shariah banks to resolve liquidity crisis

Bangladesh Bank has directed five Shariah-based banks to resolve their current liquidity crisis while three of them were asked to bring down their advance-deposit ratio (ADR) within the regulatory limit as soon as possible.

17 August 2023, 18:00 PM

Most banks in tight spot amid liquidity crunch

A majority of banks in Bangladesh are facing difficulties in running their day-to-day banking activities owing to a tightening liquidity caused by the dragging foreign currency crisis, slower deposit growth and lacklustre loan recovery.

13 August 2023, 00:00 AM

Liquidity Crisis: From banks to many fronts

Bangladesh economy showed resilience even during the global financial crisis that began in 2008.

5 February 2018, 18:00 PM

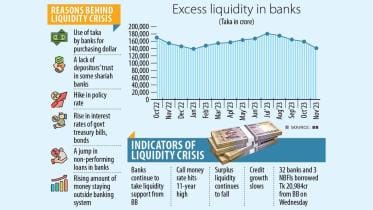

Liquidity Crisis Deepens: Money is there, money is not

On the face of it, banks are awash with money. In September last year, excess liquidity of the banks totalled Tk 92,000 crore. The paradox is the banks do not have money when it comes to lending.

25 January 2018, 18:00 PM