Islamic banks face liquidity challenges: Fitch

Liquidity shortages are still affecting Bangladesh's Islamic banking sector, which is more vulnerable than the conventional banks, according to a report released by Fitch Ratings yesterday.

The American credit rating agency added that though the Islamic banking market share is sizable in Bangladesh, it has been stagnant over the past two years.

The share of Islamic banks in terms of deposit in the overall banking sector came down from 25.8 percent in 2022 to 25.3 percent at the end of last year.

Meanwhile, their share in the overall lending among all banks fell from 29.2 percent in 2022 to 28.9 percent in 2023.

Islamic banks' liquidity coverage ratio (LCR) tumbled to 58.7 percent at the end of last year compared to 87.7 percent in 2022 and 188.5 percent in 2021.

Fitch Ratings said this is partly due to the flight of deposits, governance issues and comparatively lax prudential requirements for Islamic banks.

It also said the liquidity profiles are showing signs of improvement, with some stabilisation possible in 2024 and 2025.

The report added that Fitch was monitoring the liquidity position of several Islamic banks, including ICB Islamic Bank Ltd (not rated).

It said ICB's cash balance fell by over 90 percent year-on-year at the end of March this year based on its unaudited financial statements.

ICB is the smallest Islamic bank in Bangladesh, with a 0.3 percent share of the sector, and therefore its negative performance is unlikely to materially affect the market share of the total Islamic banking sector, as per the report.

As part of a financial sector safety net, customer deposits of Islamic banks are covered by a Deposit Insurance Scheme that protects deposits of up to Tk 100,000. However, its efficacy is yet to be proven.

In general, Fitch regards Bangladesh's banking sector and its governance standards as weak, the report said, adding that the sector could be a source of contingent liability for the sovereign if credit stress intensifies.

Fitch downgraded Bangladesh to 'B+'/Stable on May 27 this year, reflecting weaker external buffers, it said, adding that there is a lack of precedents for default resolution at Islamic banks in Bangladesh and most key Islamic finance markets.

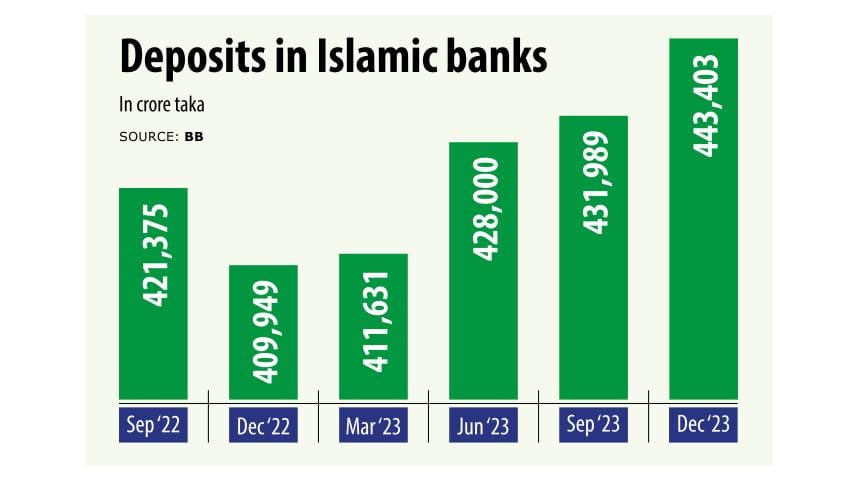

The report said the deposit profile of the Islamic banking sector improved slightly in the first half of last year compared to the previous year, when it faced sizable customer deposit outflows following loan irregularity reports.

The shortage of Islamic liquidity management instruments continues, it said, adding that government sukuk could serve as collateral for Islamic repo and enable Islamic banks to seek central bank funding, but are in low supply.

The report added that it is yet to be seen how bankruptcy courts treat Islamic bank defaults compared to conventional bank defaults, whether mudaraba-based depositors -- which are based on profit-and-loss sharing contracts -- will have full recourse to the banks, and if all depositors will be able to enforce their contractual rights in local courts.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments