Defaulted loans

Default loans hit 34%, highest in 25 years

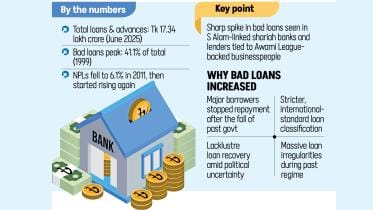

NPLs reach their highest level since 2000, reflecting irresponsible lending, political influence under previous regime

25 November 2025, 19:29 PM

BB relaxes loan exit policy for troubled businesses

Bangladesh Bank (BB) today relaxed the down payment requirements for exit facilities on defaulted loans of closed or loss-incurring companies.

10 March 2025, 15:50 PM

What does high default loan mean for the economy?

At the end of 2024, one-fifth of the total loans in the banking sector turned into bad loans, mainly because the true extent of fund embezzlement by willful defaulters is now coming to light

1 March 2025, 14:00 PM

Monetary policy likely in last week of January

Bangladesh Bank will soon announce its monetary policy for the second half of the ongoing fiscal year (2024-25) with the aim of addressing several economic challenges plaguing the country.

8 January 2025, 18:00 PM

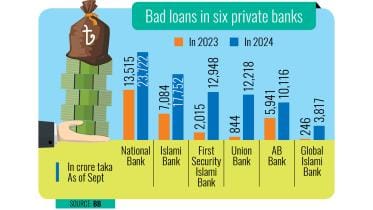

Six private banks see bad loans nearly triple in a year

Defaulted loans at six private commercial banks nearly tripled in one year till September 2024, according to central bank data, which bankers term “alarming”.

17 December 2024, 18:00 PM

Bad loans hit alarming record

Awami League-affiliated businesses had already put the country’s banking sector in trouble with huge bad debts, but the loans disbursed through irregularities to these companies turned sour even at a more alarming pace after the party’s ouster.

17 November 2024, 18:40 PM

Generous exit policy offered to borrowers

Bangladesh Bank yesterday unveiled the latest iteration of its exit policy that offers borrowers the option to close off their loan account within three years by paying only 10 percent as down payment and no interest.

8 July 2024, 18:00 PM

Defaulted loans soar 20.7pc in 2023

The banking sector’s defaulted loans soared 20.7 percent to Tk 145,633 crore in 2023 as both governance and accountability continue to get looser.

12 February 2024, 18:00 PM

When will Janata Bank’s troubles end?

The state-owned bank's failure to meet any of the performance targets set by the central bank raises a red flag.

26 November 2023, 14:30 PM

Janata Bank comes short of BB’s targets

Janata Bank has failed to meet any of its performance improvement targets set by the central bank in the first half of the year -- a worrying development given that the state bank accounts for the second-highest volume of deposits and loans among the 61 scheduled lenders in Bangladesh.

25 November 2023, 18:00 PM

What’s really causing our non-performing loans to skyrocket?

It is alleged that a group of politically-connected people took out large loans from state-owned commercial banks (SOCBs) and intentionally defaulted on them.

17 October 2023, 02:00 AM

Weak banking sector, Achilles’ heel of economy

The International Monetary Fund has identified the problems in the banking system, including the high volume of defaulted loans, as one of the three domestic risks that derail the economy in the short- to medium-term.

5 February 2023, 01:00 AM

From an incorrigible New Year enthusiast

Let’s think of some out-of-the-box ways to tackle even the most formidable of problems.

31 December 2022, 18:37 PM

Bad loans soar

Defaulted loans soared to Tk 110,874 crore as of March this year, the highest ever in the country.

10 June 2019, 18:00 PM