Provide more finance & refinance options

26 June 2024, 18:00 PM

MSMEs Day 2024

Set a specific interest rate for SMEs

26 June 2024, 18:00 PM

MSMEs Day 2024

Ensure quick and well-timed disbursements

26 June 2024, 18:00 PM

MSMEs Day 2024

Comprehensive financial partner for SMEs

26 June 2024, 18:00 PM

MSMEs Day 2024

Innovation and collaboration are crucial

26 June 2024, 18:00 PM

MSMEs Day 2024

Implement comprehensive credit guarantee schemes

26 June 2024, 18:00 PM

MSMEs Day 2024

Bridging the Gap Enhancing Financial Services for SMEs

26 June 2024, 18:00 PM

MSMEs Day 2024

Digitise operations to reach CMSMEs

26 June 2024, 18:00 PM

MSMEs Day 2024

Simplify regulatory compliance for CMSMEs

26 June 2024, 18:00 PM

MSMEs Day 2024

Banks must reach out to SMEs

26 June 2024, 18:00 PM

MSMEs Day 2024

Provide more finance & refinance options

At Prime Bank, we are dedicated to empowering the SME sector by offering tailored banking products and services to meet their specific needs.

26 June 2024, 18:00 PM

Set a specific interest rate for SMEs

Midland Bank has been committed to inclusive banking since its inception. It places great importance on the SME sector and continually strives to increase credit flow to SMEs under the policies, guidelines, and circulars issued by Bangladesh Bank.

26 June 2024, 18:00 PM

Ensure quick and well-timed disbursements

Eastern Bank PLC aims to dominate the SME lending market by offering a range of competitive and differentiated product solutions to its customers.

26 June 2024, 18:00 PM

Comprehensive financial partner for SMEs

Since CMSMEs lack collateral, most banks are usually discouraged from providing them with financing support due to the risks involved in unsecured credit. Despite this challenge, BRAC Bank, the country’s sole SME-focused bank, remains steadfast in its commitment to facilitating easy access to credit for grassroots entrepreneurs.

26 June 2024, 18:00 PM

Innovation and collaboration are crucial

Most banks support SMEs through a variety of services and products designed to address their specific needs. At Bank Asia, however, we offer specialised checking and savings accounts tailored for businesses, often with features like higher transaction limits and integration with accounting software.

26 June 2024, 18:00 PM

Implement comprehensive credit guarantee schemes

City Bank has a robust framework for supporting CMSMEs, offering a variety of financial products and services tailored to meet the unique needs of small and micro enterprises.

26 June 2024, 18:00 PM

Bridging the Gap Enhancing Financial Services for SMEs

The SME sector currently contributes approximately 30-32% to Bangladesh’s GDP, showcasing substantial potential to emerge as a leading driver of economic growth in the country in the foreseeable future.

26 June 2024, 18:00 PM

Digitise operations to reach CMSMEs

MTB has consistently served as a trusted partner for SMEs nationwide since its inception. Our strong compliance with regulatory directives for CMSMEs reflects our commitment to developing these sectors while enhancing financial inclusiveness in the country.

26 June 2024, 18:00 PM

Simplify regulatory compliance for CMSMEs

Sustainable growth in the CMSME and Emerging Business industry is a major priority for Dhaka Bank.

26 June 2024, 18:00 PM

Banks must reach out to SMEs

As part of its all-inclusive banking policy, EXIM Bank has always promoted investments in SMEs and related sectors like agriculture, cottage industries, micro-enterprises, women entrepreneurship, and rural finance.

26 June 2024, 18:00 PM

More funds and digitalisation needed

Currently, the total contribution of our country’s CMSME sector towards our GDP is around 27 percent. Just a year ago, it used to be 24 percent.

26 June 2024, 18:00 PM

Boosting women-led SMEs through financing

“To overcome poverty, I started my embroidery business with my savings. Due to a lack of funding, it was initially difficult to make a profit. Later, I took a loan from a bank,” shares Sultana Afroze, founder of Sultana Embroidery, reflecting on the early stages of her SME journey.

26 June 2024, 18:00 PM

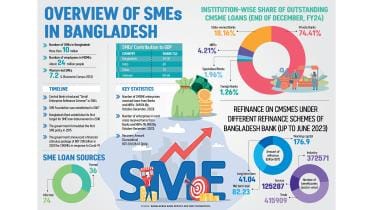

Overview of SMEs in Bangladesh

Overview of SMEs in Bangladesh

26 June 2024, 18:00 PM

Leveraging the power of SMEs

According to Dr. Mohammad Masudur Rahman, Chairperson of the SME Foundation, SMEs currently contribute 30-32% to the GDP, but there is potential for them to contribute even more significantly to overall economic development.

26 June 2024, 18:00 PM