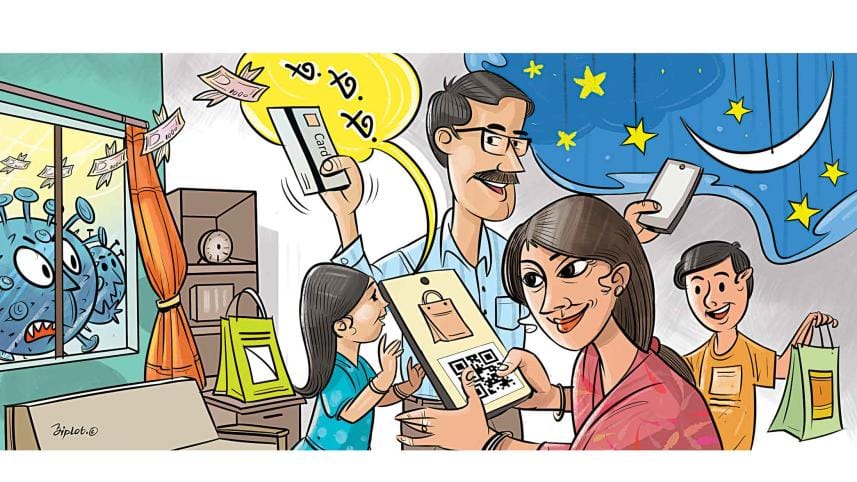

Digital payment: A saviour amid the pandemic

As cashless transactions turbocharged across the world during the pandemic, for Zyma Islam, a resident of the capital's Dhanmondi, digital mode of payment turned out to be a saviour.

From buying manure to fertilise the plants in her garden to shopping for toiletries, she purchases almost everything online and makes payment with her credit card.

"Cashless payment has become more important than ever and it is now a lifestyle. I have forgotten when I last withdrew cash from the bank booth," she said.

For Zyma, who is a credit cardholder of Standard Chartered Bank, one of the main drivers of cashless payment has been the app of the bank that has made money management much easier for her.

"The app is super user friendly. It no longer requires me to record my spending manually and I can keep track of all my transactions on the app," she added.

"Above all I feel secure in making digital transactions."

She keeps open a bill payment system that automatically pays her credit card bills, in case she forgets to do that before the expiration of the credit card payment cycle, helping her to avoid late fees.

Like Zyma, millions of people now make their daily payments using credit cards, debit cards and different mobile financial services, helping them avail products and services from the comfort of their homes at a time when going outside increases the risk of getting infected.

To incentivise customers to go cashless, banks and MFS are providing hefty discounts, cashbacks and buy-one-get-one-free offers, teaming up with brands, consumer goods companies, restaurants, airlines and different service providers.

Asif Rahman of the capital's Mohammadpur said he purchased a refractor at Tk 60,000 last year availing equal monthly instalment (EMI) facility.

"I started using a credit card a little more than a year ago and I have bought some essentials, home appliances and electronic products using the EMI option. It helped me a lot during this tough time of Covid," he added.

He also regularly purchases groceries from superstores using his card.

Maizur Rahman, a merchandiser in the capital, considers credit cards as an emergency backup.

"It not only helps with purchase of goods abroad, eliminating the need to carry cash, but if you ever miss a flight, the credit card can basically rescue you," he said.

He also uses a debit card that enables him to avail cash without visiting bank branches.

Ibrahim Mollik, a Cox's Bazar resident, purchased essentials and home appliance products worth over Tk 1 lakh from Evaly using the app of MFS provider Nagad.

"In the last one month, I purchased grocery items worth Tk 20,000 and received a discount of Tk 2,000. No brick-and-mortar shops give me such discounts," said Mollik.

According to him, utilising MFS benefits him in two ways. Firstly, he is able to avail discounts. And secondly, he feels safer using MFS, as making cash transactions can expose people to the virus.

Rubel Hussain, a resident in the capital's Rupnagar, said he now shops daily necessities without using his wallet as many shops now accept bKash payment through its merchant payment option.

"It's like magic. My mobile has turned into a wallet," said Hussain, adding that if more shops introduced such payment systems, then in the future, physical notes will no longer exist.

Besides, he is very cautious about coming into contact with cash because of the virus.

Md Shahed, who resides in Uttara, said he recently bought a washing machine using his credit card.

"Amid the pandemic, I got an opportunity to buy the washing machine by availing EMI facility as well as a 10 percent discount," Shahed said.

As the second wave has forced the government to ban dine-in services in restaurants, credit card offers and buy-one-get-one offers for iftar home delivery are now common.

"I avail some buy-one-get-one offers for iftar using my cards," Shahed added.

"A few months ago, one of my family members got sick and we sought emergency medical help at a nearby hospital. It was night time and we had no cash. But the biggest relief was that I had a credit card which helped me buy medicine and pay the hospital bills," Shahed observed.

However, for Ishtiaq Parvez, credit cards have never brought him ease.

"Credit cards are not the best option in Bangladesh because banks charge preposterously high interest rates," said Parvez.

He also noted that some banks hire third parties to push cardholders to pay their dues if they miss a payment. These third party individuals severely misbehave with clients.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments