Synopsis of Delta Life: Business Performance and Future Prospect

We tend to strengthen our investment in the capital market by more than ten billion TK. We look forward to enhancing the Gono-Grameen Bima regarding social safety for the lower-income and lower middle-class people. Empowerment of women and increasing the extent of employment is our target. Insurance agents and employers would be given proper training in order to make them professional insurance agents. New products will be included in terms of world innovation and the demand of the customers. Moreover, contributing more to GDP is our aim and to be an illustrious company by achieving good governance.

After Independence, while all the insurance companies were nationalized, in the mid 80's Government gave permission to run insurance companies in the private sector. Delta Life Insurance Company Ltd. emerged then and started its operation under the leadership of renowned Actuary and first Controller of Insurance of Independent Bangladesh, Mr. Shafat Ahmed Choudhury, FIA as its Chairman and Managing Director in the year 1986. The objective was to provide economic security and financial protection to the masses and to prove savings and investment in insurance are in fact profitable and lucrative.

The low income and marginalized people, who cannot leave any wealth and property for their children and family, have to ensure financial security for their family, but there was no provision for the low Income and marginalized section of the society to provide them insurance protection through traditional insurance. Low income and marginalized people comprise a larger part of the society. Socio-economic security and progress is not possible by keeping them financially unsecured.

With this thinking in mind, Shafat Ahmed Choudhury introduced Micro-Insurance for the first time in Bangladesh through Grameen Bima Project in the year 1988 to bring the low income and marginalized people under the umbrella of insurance. For this reason, he is known as the pioneer of Micro-insurance, not only in Bangladesh but also all over the world. From the experience of successful operation of Grameen Bima, another project named Gono Bima was started in the year 1993 designed mainly for the poor people of urban slums. Both the projects became successful and contributed to the investment and life fund of the company. Later on, for Management and operational efficiency, transparency and cost reduction the above two projects were merged in the year 2003 and started operation in the name of Gono-Grameen Bima Division. Following Delta Life, other Life Insurance companies also introduced Micro Insurance and became successful. But Delta Life is the only life insurance company which is operating Micro-Insurance all over Bangladesh through Gono-Grameen Bima Division with completely separate organizational structure.

Role of Gono-Grameen Bima (GN-GRB) of Delta Life in Women Empowerment

Since inception, Gono-Grameen Bima (GN-GRB) of Delta Life has been working for women empowerment and establishment of women's right. From the beginning less educated village women were especially encouraged to work as agents for selling policy and collection of premium. The number of female agents is about 70% of total agents and there are more female policyholders than male. By expanding Micro Insurance activities day by day, Gono-Grameen Bima is playing the role of a change maker for the women agents and policyholders. They could earn and build assets for their family. As a result, they established self rights and dignity in the family and society as a whole and are empowered to take decision in everyday matters.

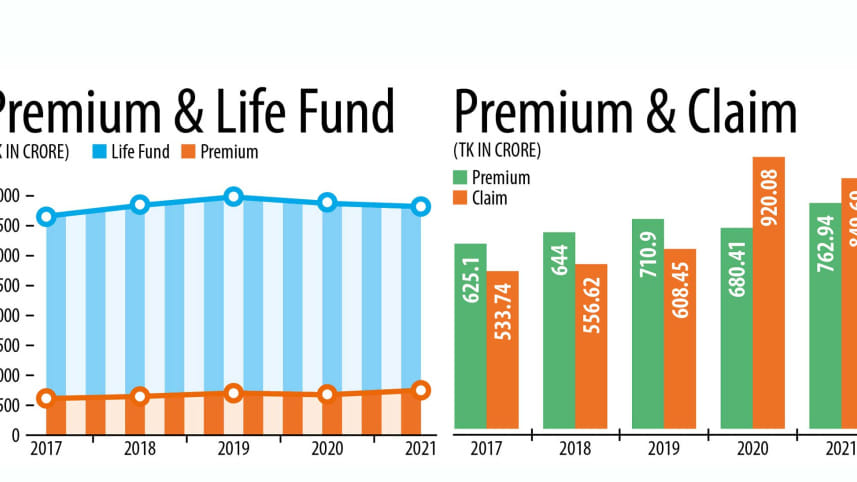

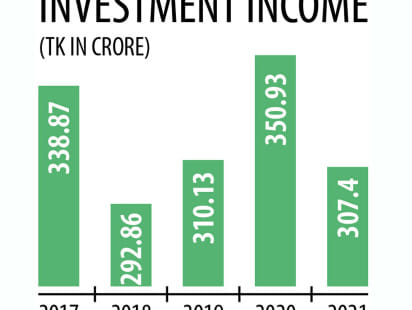

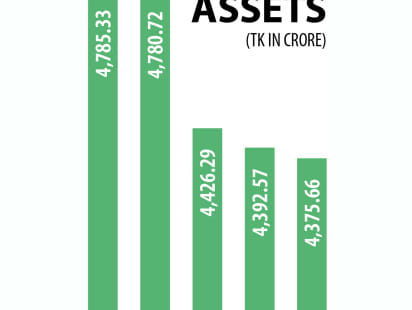

Currently, the life fund stands at its highest and the fund of investment is edged at an outstanding level, and rate of claims settlement is more than the Company's existing premium income. Delta life Insurance achieved 'AAA' credit rating in 2015 and later.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments