Reduce VAT to tolerable level: BNP

BNP today urged the government to reduce Value Added Tax (VAT) to a tolerable level in the proposed budget for 2017-18 fiscal year.

The 15% VAT proposed in the budget is the highest among South and South-East Asian countries, BNP Secretary General Mirza Fakhrul Islam Alamgir said.

READ more: New VAT system won't hurt people

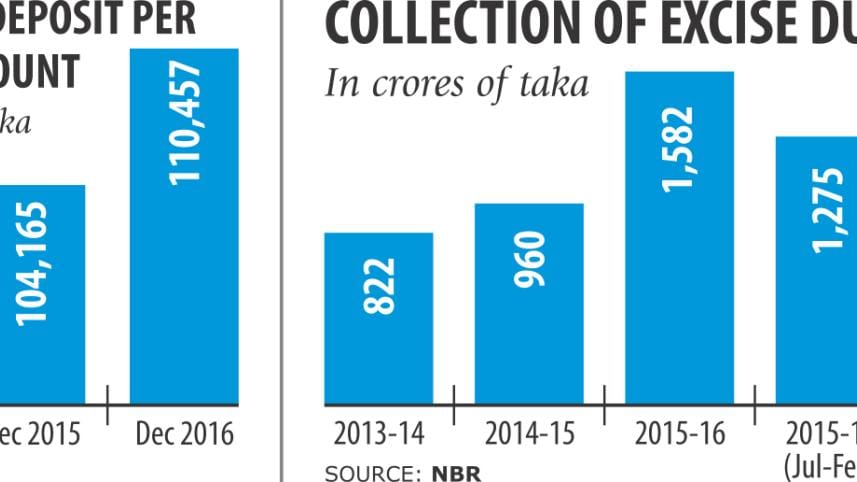

Ten days into the submission of the budget at the parliament, the party leader also demanded withdrawal of excise duty on bank accounts.

In a formal reaction over the proposed budget, Fakhrul said, "We demand a reduction of proposed VAT ceiling on different essential commodities from 15% to a tolerable level for the consumers."

Also READ: Powered by VAT

Prices of essentials and living cost will go up and pressure on inflation will rise, due to the collection of higher percentage of VAT, Fakhrul said adding that thus it will increase sufferings of middle and lower-income people.

After Finance Minister AMA Muhith presented the budget in Parliament on June 1, chamber leaders and the business community criticised the proposed 15 % VAT.

READ more: VAT rate too high

In the 2017-18 fiscal, Bangladesh is finally going to implement a single and uniform VAT rate, ending the two-and-a-half-decade system of multiple VAT rates for different goods and services.

VAT was introduced in 1991. More than two decades later, the government formulated the VAT and Supplementary Duty Act, which provides for imposition of a uniform VAT rate.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments