Power subsidies aren’t a fix for global shocks

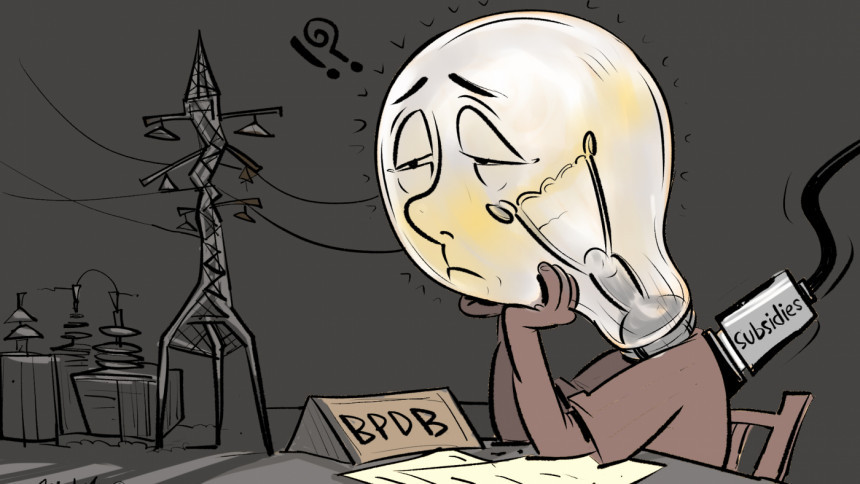

Bangladesh's heavy reliance on fossil fuel imports has emerged as a major threat to its fiscal health and overall macroeconomic stability. Despite mounting fiscal pressures and increasing volatility in international energy markets, the country continues to raise its subsidy allocations for the power and energy sector. In the national budget for FY25-26, the government allocated Tk 37,000 crore in subsidies for this sector—slightly lower than the originally proposed Tk 40,000 crore for FY24-25. However, the revised power subsidy for FY24-25 was later increased to Tk 62,000 crore. Although the proposed subsidy of Tk 37,000 crore for FY25-26 marks a substantial reduction from the revised figure, it remains uncertain whether this cut will hold, given the government's previous tendency to revise allocations upward during the fiscal year.

The government had initially proposed an overall subsidy allocation of Tk 1,15,000 crore for FY24-25, which later rose to Tk 1,33,000 crore after overdue payments were cleared across several sectors. For FY25-26, the proposed allocation stands at Tk 1,15,741 crore—nearly unchanged from the earlier year's proposal. The lion's share of these subsidies continues to go to the power and energy sector, driven by the country's growing dependence on imported fossil fuels such as crude oil, diesel, furnace oil, coal, and LNG. The global rise in fuel prices—exacerbated by the Russia-Ukraine war—has significantly increased the cost of power generation. Additionally, the depreciation of the Bangladeshi taka has made imports even more expensive, intensifying the government's subsidy burden. This vulnerability was reflected in FY24-25, when the originally allocated Tk 40,000 crore for energy subsidies had to be increased to Tk 62,000 crore to cover mounting arrears and higher import costs. The trend highlights a structural issue: Bangladesh's energy sector remains highly exposed to external market fluctuations, making it susceptible to price shocks that threaten macroeconomic stability.

The risks are further amplified by ongoing geopolitical tensions. The current conflict in the Middle East has introduced new uncertainty into global energy markets due to potential supply disruptions. The Iran-Israel conflict, in particular, posed a major threat to the global energy market in June 2025, as it risked disrupting the Strait of Hormuz—a vital chokepoint that facilitates the daily movement of over 20 million barrels of oil and substantial volumes of LNG, accounting for nearly one-fifth of the world's total supply. A temporary blockade could push oil prices above $100 per barrel, as projected by Goldman Sachs analysts—sharply increasing Bangladesh's import costs. Such a surge would raise electricity generation expenses, disrupt industrial activity, and drive up costs in the transport and agriculture sectors. These effects would, in turn, fuel inflation, elevate living costs, and constrain both public and private investment.

A rising import bill would also place immense pressure on Bangladesh's already strained foreign exchange reserves, potentially triggering further depreciation of the taka. A weakened currency would increase the cost of all imports, risking an inflationary spiral that may prove difficult to control. Although the government has tried to cushion the impact through subsidies, this approach is neither fiscally sustainable nor economically efficient. Blanket subsidies, particularly in the power sector, protect inefficient production systems and delay essential reforms. Underutilised power plants continue to receive high capacity payments from the government, resulting in wasted public resources—funds that could be channelled into more productive areas.

The current subsidy framework also suffers from distributional inefficiencies. A significant portion of energy subsidies benefits wealthier households and industries rather than the low-income groups they are meant to support. This regressive outcome stems from poor targeting mechanisms and weak institutional coordination. The continuation of such subsidies imposes a heavy fiscal burden and limits the government's capacity to invest in modern energy infrastructure, renewable energy, and crucial social development programmes. Despite these concerns, the FY25-26 budget reflects only marginal reforms. While energy subsidies have been slightly reduced to Tk 37,000 crore, the allocation for LNG subsidies has increased from Tk 6,000 crore to Tk 9,000 crore—signalling a continued reliance on the volatile international energy market.

Bangladesh must therefore embark on rationalising its energy subsidies through a medium-term reform roadmap that balances fiscal prudence with energy security and equity. This requires improving energy efficiency by upgrading transmission infrastructure, conducting regular energy audits, phasing out outdated and underperforming power plants, and renegotiating costly power purchase agreements with independent producers. Diversification of the energy mix is equally vital. The government should invest in local gas exploration and accelerate the transition to renewable energy sources. Aggressively pursuing solar and wind projects could significantly reduce dependence on imported fossil fuels. While the Rooppur Nuclear Power Plant and the Matarbari coal-fired plant may ease some pressure on energy imports, a comprehensive strategy centred on cost-effective, affordable, and sustainable solutions remains essential. Public-private partnerships (PPPs) should be utilised to fund gas exploration activities, offering attractive yet fair conditions to international oil companies (IOCs). Properly managed PPPs and international collaborations can enhance domestic gas production and lower import dependency. Meanwhile, the government should introduce a transparent fuel pricing mechanism that reflects global prices while maintaining a buffer to absorb shocks. High taxes on solar equipment should also be revised to promote cleaner, domestically sourced energy.

Institutional reforms are equally crucial. Strengthening energy governance by reducing corruption, enhancing transparency, and developing competitive energy markets is vital. State-owned enterprises have long suffered from inefficiencies and corruption, leading to inflated costs and declining performance. Effective coordination among the Ministry of Finance, Energy Division, Bangladesh Energy Regulatory Commission (BERC), and Petrobangla is essential to streamline budgeting, minimise system losses, and ensure reform implementation. Without a credible and coherent policy approach, Bangladesh risks remaining trapped in a cycle of fiscal deficits, currency instability, and energy insecurity. The country can no longer afford a reactive stance in energy policy, especially in a global context shaped by geopolitical uncertainty and climate transition challenges. A well-targeted, proactive, and fiscally responsible subsidy reform strategy is imperative to safeguard Bangladesh's economic future. Rationalising energy subsidies is not only crucial for fiscal relief but also essential for building a more resilient, equitable, and sustainable energy system.

Md Razib is research associate at South Asian Network on Economic Modelling (SANEM). He can be reached at mdrazib329@gmail.com.

Md Tuhin Ahmed is lecturer of economics at Mawlana Bhashani Science and Technology University and honorary deputy director at SANEM. He can be reached at tuhin.ahmed@mbstu.ac.bd.

Views expressed in this article are the authors' own.

Follow The Daily Star Opinion on Facebook for the latest opinions, commentaries and analyses by experts and professionals. To contribute your article or letter to The Daily Star Opinion, see our guidelines for submission.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments