How to go about reforming Bangladesh’s financial sector

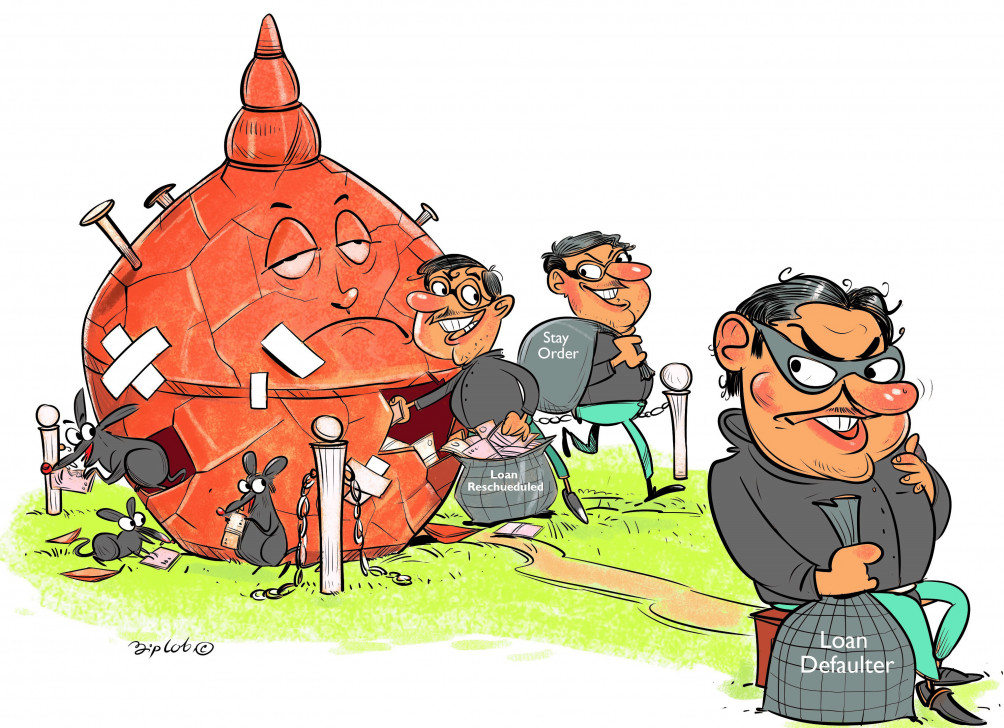

The financial sector of Bangladesh requires many reforms, from the macro to the micro perspectives. The laundry list of reforms is long, and focus is required for bringing discipline in the lending practices of the sector and finding a recovery pathway for the economy largely affected by the mounting non-performing loans (NPLs).

No one can deny the sorry state of the banking sector. But like all other sectors of the country, the banking sector also requires bringing back focus to the people it serves—the people who need a reliable service for all their banking and finance needs day in and day out. We are also going through an unprecedented climate emergency and do not yet have an estimate of the economic impact it will leave us with.

Combining the shocks of the financial sector crisis, along with climate risks, compels us to think what new ways are available to serve and protect the consumers, especially the micro small and medium enterprises (MSMEs) that are in distress. The climate emergency and its impact on the MSMEs will continue to escalate unless we take actions. Given that the MSMEs were pushed to the tail end of priorities over some years now, they are expected to be impacted the most in this crisis.

On a global scale, the term "great finance divide" is being used. This refers to how the majority of the developing countries and one in four middle income countries are at high risk of fiscal crises in the post-pandemic world, creating a financial divide between the developed and developing economies. The inequitable practices of the global financial system have always been questioned whether it is conducive to the growth of the developing economies or whether it has worsened this divide.

While Bangladesh is part of that global tragedy, the suffering has been worsened by its own man-made financial sector crisis. The "great divide" has taken a different shape in our economy, as it is mostly the large corporates that have benefitted from the stimulus and privileges of the banking sector at the cost of the MSMEs and the individual depositors, both in the pre- and post-pandemic scenarios. While the inequitable international financial and monetary system is beyond the reach of our reform, we need to focus on how we can minimise this inorganic divide that we created.

The upcoming white paper on the state of the economy will hopefully shed some light on the extent of the damage done to the sector. As for recovery, coordinated efforts will be required from both from the policymakers and the financial institutions.

It is most likely that we will need multiple push and pull factors to survive through this financial sector crisis. The pull will hopefully come from the multilateral agencies through a factual assessment of the sovereign debts, but the push has to come from the regulatory bodies, namely Bangladesh Bank (BB), Microfinance Regulatory Authority (MRA), Insurance Development and Regulatory Agency (IDRA) and Bangladesh Securities and Exchange Commission (BSEC). BB, as the monetary policymaker and as a board member in the rest of the regulatory agencies, will have to shoulder much of the responsibility to regain trust of the depositors/ borrowers through regulatory oversight and enhanced transparency.

The first step can be enhancing the financial literacy of the consumers in understanding all the products available for short- and long-term investments, especially capital market instruments such as government issued securities or treasury securities. Possibly expanding the network of treasury securities, like the Sanchaypatra, can make it simple and accessible to the investors across the country. This will provide the consumers with a safe choice of investment and the government the ability to mobilise more resources through the financial channels.

BB can also consider amending its Bangladesh Bank Order, 1972 and expand the definition of "borrower" instead of limiting it to banking companies only. MRA has launched its own Microfinance Credit Information Bureau (MF-CIB) but has its own limitations. Due to lack of interoperability with the banking sector CIB, a loan from a microfinance institution (MFI) will not show up in the banking sector credit information check and vice versa. As we are heading towards a more digital and integrated economy, it's high time that the central bank brings all categories of borrowers under the umbrella of one credit information check. With this small change in the legislation, the sector will have benefits in two folds—the obvious one is enhancing transparency in lending practices especially from the capital market, but the more important one is it will allow the small borrowers to become bank borrowers with a reliable credit history that they built up over the years with the MFIs.

Roughly over 50 percent of Bangladesh's bankable population do not have access to a reliable financial service, and the ones who have access do not always get the quality product or service they need. While there is a huge demand and potential in the market for innovative financial products, what we lack is a safe space for testing new ideas.

BB will need to work with MRA, IDRA and BSEC to catalyse innovation in the sector to expand the offers of reliable financial products and services, especially insurance that can provide protection during the climate disasters that we are experiencing now. BB, along with the other regulators, needs to think at the system level what needs to be done to ensure the market experiences innovations while remaining focused on serving the customers. We have a number of policies, including the National Financial Inclusion Strategy (NFIS), so it is time to bring back focus on the implementation of these policies with adequate resource allocation.

While we can continue to provide a reform agenda, the key objective will remain in bringing back the trust, enhancing the transparency in lending practices/payment systems, limiting the access to finance for the highly leveraged businesses/individuals, and improving the overall consumer protection. Access and usage of quality financial services has been a challenge. To address that, BB can reconsider its digital bank licensing and allow a competitive procedure that can bring efficiency in financial services, as well as carry forward with the more important agenda of implementing financial inclusion and achieving the Sustainable Development Goal (SDG) targets. We have a long way to go, and I want to remain hopeful of my country and its ability to serve its people through adequate and reliable financial sector services.

Afsana Islam is development practitioner and former banker. She can be reached at islam.afsana@gmail.com

Views expressed in this article are the author's own.

Follow The Daily Star Opinion on Facebook for the latest opinions, commentaries and analyses by experts and professionals. To contribute your article or letter to The Daily Star Opinion, see our guidelines for submission.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments