Bangladesh’s economic performance has been unique post-uprising

Last year, after the violent change in power through the mass uprising, when the interim government assumed the responsibility of salvaging the economy from the brink of total collapse, the task to bring it back on track seemed almost impossible. As the true state of the economy emerged from reports of various commissions, people came to know the real depth of destruction that the economy suffered during the previous regime. The unchecked spiral of inflation, dwindling foreign exchange reserves, persistent large trade deficits, gross financial irregularities leading to a near collapse of the banking system, and deeply corrupted governance that destroyed almost all institutions, among others, were identified as the main challenges for the interim government. To stop the freefall of the economy and bring it back on course, we had to take some bold steps. Monetary and fiscal policies were tightened, stricter austerity measures were put in place, corrective measures were taken to restore discipline in the financial sector, and maximum efforts were employed to fight against corruption.

Major steps under the bold reform and recovery programmes included a detailed asset quality review, structural reform guidelines for ensuring discipline in the financial sector, initiating a process of recovery of the assets stolen from the financial system, and ensuring sufficient liquidity in the banking system. To strengthen fiscal governance, the government employed best efforts to enhance revenue collection, such as by phasing out special tax privileges and separating tax policy from tax administration. To tame inflation, the policy rate has been increased to 10 percent, which can help stabilise the exchange rate.

Looking back after a year, we are pleased to share Bangladesh's unique macroeconomic success and the story of how we have been able to turn the tide and overcome the seemingly impossible task. Recent figures and macroeconomic indicators available now tell the story.

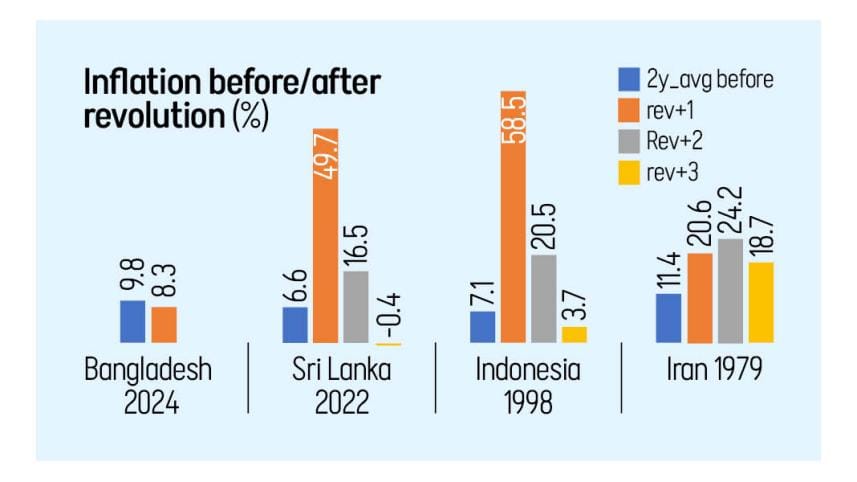

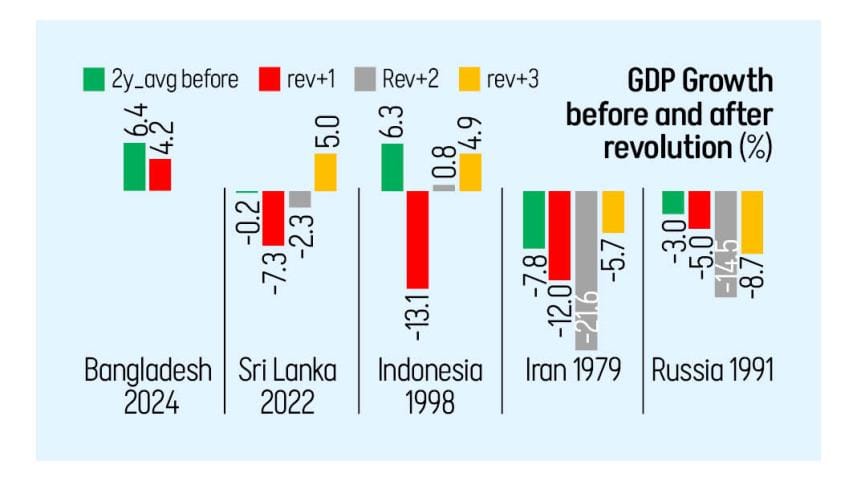

Almost every country in the world that underwent a violent change of regime experienced output declines and a rise in inflation immediately afterwards. This has been true, for example, in the case of Sri Lanka recently, also in Indonesia when the Soeharto regime fell, in Iran during the early 1980s, and in Russia during the early 1990s. In Indonesia, poverty rate jumped from around 15 percent to around 33 percent in one year. In Sri Lanka, around 26 percent of people lived in poverty in 2023, a year after the violent fall of the previous regime. Between 1991 and 1993, Russia's inflation exceeded 800 percent, and it took nearly 10 years for the country to recover. Meanwhile, male life expectancy fell six years between 1991 and 1994 in the country. The former Soviet republics and Eastern Europe experienced a similar decline in life expectancy during this same period.

But this did not happen in Bangladesh, where rather inflation fell and GDP growth remained in the positive territory.

This remarkable macroeconomic resilience, supported by our government's policies, is being reflected in growing investor confidence. For example, Dhaka Stock Exchange's (DSEX) rally in July, surging by 12.5 percent, ranked third among major global market performers, behind only Vietnam's VN30 (+13.93 percent) and Thailand's SET (+12.54 percent). The index soared 605 points to close at 5,443, the highest level in nine and a half months.

The right policies taken by the interim government have stopped the bleeding of the Bangladesh economy, which is showing signs of rebound. Due to incentives and confidence improvements, the expatriates are sending out record levels of remittances through proper channels, leading to a significant improvement in the foreign exchange reserves. Confidence in the financial system has also been regained through improved governance. The local currency has become stable even after adopting a market-based exchange rate regime.

However, challenges still remain, especially in the financial sector. It will require a careful mix of salvage operations and difficult decisions to reduce risks in the financial sector to acceptable levels. Special care will be needed to avoid expenditures against unnecessary projects and to improve the project implementation rate. Innovative measures are being taken in the power sector to reduce subsidies. We are also continuing necessary support to critical areas such as food security and social safety.

What seemed impossible a year ago is now under control and we hope to further improve the state of the economy in the coming months. While the inflation is now showing a downward trend, we will continue our policies to bring it down below seven percent. Based on strong fundamentals and macroeconomic stability, supported by well-coordinated fiscal, monetary, exchange rate, and capital market policies, we expect further improvements. In other words, we expect growth to pick up, inflation to decline further, as well as buoyancy of the stock market.

Salehuddin Ahmed is adviser of Ministry of Finance and Ministry of Science and Technology.

Anisuzzaman Chowdhury is special assistant to the chief adviser at the Ministry of Finance.

Views expressed in this article are the author's own.

Follow The Daily Star Opinion on Facebook for the latest opinions, commentaries and analyses by experts and professionals. To contribute your article or letter to The Daily Star Opinion, see our guidelines for submission.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments