What BNP should keep in mind as it assumes power

17 February 2026, 00:00 AM

MACRO MIRROR

Can election manifestos deliver on economic pledges?

10 February 2026, 00:00 AM

MACRO MIRROR

Opinion / A tough fiscal test awaits the next government

3 February 2026, 00:28 AM

MACRO MIRROR

Opinion / Can we afford such a steep public-sector pay hike?

26 January 2026, 23:57 PM

MACRO MIRROR

Global risks in 2026 / What Bangladesh and the Global South face

21 January 2026, 11:30 AM

Opinion / Three economic priorities for the upcoming political government

13 January 2026, 09:00 AM

Khaleda Zia’s economic legacy, lessons, and the road ahead

6 January 2026, 02:00 AM

MACRO MIRROR

Bangladesh economy in 2025 and expectations for 2026

31 December 2025, 02:00 AM

MACRO MIRROR

Unchecked violence casts a shadow on our economy

23 December 2025, 02:00 AM

MACRO MIRROR

Victory Day and the republic we owe ourselves

16 December 2025, 03:00 AM

MACRO MIRROR

What BNP should keep in mind as it assumes power

The election came after years of severe distrust in the electoral process, questions over legitimacy, and institutional strain, so the poll’s successful conduct has reinforced trust in the process as well as the principle that governments derive authority from the consent of the governed.

17 February 2026, 00:00 AM

Can election manifestos deliver on economic pledges?

Bangladesh’s GDP in the fiscal year 2025 was $461.63 billion. If the country aims to reach a $1 trillion economy by FY2034, the economy would need to more than double over nine years.

10 February 2026, 00:00 AM

A tough fiscal test awaits the next government

The incoming government will have to make austerity a top priority at the leadership level for fiscal consolidation. Enhancing accountability mechanisms is essential to improving expenditure efficiency. Parliamentary oversight of public funds must be strengthened.

3 February 2026, 00:28 AM

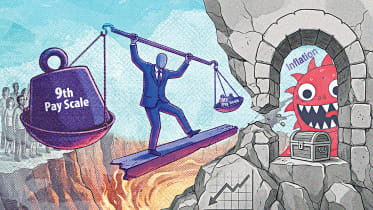

Can we afford such a steep public-sector pay hike?

The Ninth National Pay Commission formed by the interim government recently recommended a salary increase for government employees in the range of 100-142 percent.

26 January 2026, 23:57 PM

What Bangladesh and the Global South face

The Global Risks Report 2026, published by the World Economic Forum (WEF), presents some of the stark realities of the world today.

21 January 2026, 11:30 AM

Three economic priorities for the upcoming political government

The upcoming parliamentary election, scheduled for February 12, is of exceptional political and economic significance for Bangladesh.

13 January 2026, 09:00 AM

Khaleda Zia’s economic legacy, lessons, and the road ahead

Over the 55 years since Bangladesh's independence, the processes of state-building, political transformation, and economic reconstruction have unfolded in deeply interconnected ways.

6 January 2026, 02:00 AM

Bangladesh economy in 2025 and expectations for 2026

The outlook for FY2026 indicates a modest recovery, although some risks remain.

31 December 2025, 02:00 AM

Unchecked violence casts a shadow on our economy

The recent wave of violence has revealed a deeply worrying trend in public life.

23 December 2025, 02:00 AM

Victory Day and the republic we owe ourselves

The erosion of democracy became most pronounced between 2014 and 2024.

16 December 2025, 03:00 AM

How to bridge education and employment in Bangladesh

Bangladesh's inability to create adequate opportunities for its young population has moved far beyond an economic concern.

10 December 2025, 02:00 AM

COP30 brings both hope and letdowns for vulnerable countries

COP30 could not deliver concrete actions to phase out fossil fuels and advance climate finance, but some new opportunities were created for vulnerable countries.

4 December 2025, 02:00 AM

Can COP30 deliver on climate promises?

Global attention has currently turned to Belém, one of the gateways to the Brazilian Amazon, where the climate community has gathered for the 30th Conference of the Parties (COP 30) under the United Nations Framework Convention on Climate Change (UNFCCC).

12 November 2025, 02:00 AM

Bangladesh Bank’s autonomy is key to economic stability

In Bangladesh, successive governments have undermined the autonomy of the Bangladesh Bank.

4 November 2025, 02:00 AM

Why the 2025 Nobel prize in economics matters for us

When automation and artificial intelligence are transforming economies, the Nobel laureates’ work offers caution and hope.

15 October 2025, 02:00 AM

Bangladesh raises the bar in global climate commitment

Bangladesh pledges to reduce emissions from energy sources by 26.46 percent by 2035.

7 October 2025, 02:00 AM

The promises and perils of a bank merger

Optimism regarding the merger of five struggling banks must be weighed against significant challenges.

30 September 2025, 02:00 AM

Just transition is key to Bangladesh's pledge to cut emissions

A fair transition would ensure that climate action benefits are broadly shared.

23 September 2025, 02:00 AM

Lessons from Bangladesh and Nepal’s youth uprisings

Nepal's recent political development reflects a broader political pattern in South Asia.

16 September 2025, 02:00 AM

Managing our external debt needs a balanced strategy

Bangladesh's steadily rising debt levels are becoming a pressing issue.

9 September 2025, 02:00 AM