Telecom reforms gain pace, but investment challenges remain

After years of inertia, Bangladesh’s telecom sector has begun to move again under the interim government, reopening long-stalled reform pathways even as deep structural problems continue to weigh on investment and innovation, according to Grameenphone (GP) CEO Yasir Azman.

“There were a lot of ups and downs,” Azman told The Daily Star in a recent interview, noting that the industry has gone through “substantial change in terms of how the future will be defined.”

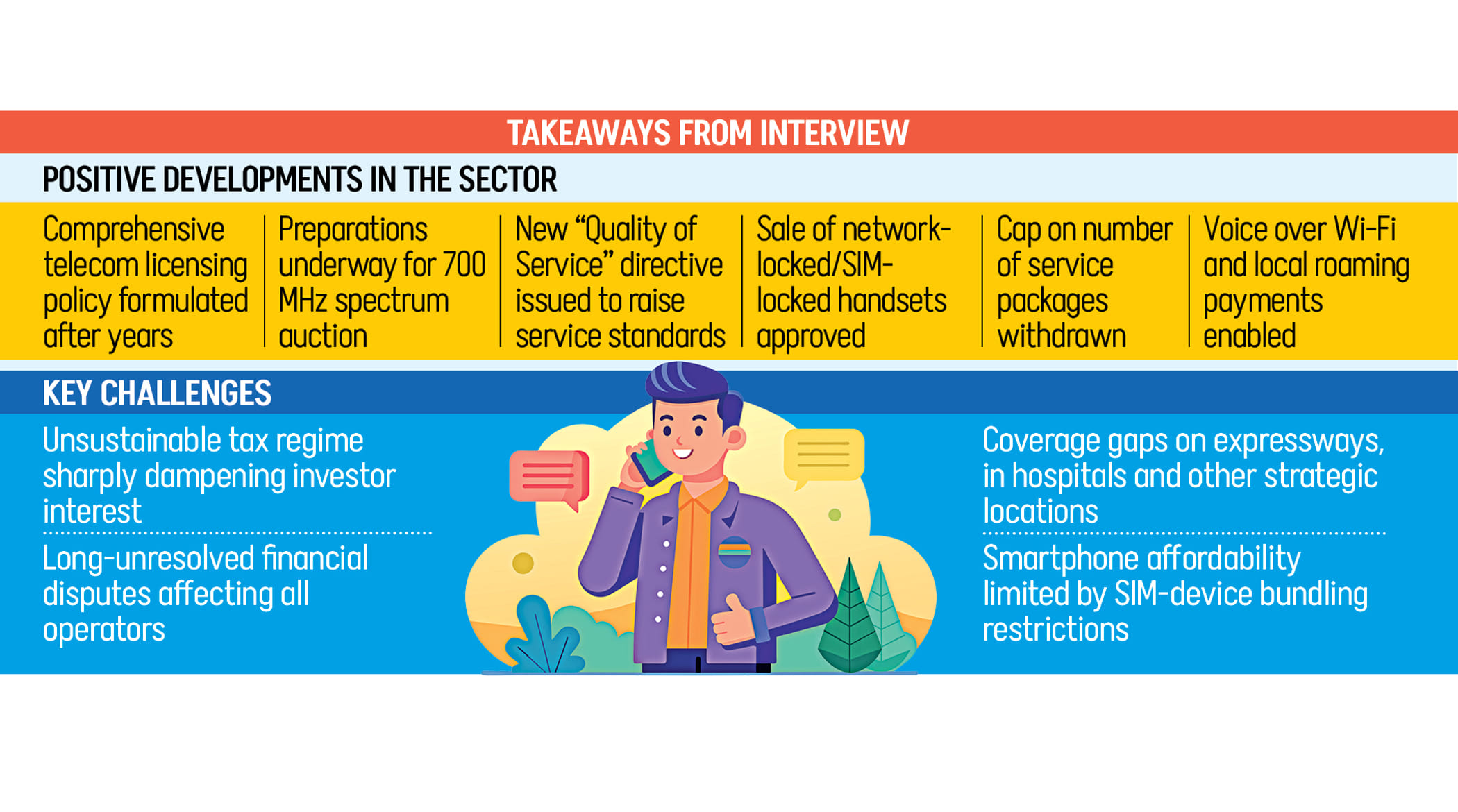

He said the past year saw sustained work on long-delayed reforms, including drafting a comprehensive telecom licensing policy, preparations for the auction of the 700 MHz spectrum, issuance of a new quality of service directive and the enactment of a new telecom law.

These developments, he noted, brought both opportunities and fresh challenges.

He also pointed to a series of regulatory decisions that eased operational constraints, such as approving the sale of network-locked or SIM-locked handsets, withdrawing cap on the number of service packages, permitting voice over Wi-Fi, and enabling access to leased dark fibre.

Despite many headwinds and volatility, the GP CEO said he sees the developments through an optimistic lens. That optimism, however, was tempered by sharp criticism of the financial and regulatory environment.

The chief executive of the country’s largest telecom operator identified tax burden as the biggest obstacle for the industry. “There are 40 percent corporate tax, 15 percent VAT, 20 percent supplementary duty, 1 percent surcharge, 5.5 percent revenue share, 1 percent SOF and then licence and spectrum fees.”

“Unless these issues are resolved, investors’ appetite will remain extremely limited. This is not a concern unique to Grameenphone; it affects all operators,” he added.

Besides, he complained that operators are not only heavily taxed but also locked in unresolved disputes with the regulator. “In our 28 years of operation, not a single annual audit dispute has been resolved. So, we have not been able to get clear of financial disputes from inception to this day.”

He said this uncertainty directly undermines investor confidence, noting that GP has “Tk 12,500 crore stuck in financial disputes with the regulator”.

“All three private telecom operators are (fully or partly) owned by foreign investors. How will they decide to continue to invest heavily?” he said.

As a way forward, Azman suggested pursuing international arbitration. Otherwise, he warned, the disputes could remain stuck in court for another decade, increasing pressure on operators.

The GP CEO informed that discussions were underway with the Bangladesh Telecommunication Regulatory Commission (BTRC) to initiate arbitration.

On service quality, Azman rejected criticism that network performance has deteriorated, claiming that the latest regulatory report on the matter was flawed. The report identified frequent call drops, blurred video calls and no indoor network coverage in several locations across the country.

Azman said both operators and the regulator had agreed to dispute the weaknesses in the report’s methodology.

He countered the report’s findings with performance data, noting that the call drop rate now stands at 0.15 percent, far below the 2 percent threshold. He also said data speeds have improved significantly, with operators now delivering “more than 15 Mbps,” while they struggled to reach 5 Mbps a few years ago.

He, however, acknowledged persistent coverage gaps. Elevated expressways, hospitals and other strategic locations still experience service drops.

“There are more than 200 spots in Dhaka where it’s very difficult,” he said, adding that operators often lack permission to install infrastructure. These remain operational challenges the industry must “take on our shoulders”.

On pricing, he said recent changes in charging structures have altered how customers perceive costs. From the user’s perspective, he acknowledged, “price is going up,” but said company data showed otherwise.

“Our ARPU (average revenue per user) has not increased… Data price per MB has gone down by another 11 percent,” he said.

He attributed the disconnect to changing consumption patterns, as customers shift from short-duration packs to monthly combo offers. “If you buy 2 kilogrammes of rice for Tk 100 and 5 kg for Tk 150, you feel you paid more, but per kg it’s cheaper,” he explained.

He argued that customers are now buying larger data volumes with longer validity, increasing total spending while reducing per-unit costs. He said it would take three to six months for users to fully adjust to this transition.

Azman also criticised regulatory constraints on competition and innovation, particularly for GP as a significant market power (SMP) operator.

“We need approvals for every product and service we launch… it takes years,” he said, noting innovation is difficult under such conditions.

On 5G, he urged caution, arguing that expectations were ahead of reality. “5G is not for (individual) customers, it’s for industries,” he said, noting that there are only “5 percent to 7 percent 5G devices” in the market.

Everything is possible with 4G, provided that the speed is good, he said, emphasising the need to strengthen indoor coverage and address rural gaps before pushing for widespread 5G deployment.

Asked why GP has not applied for a digital banking licence while rivals Robi Axiata and Banglalink have, Azman said it was not a strategic priority. “We are experts in telecom; we should focus on our telecom.”

He also addressed concerns over data security and SIM-related fraud, calling cybersecurity and privacy “the topmost priority”.

While he cited steps such as shutting down thousands of suspicious retail points, he acknowledged that the ecosystem remains difficult to fully control.

Smartphone affordability, he said, is another structural constraint. Restrictions on SIM-device bundling and limited access to consumer credit have slowed smartphone adoption. Only recently, he noted, had SIM-locking been permitted, which could accelerate penetration.

Azman repeatedly linked the health of the telecom sector to broader national development.

“Without strong connectivity, we will not be able to progress,” he said, pointing to digital services across health, education and business.

Asked about expectations from the new government after the upcoming election, he said a predictable business and regulatory environment is needed, where business can be conducted fairly and transparently.

“This is not about benefiting the operators; it’s about benefiting the customers. If we can bring that perspective, all the problems will be solved,” he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments