Timely steps can help avert crisis

Bangladesh may fall into a deep economic crisis unless it immediately frames and implements a package of comprehensive reforms and policies, said a number of economists yesterday.

The suggestions come as the country faces problems such as high inflation, increasing cost of the US dollar, and rising pressure on foreign exchange reserves -- stemming from factors such as Russian invasion of Ukraine, record energy prices, and high commodity prices.

Of late, industries both large and small have been hit by acute gas crisis and recurrent load shedding, with production falling while costs have shot up.

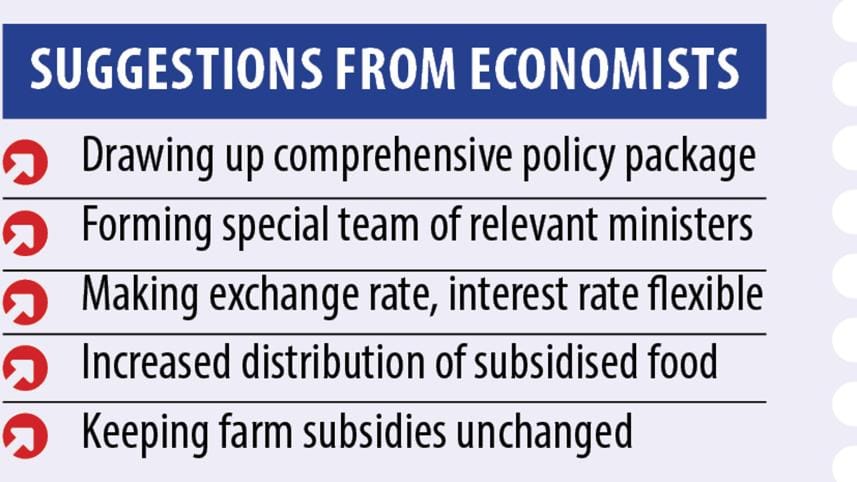

At a roundtable organised by The Daily Star at its office in the capital, the experts said that the measures taken so far by the government were discrete, although issues are interlinked and require a well thought-out and coordinated strategy to ride out the current economic problems.

Domestically, there has been inaction on the part of the policymakers in dealing with structural impediments such as insufficient revenue collection, and spiralling cost of public-funded projects.

Economists said they had long suggested reforms in financial, revenue, and other sectors.

The government did not carry out the reforms and will now have to accept conditions from the International Monetary Fund (IMF) for reforms in various areas, sacrificing its policy sovereignty, to get a $4.5 billion loan.

"Bangladesh is in a slow-burning crisis. We can still manage this, but if we do not come up with a comprehensive package, we will be in deep trouble," said Debapriya Bhattacharya, a distinguished fellow of the Centre for Policy Dialogue (CPD), at the roundtable on "Bangladesh economy: the way forward".

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh; Salehuddin Ahmed, a former governor of the Bangladesh Bank; MM Akash, professor and chairman of the economics department at Dhaka University; Sayema Haque Bidisha, economics professor of Dhaka University; and Miran Ali, vice-president of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), also spoke at the roundtable.

Mahfuz Anam, editor and publisher of The Daily Star, moderated the event.

At the discussion, Debapriya said Bangladesh's economy started to deteriorate over the last five months.

He said the measures that the government took so far -- such as import control, marginal adjustment of annual development programme and so on -- were not interconnected.

"The government has responded belatedly and half-heartedly without coordination and adequate follow-ups. But doing partial adjustments will not help overcome the problem," he said.

"Given the circumstances, the government has two immediate policy choices -- flexibility in foreign exchange rate and interest rate adjustments."

He said timing and sequencing will be most important. There must be a transparent policy package and strategy for implementing the package.

LACK OF CLARITY, COORDINATION

Ahsan H Mansur said there was still a lack of clarity from the government about the problem and the steps it was taking, despite these problems existing in the economy for some time.

He said the depth and width of the problems had still not been determined.

"I have not seen any action from the government's side, except shutting down the electricity during daytime or talking about a probable famine in the foreseeable future. The government has not made an analysis of the current economic situation yet, particularly on the critical areas of the economy."

Mansur said there was a lack of coordination in economic management. Nothing had been managed or planned by the politicians.

"Bureaucrats are running the show," he said.

In the last four months, the taka depreciated to a large extent.

There are still four rates for the US dollar in the market, which is not rational, he said.

The multiple exchange rates are not sustainable and has not helped avert foreign exchange depletion.

He said the country's foreign exchange reserves are now depleting by around $1.2 billion per month

The country's net foreign exchange reserves are now around $27 billion. If there is depletion of $5 billion more in the next four months, the economy will go from yellow to red, he said.

"This will also erode confidence in the economy. We can't go to that level; something has to happen before that, or the situation will become ugly and we do not want that.

"We should avoid such a situation. The management side is still not rational and the government has not taken any moves to generate confidence [in its ability] to tackle the situation," he said.

"Interest rate flexibility is highly important given the current state of the economy."

The central bank, however, has allowed banks to impose interest rates beyond 9 percent in some cases. But it is not documented as the central bank has given the instruction verbally.

"We need to have more clarity regarding what we are doing and what we want to do."

The current status quo cannot continue for several months, and the government should devise a strategy right now.

"It can't be the role of the prime minister; it is the role of the finance minister along with an economic team comprising three-four ministers who work with the economy," he said.

Nobody has consulted with the business community, professionals or bureaucrats in a concerted manner.

INTERLINKED PROBLEMS, DISJOINTED SOLUTIONS

Salehuddin Ahmed, former governor of Bangladesh Bank, said most of the steps were taken here and there.

"If it continues, the problems will not be solved," he said, adding that the economic issues are linked.

The government must go for in-depth policy packages and identify the linkages among them, he said.

The interest rate should not be fixed at 6 to 9 percent because the cost of funding depends on many things, such as under-the-table dealings and transport costs, he said.

The Bangladesh Bank can work to minimise the spread rate between the lending and deposit rates as it is sometime very high, added Salehuddin.

The central bank needs to have the courage to implement its policies like an autonomous body, he said.

"Autonomy is not given; it needs to be earned. When I first launched monetary policy in 2006, I did not even ask the finance minister about it."

He suggested that wastages from other sectors be cut instead of reducing subsidies for the agricultural sector.

Foreign exchange reforms are necessary, because four rates in the banking sector for dollars cannot be efficient, but rates can instead be dictated by the market, he said.

He suggested a package that should be well thought out and not time-consuming in implementation, adding that fine tuning would not work now as it was time for blunt action.

MM Akash, professor and chairman of Department of Economics, Dhaka University, said the problems Bangladesh was facing was not created all of a sudden. There were cumulative factors, he said.

He said the power struggle between the two big political parties would heighten centring the next parliamentary election.

So, along with the current economic crisis, Bangladesh could fall into a political crisis next year, he added.

BGMEA Vice-President Miran Ali said, "We need to free the exchange rate to whatever extent that is possible. We need to address the problem. We just want the government or policymakers to make business easier for us."

Sayema Haque Bidisha, professor of economics at the Dhaka University, spoke in favour of foreign exchange rate flexibility to reduce the difference between the kerb market and official rates.

She said the problem of fixing the exchange rate was that it could trigger inflation.

"We have to take the risk. Maybe we can change the rate gradually," she said, suggesting countering the inflationary risk by reducing regulatory and other duties, VAT and other taxes.

POVERTY WILL RISE, BUT FAMINE UNLIKELY

Akash, however, said he did not think there would be famine in the country.

"But there is localised hunger," he said, adding that if the prices of essential commodities increased further, many would find it difficult to pay for basic necessities.

Debapriya said, "Whatever we do, dealing with inflation should be the anchor."

He suggested examining whether people in real need had been brought under the Trading Corporation of Bangladesh's (TCB's) one crore family cards.

"People who remain unattended are [from] the middle class," he said, adding that families that spent Tk 10,000 monthly for two children in school, now face difficult choices.

He defined middle-income families as those that have a monthly income of Tk 70,000-Tk 1,25,000.

"The middle class is really having a tough time," he said.

Debapriya said addressing the food security issue was critical to overcome the challenge.

"There will be no famine in the country but many people will become poor."

Bidisha said the government can consider fair price shops and open market sales of essential commodities to reduce pressure on middle-income families.

She said the government should think about providing some cushion for the middle-income families.

Bidisha said the government should increase the amounts of allowances under social safety net programmes and expand coverage so that people could fight the inflation better.

If the inflation is considered, the current allowances are very small, she added.

IMF LOAN

Debapriya said economists have long been saying that the government should address fundamental problems such as governance and it should implement reforms and automation in the banking sector, and redo the tax systems.

He also urged ensuring quality public expenditure.

The irony, he said, was that the same was now being prescribed by the IMF as part of its conditions for the $4.5 billion loan, and the government has to accept those surrendering our policy sovereignty.

Ahsan H Mansur said in the absence of our own strategy, the IMF prescriptions have become the basis on which policy discussions are currently taking place.

"We are talking from a nationalistic perspective, but are not giving our own plan."

He said the reforms prescribed by IMF are more important than the loan it may provide.

"We should have implemented the reforms, which the IMF prescribed, on our own," Mansur said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments