Novoair may be grounded from May

Novoair is likely to shut down its operation for around three months from May as the private airline has started the process of selling the five ATR aircraft in its fleet.

The process is likely to be completed this month, said Md Mofizur Rahman, managing director of Novoair.

Novoair is hopeful of getting a new investor on board soon, he said, adding that discussions are at the final stage.

"If we get the new investor, we will not sell our aircraft to foreign buyers. In that case, our flights will not shut down. Otherwise, we will have to discontinue the flight operations for three months."

The airline's staff and officials will get their salaries as normal in those three months.

Since its inception on January 9, 2013, Novoair has invested more than $50 million in aircraft acquisition and an additional $10 million in infrastructure and support equipment.

Except for its 2018-1019 financial year, the airline has incurred losses every year.

The pandemic caused significant losses to the airline and the ongoing price escalations due to the Ukraine war have continued to affect profitability, Rahman said.

Additionally, the shrinking domestic market and reduced demand have compounded the challenges.

Despite plans to expand its fleet and international network, Novoair has been unable to do so due to a global shortage of aircraft available for lease and due to competition from larger airlines.

Currently, Novoair operates daily domestic flights connecting Dhaka to Chattogram, Cox's Bazar, Sylhet, Jashore, Saidpur and Rajshahi.

Flights on its lone international route of Kolkata have been suspended since September last year due to a shortage of passengers.

Although on paper Bangladesh has all the ingredients to be a money-spinner with a unique geographical location that allows it to serve as a transit hub for passengers coming from the Middle East and Europe to the Asia Pacific, a constantly growing pie of upwardly mobile population and an economy that is staking its claim in the global scheme of things, country's airlines industry remains in a sorry state.

At least eight private airlines were forced to shut down their operations in the last 25 years, according to aviation experts.

The aviation industry in Bangladesh could not grow due to regulatory malfunction, excessive tariffs, high jet fuel prices, undue patronisation of the state-carrier Biman Bangladesh Airlines, said Kazi Wahidul Alam, editor of the Bangladesh Monitor.

"If the situation remains the same, airlines will come and go. They may sustain for 10 to 15 years but they will have to exit ultimately," he added.

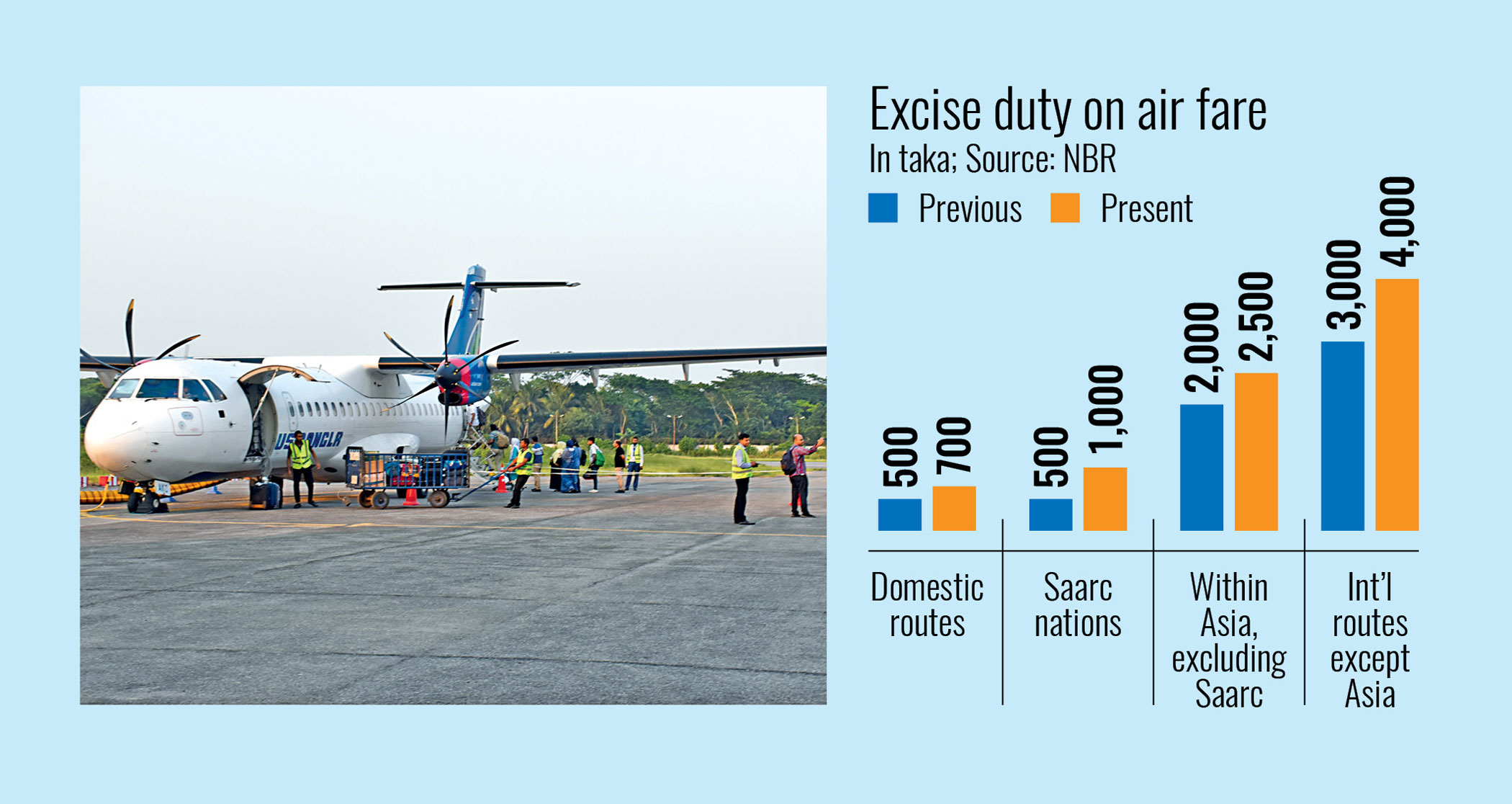

There are regulatory roadblocks such as the high rates of surcharges, aeronautical, landing and parking fees and prohibitive jet fuel prices. About 40 to 46 percent of the operating costs of an airline are comprised of jet fuel, according to Rahman.

GMG Airlines, United Airways and Regent Airways are vivid examples of private operators that had to ground their fleets as the surcharge dues piled up, according to aviation analysts.

Regent Airways, the latest private airline to cease operations, owes Tk 283 crore in surcharge, United Airways Tk 355 crore and GMG Airlines Tk 368 crore, according to data from the Civil Aviation Authority of Bangladesh.

"Once you fall into a backlog with the surcharge payments, there is no chance for you to turn around. The surcharge is a major reason why the airlines are struggling," Alam said.

The aeronautical, landing and parking charges are very high compared with other countries in the region.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments