It’s time to go for more flexible exchange rate: IMF

The time is right for Bangladesh to move towards a more flexible exchange rate regime, said Chris Papageorgiou, mission chief of the International Monetary Fund (IMF) to Bangladesh.

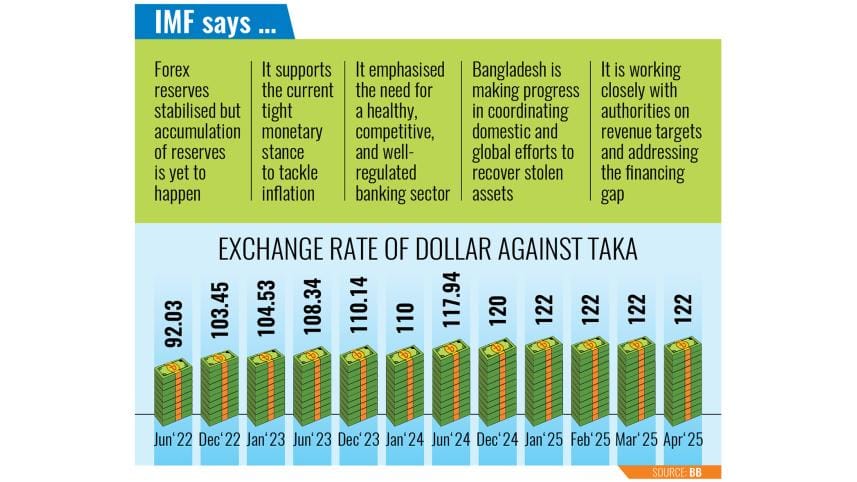

At a press conference at the Bangladesh Bank headquarters yesterday, Papageorgiou said that the gap between the official and unofficial exchange rates had narrowed significantly, creating an opportune moment for the shift.

Describing the current regime, he said, "This is not full flexibility — it's a crawling peg, which provides some guidance within a band but still allows for a future transition to complete flexibility."

The press briefing followed the IMF delegation's visit to Dhaka from April 6 to 17 as part of the combined third and fourth reviews under its ongoing $4.7 billion package.

It includes the Extended Credit Facility (ECF), Extended Fund Facility (EFF), and Resilience and Sustainability Facility (RSF).

Papageorgiou said, "From the IMF's perspective, and looking at the reform and its history, we have been discussing this crawling peg for at least one or two years."

"This is, in fact, the right time to move towards this flexibility," he replied, when asked whether it was the right time to move towards greater flexibility.

"We also see that the difference between the illegal exchange rate [unofficial rate] and the official exchange rate is very small, and we praise the authorities for this," he added.

The IMF and the government, specifically the Bangladesh Bank, were aligned on the need for greater flexibility, he said, adding, "There is no doubt that we all want to move in the same direction. We see more flexibility in the exchange rate regime in Bangladesh."

For more than three years, the country's foreign exchange market has been facing volatility.

However, recent months have seen signs of stability, due mainly to increased inflows of US dollars, which have reduced the gap between the official and parallel market rates.

Despite this improvement, the exchange rate system remains partially controlled.

In February, the Bangladesh Bank governor said that a full transition to a market-based system was not yet feasible, citing concerns about market manipulation.

"If we make it fully market-based, they will take advantage of it," the central bank governor said at the time.

At yesterday's press conference, Papageorgiou said, "We see that reserves are now stabilised, and again, we give a lot of credit to the authorities for that, because, if you remember, for a number of years, reserves had been on a steady decline and worrisome trend — now they are stable."

However, he cautioned that reserve accumulation had yet to begin in earnest. "We expect that, with more flexibility, this accumulation will happen in the near term."

On monetary policy, the IMF said that it was up to the central bank.

"We leave that decision completely to the governor. We fully endorse the current stance, which is tightening, as we want to ensure that inflation comes down in a timely manner," said the mission chief.

"So far, inflation has been very persistent — stubborn, we would say — compared to other regions. We applaud the governor for maintaining this stance."

He added that the 10 percent policy rate would likely remain unchanged until inflation showed clear signs of easing. "Looking ahead, as we expect inflation to ease, possibly by next year, the governor will consider what to do with the policy rate."

On the banking sector, Ivo Krznar, deputy mission chief to Bangladesh, said that there is no doubt that a healthy and competitive banking sector, which is regulated and supervised in line with international standards, is a prerequisite for a healthy growth rate.

Commenting on recent regulations concerning asset classification and provisioning, Krznar said, "The new regulation is a cornerstone of reform that aligns with international best practices, and the IMF commends the authorities for implementing this rule."

"It revealed the legacy problem of NPLs [non-performing loans]. NPLs did not appear because of the classification; they were simply revealed as a legacy issue."

Turning to the issue of recovering stolen assets, the IMF official said that while progress was being made, Bangladesh needed to balance effective policy objectives with minimal disruption to asset recovery efforts.

"At this point, we would just say that the authorities are making progress in the right direction in coordinating domestic and global efforts to freeze, confiscate, and recover stolen assets," said Krznar.

On revenue generation, IMF economist SeokHyun Yoon said the fund remained in close consultation with the government on targets.

"For example, to give you a sense of how we assess the needs of the country, we have something called the financing gap. Based on this financing gap, we make an assessment of these targets, and we are in continuous discussions during every review regarding these targets."

"Our immediate focus is to remove the expensive tax exemptions," he said. "Our immediate focus on the VAT and income tax side is that extensive exemptions should be eliminated."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments