Capacity payments for power plants: One third goes to three firms

Thirty-five percent of all capacity payments the government made to independent power producers (IPPs) over the last three years went to two private companies and a joint venture.

The firms -- United Group, Summit Group and Bangladesh-China Power Company Ltd -- together got at least Tk 12,353 crore between July 2019 and March 2022, Power Division data show.

After vetting, the Power Division on July 17 submitted the data to the parliamentary standing committee on the power, energy and mineral resources ministry.

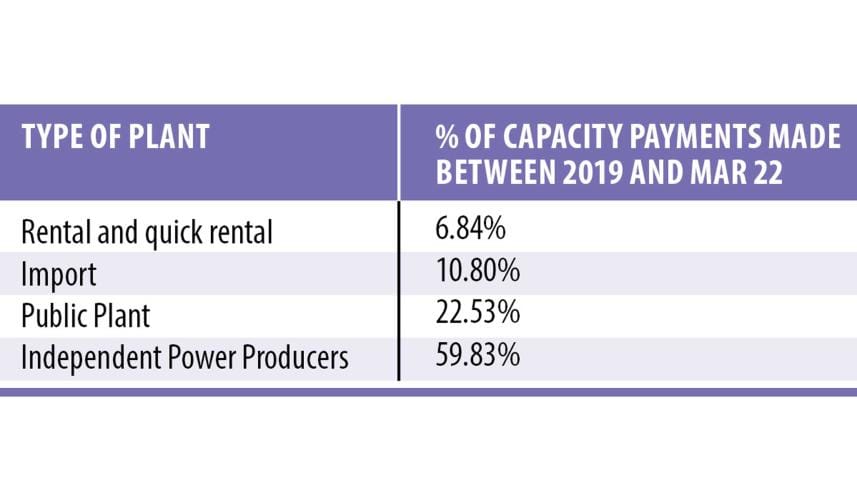

The government paid a total of Tk 35,046 crore in capacity payments to IPPs owned by 55 companies during the July 2019-March 2022 period. The amount is over Tk 5,000 crore more than the Padma Bridge construction cost.

As per the agreement with power plants, the government has to pay "capacity charges" based on the plant's capacity and establishment costs. The capacity charge is factored into the per unit cost of the electricity sold to the government. But even if no electricity is produced or bought, the government must make these minimum payments to the power plants.

Summit Group Chairman Aziz Khan said these payments are to ensure that a sufficient supply capacity is always on standby to meet present and/or future demands.

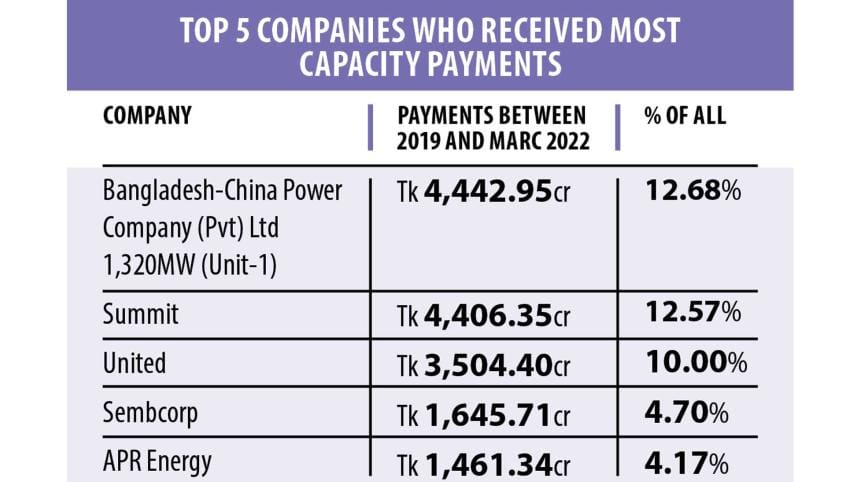

Bangladesh-China Power Company Ltd, which owns the coal-fired Payra power plant, and Summit Group received the largest chunks of all capacity payments during this period.

The Payra plant received about Tk 4,443 crore while Summit Group's earnings from capacity charges were Tk 4,406 crore during this period, which are each about 12.6 percent of the total payouts.

United Power Generation and Distribution, the power subsidiary of United Group, got the third largest share, 10 percent of the total payment or Tk 3,504 crore.

Analysing the government data, The Daily Star learnt that the other 50 or so companies each got less than 5 percent of the Tk 35,046 crore, with the majority getting less than one percent.

The payments to United Group were made for United Anawara 300MW, United Ashuganj Energy Ltd, United Payra 150MW, United Mymensingh Power Ltd, and United Jamalpur 115MW.

The payments to Summit Group were made for Summit Meghnaghat Power Ltd, Summit Bibiyana II Power Company Ltd, Summit Gazipur II Power Ltd, Summit Barisal Power Ltd, Summit Purbanchal Power Ltd, and Summit Narayanganj Power Units I and II Ltd.

Bangladesh-China Power Company Ltd got the payments for the massive 1,320MW Payra power plant. The plant was ready for operations last year, but it cannot be used because the government is yet to complete the transmission line that would supply power from Mongla to Dhaka's Aminbazar.

Not taking Payra power plant into consideration, since this is a massive outlier of all 120 power plants in the country, Summit's Meghnaghat Power Ltd was paid the most. It received Tk 1,677 crore over the last three years.

The government's daily power generation data (evening peak) show that the 335MW plant produced nothing in January-February this year, citing gas shortages. It only picked up production in the middle of March, utilising three-quarters of its capacity on average. April too was spent producing barely anything, citing the gas crisis.

If a plant is ready to produce power but is sitting idle because the government is unable to supply fuel, it will still receive its capacity charges, which are fixed at the time of signing contracts.

This Summit plant was paid on average Tk 37.8 crore in capacity charges per month for the first three months this year, according to the Power Division data.

Throughout July, the plant cited gas shortages and has been operating at 0.8 percent load factor (ratio of average power generated by the plant to the maximum power that could have been generated). The plant has been inoperative since July 3.

The government's austerity measures came into effect last month, but that was only for diesel-fired power plants. In July, the government shut 10 diesel-run plants. But it has made no such directives about gas-fired plants.

This Summit power plant in question can run with natural gas and diesel.

While the Summit plant suffered from such gas shortages that it could produce nothing at all, its neighbour, a power plant called Meghnaghat Power Limited (MPL) 450MW, operated consistently, although on average at half capacity.

It was paid Tk 571.7 crore in capacity charges during July 2019–March 2022 – three times less than the Summit plant. MPL 450MW is co-owned by the China Southern Power Grid and China General Nuclear Power.

"The Ministry of Power, Energy and Mineral Resources along with Petrobangla decide on the allocation of gas. Almost 50 percent [of the country's gas] is allocated for power generation. Therefore, if Petrobangla is unable to supply gas, independent power producers are not in default," Summit Chairperson Aziz Khan told The Daily Star this week.

The MPL power plant has been operational for 20-plus years and therefore its capacity payments may be lower, which is typical. As a result, MPL's tariff could also be lower, he added.

In the power industry, lower capacity charges mean lower tariff rates.

For example, last year MPL's cost per kilowatt-hour was Tk 2.7, while Summit Meghnaghat's was Tk 4.2, according to Power Development Board's Annual Report.

"The policy is least-cost generation. The ones that are most expensive will be used the least. The MPL 450MW power plant is one of the best performing – its production cost is very low and its production is very high," said energy expert Mohammad Tamim.

This means it is cheaper to bench the Summit plant and pay capacity charges than operate it.

According to energy policy expert Prof Enamul Haque, power plants must be disincentivised from sitting idle.

"They have to profit less from sitting idle. Otherwise, they will not be interested in producing power," he noted.

In a research paper on the impacts of Bangladesh's collusive power plant contracts, Mushtaq Husain Khan, a professor of economics at SOAS, University of London, reached a similar conclusion.

The research titled "De-risking private power in Bangladesh: How financing design can stop collusive contracting" analysed 58 private plants between 2004 and 2017.

"These large capacity charges created incentives for interested parties to arrange for orders not to go to these plants as profits were larger by not producing," the report said.

According to Tamim, capacity payments were sometimes justified, but it needs to be seen if some plants are being given "preferential treatments".

"I cannot say for sure, but I have seen that some power plants received no demand orders for electricity for the entire year. If the government wants power but the plants cannot deliver, they have to pay a certain fee. There are allegations that power plants unable to deliver electricity are benched instead of demanding power from them, so as to waive the fees," he added.

Ashuganj, a town in Brahmanbaria, has the largest collection of power plants within a single area in the country. There are 11 units, of which 10 are gas-fired. One of them belongs to United Group, the power company currently receiving the third biggest chunk in capacity payments.

The 195MW gas-fired United Ashuganj Energy Ltd utilised on an average approximately 15 percent of its capacity between January and March 2022, citing gas shortages, making it the least efficient producer in the area, according to Power Grid Company's data taken during evening peak hours. The median production of the plant during these three months was at 4.1 percent capacity and there were many days when the plant produced nothing at all.

Even during this fiscal year, when all Ashuganj plants in operation produced at 60 to 90 percent capacity, the United plant had a plant load factor of 18.6 percent.

Kutubuddin Akhter Rashid, an associate director at United Group, said, "The plant has been operating at 14-15 percent load factor. This is a public-private partnership project. We have told them that the factor needs to be increased. They [the government] keep saying that gas pressure is an issue. We want this plant to be generating at maximum capacity. We have officially communicated the matter with them. They are not increasing it. If we are able to generate at maximum capacity, the electricity produced in that location will be the cheapest."

The plant was paid Tk 19.9 crore per month in capacity charges between January 2021 and March 2022, government data show.

"For the operators, the one sitting idle and the one in production are both profiting from capacity charges," said Prof Tamim.

How much is that profit or how much capacity payment is to be paid to a plant depends on the contract between the plant and the government and it differs from company to company. This is why experts say that independent power producers are more expensive than public power plants.

This is evident at the United plant in Ashuganj.

Between January and March 2022, when the 195MW plant's utilisation was about 15 percent, its neighbour, the 395MW government-owned APSCL thermal plant, had utilisation of about 18 percent.

They were both paid about the same amount in capacity charges during the period, even though the public plant generated a lot more power.

According to Mohammad Hossain, director general of Power Cell, a wing of the Power Division, the capacity charge paid was proportional to the energy sold by a power plant.

Then why was the smaller United plant paid as much as the government-owned APSCL thermal plant?

According to energy expert Prof Enamul Haque, the capacity payments depend on how fuel efficient the plants are. Public power plants like APSCL are older and so not very fuel-efficient. "That could be the reason why they are getting less."

APR Energy 300MW is a diesel-fired power plant and it received the fifth-highest amount in capacity payments between 2019 and 2022. It was paid Tk 1,461 crore.

The Power Development Board's annual report shows that last year (FY20-21) the plant's load factor was an abysmal 3 percent. In that fiscal year, the plant was paid Tk 526 crore in capacity payments.

Surprisingly, a year before the plant ran at 72.68 percent capacity. In the immediate past fiscal year, it was among those plants sitting idle.

Banglatrac's two plants with a combined capacity of 300MW received the sixth-highest amount in capacity payments between 2019 and 2022. Its payment totalled Tk 1,454 crore.

One of them, the expensive diesel-run 200MW Daudkandi plant, had a load factor of 2 percent during fiscal year 2020-21. It was paid the same amount in capacity charges that year as the year before when it had a load factor of 43 percent. It was paid Tk 351 crore each year, Power Division data show.

But should plants be kept sitting around?

"It is difficult to justify the need for a power plant, if it is made to sit idle for a majority of the time," said Tamim.

Hasan Mehedi, member secretary of Bangladesh Working Group on External Debt, a platform of organisations doing power sector research, said if a plant produces less than 40 percent of its capacity then the government can decommission it, and every power plant agreement has this provision.

"But no one knows why this is not done," he said.

The PDB chairman could not be reached for comment. Power Division secretary and PDB member, distribution, declined to comment.

Power Cell Director General Mohammad Hossain said these contracts were signed years ago in line with international norms and standards.

"It's the international practice that idle power plants be paid capacity charges. There is no way to stop their payments under the existing contracts. These terms can be reconsidered in the future," he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments