Banglalink’s revenue grows over 12% in 2022

Banglalink registered a double-digit growth rate in its revenue in 2022 driven by increased investment in 4G network, expanding coverage and enhancing network speed.

Revenue rose 12.1 per cent year-on-year to Tk 5,374 crore, according to the 2022 earnings report published by the telecom operator's parent company, VEON Ltd, recently.

This was the third double-digit growth in consecutive quarters.

The operator's annual service revenue grew 12.3 per cent last year while data revenue surged 26.6 per cent.

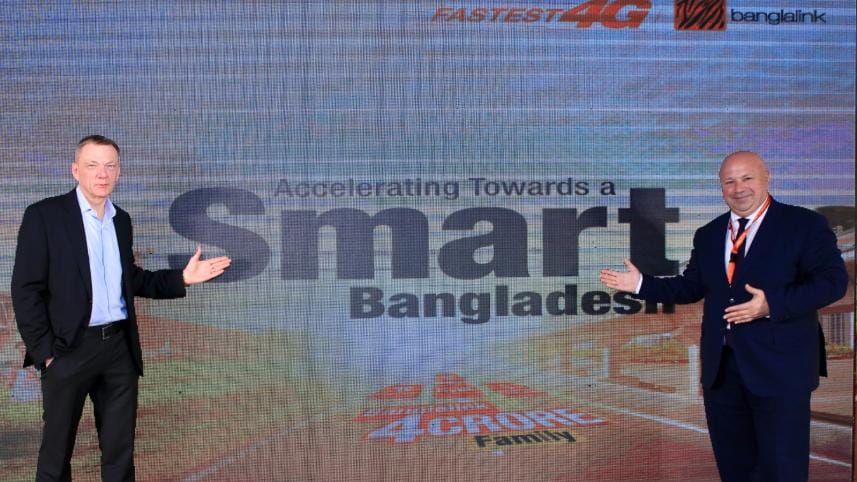

The innovative and improved digital services also expanded the customer base last year, said Banglalink Chief Executive Officer Erik Aas while sharing the earnings report during a press conference at the corporate office of the operator in Dhaka today.

"Banglalink embarked on a new era of growth as a digital powerhouse in 2022, delivering exceptional results across all segments. Our growth rate surpassed that of the industry by a two-fold margin."

He said by extending the fastest 4G network and delivering superior digital services to every corner of the nation, Banglalink has achieved the status of a truly national operator.

"Armed with our unparalleled speed and nationwide reach, we are poised to serve our customers with top-of-the-line connectivity in the coming years."

Kaan Terzioglu, chairman of Banglalink and group CEO of VEON, said, "It is great to see VEON's consistent investment in Bangladesh yielding pronounced results. Banglalink's double-digit revenue growth for three consecutive quarters is a testament to its success in strengthening customers' trust."

He said Banglalink is on track to enhance its growth while contributing to the realisation of a Smart Bangladesh through consistent delivery of high-quality digital services to the thriving digital market in the country.

Cem Velipasaoglu, Banglalink's chief financial officer, Upanga Dutta, chief commercial officer, and Taimur Rahman, chief corporate and regulatory affairs officer, were also present at the event.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments