Remittance slumps to six-year low

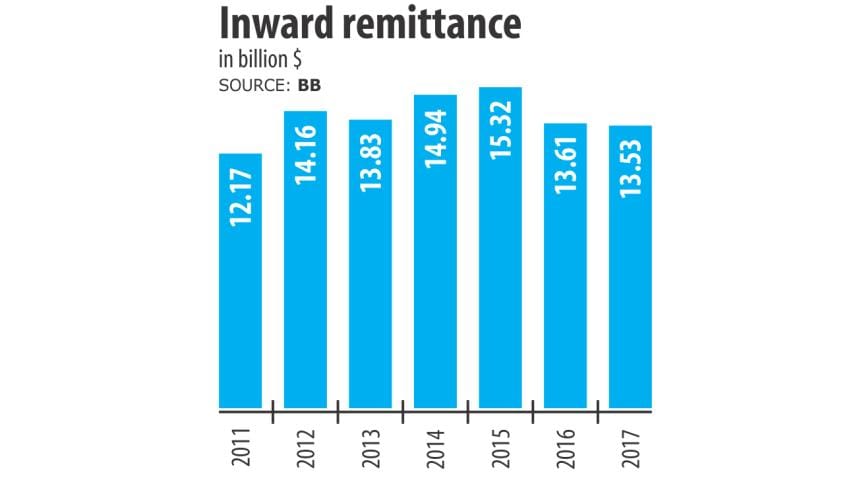

Remittance dropped to a six-year low to $13.53 billion in 2017 as many expatriate Bangladeshis sent money home through illegal channels.

In the just-concluded year, Bangladesh's key source of foreign currency was 0.53 percent lower than that of 2016 when migrant workers remitted $13.6 billion, according to data from the central bank.

The migrant workers opted for the illegal channels like hundi for most part of the year because of a lower rate of the American dollar against the taka, according to bankers and experts.

Remittance inflow, however, accelerated in the last few months of the year as the local currency depreciated significantly against the greenback but still failed to offset the decline in the most months to lift the full-year earnings above the 2016's.

Salehuddin Ahmed, a former governor of the Bangladesh Bank, told The Daily Star yesterday that remittance flow is still not on the right track despite the upward trend in the last few months.

The depreciating taka against the dollar helped the country increase its income from remittance in recent times, but it may be temporary, he said.

Inter-bank exchange rate was Tk 82.70 on January 1, up 5.08 percent from Tk 78.70 on the same day a year earlier, according to central bank data. Ahmed said the latest volatile situation in the banking sector eroded the clients' confidence that left an adverse impact on the banks' deposit mobilisation, including remittance inflow.

Migrant workers sent their hard-earned money to their near and dear ones through the illegal channel to get higher rates than those offered by banks, he said. "The export of human resources has recently increased but the majority of workers are unskilled. So, it is not bringing any good outcome."

MA Halim Chowdhury, managing director of Pubali Bank, said the income of many expatriate Bangladeshis decreased recently, which hit remittance flow adversely.

He said the central bank has strengthened its surveillance over cross-border financial transaction through hundi, giving a boost to remittance income.

Syed Mahbubur Rahman, managing director of Dhaka Bank, said the increased trend in remittance would continue in the coming months if the exciting exchange rate prevails.

The central bank should continue its monitoring of hundi in the best interest of remittance flow, he said.

Remittance is a major source of foreign currency for Bangladesh and its descent since fiscal 2015-16 has progressively become a matter of concern for the government.

Hundi traders have been fast transferring remittance to relatives of expatriate Bangladeshis through mobile services, which have resulted in a fall in the amount of money sent through banking channels, said the Bangladesh Institute of Bank Management in a report in December.

In November, an inter-ministerial committee came up with 18 proposals to boost remittance flow through formal channel and ward off the rising menace of digital hundi.

Remittance income stood at $1.16 billion in December, posting 21.74 percent year-on-year growth.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments