Poultry industry moves to next step of development

The poultry industry is in a new phase of development, with an increasing number of poultry giants going for integrated farming to market chicken meat and eggs.

After the entry of Aftab Bahumukhi Farms, CP Bangladesh and Kazi Farms, another leading breeder, Paragon, has signed up for marketing eggs, dressed or processed chicken, and chicken-based ready-to-cook products that will be produced in its own farm.

The trend will not only create competition among the industry operators to ensure safe and hygienic poultry products but may also force many small farmers to quit farming, said analysts.

“The good part of it is quality assurance,” said Nitish Debnath, former vice-chancellor of Chittagong Veterinary and Animal Sciences University.

If the product quality is not up to the mark, one can easily identify its source, which is difficult now because of the presence of a number of players in the value chain, he said.

But on the other hand, the livelihood of many small farmers, retailers and those who are involved in the slaughtering of birds may be affected.

The industry giants, who had in the past mostly focused on selling day-old chicks and feeds, have signed up for producing final products at a time when the demand for broiler meat and eggs is on the rise.

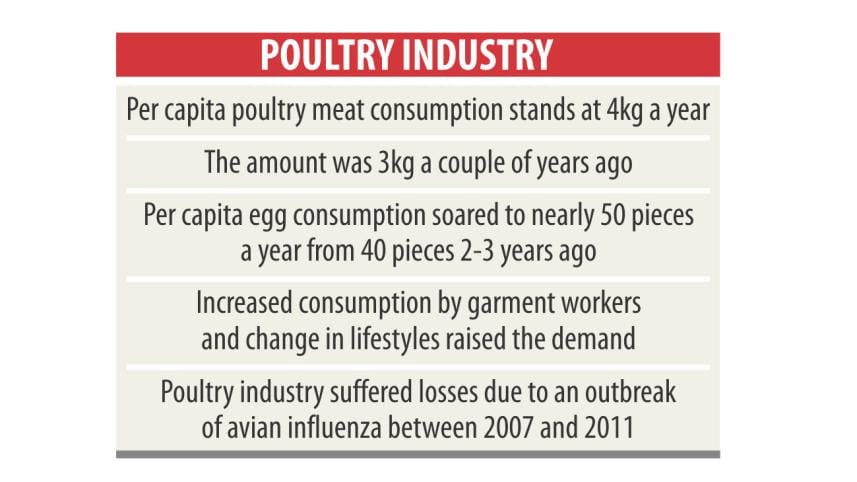

Bangladesh's per capita poultry meat consumption now stands around 4 kilogram a year, up from about 3 kilograms a couple of years ago, according to industry operators.

Per capita egg consumption has also soared to nearly 50 pieces a year from 40 pieces two-three years ago, said Rahman, also the convener of Bangladesh Poultry Industries Coordination Committee (BPICC).

Increased consumption by garment workers and the gradual change in lifestyle in rural areas for rising income have driven up the demand.

The availability too has risen due to higher production after the government allowed vaccination to prevent avian influenza.

The poultry industry suffered losses due to an outbreak of avian influenza between 2007 and 2011. The sector started to regain pace after the introduction of the vaccination.

Now, the sector meets almost all the local demand for chicken meat and eggs, according to BPICC.

Increased integration in the industry will benefit consumers as they will get poultry products at competitive prices, said Moshiur Rahman, convener of BPICC.

“This is going to take the industry to a new height,” said Rahman, also the managing director of Paragon Group that owns grandparent farms to feed mills.

His company will market dressed and live chicken, eggs along with processed chicken and chicken-based products.

It has been marketing eggs for the last one year and has now started selling packaged chicken meat in chilled form along with chicken-based products.

“We will soon open showrooms in various places of Dhaka and Chittagong as part of our plan.” The showrooms will sell live chicken as well. There will be demand because many people are afraid of buying broiler chicken and eggs from the open market for safety concerns over the use of tannery waste in feed.

At present, it is not possible for a person to know from where the broilers were farmed and what type of feed they were given, Rahman added. Increased integration by large farms will hit small farmers, said MM Khan, secretary general of Bangladesh Poultry Industries Association (BPIA).

“It will be tough for small farms to survive as big farms will follow the scientific methods of farming to prevent mortality. They will also be able to make up losses in one stage of production by making profits in the other stage.”

But this is good news for consumers -- they will get relatively healthy and quality chicken, as the brands will have to compete through quality, he added. Industry stakeholders, however, said the demand for packaged or frozen chicken still remains very low, owing to the consumers' preference for live birds, partly due to religious reasons.

However, they expect that the demand for frozen or ready broiler chicken will grow due to the consumers' increasing quest for safe and convenient food. “The prospect is very high at least for processed chicken. Youths with modern thinking and education will prefer ready broiler chicken to live chicken,” said Tariquzzaman, director of strategic planning and marketing of Aftab Bahumukhi Farms Ltd, the pioneer in integration in Bangladesh.

In the past, the company slaughtered 5,000 birds a day. The number has now risen to 7,000. The retail poultry market is likely to be reshaped in the years to come because of food safety reasons, he added.

The demand for dressed and ready-to-cook chicken will rise if the price gap between live and frozen chicken narrows, said Md Rafiqul Haque, former secretary of World's Poultry Science Association, Bangladesh. Live birds are slaughtered in an unhygienic manner in the wet market, and this is a major reason for diseases. “But integrated farming will ensure safe and hygienic production -- it's a good development.”

He, however, echoed others in that it would be tough for small farmers to sustain the competition. “The number of small farmers will decline,” he said, citing that large investment has begun in layer farming to produce eggs.

To support small farmers, who account for a large portion now, BPIA Secretary General Khan urged the government to ensure low-cost finance and other incentive for them. Tariquzzaman of Aftab Bahumukhi Farms suggested formation of associations among farmers. “They will be able to play a role in the market by forming associations,” he said.

Debnath recommended the government and the local government bodies should establish common slaughtering houses to ensure that customers get relatively safer chicken from the wet market.

Citing Southeast Asian countries, he said live birds are slaughtered in specific places.

A competition in quality assurance is needed and the building of common slaughtering houses will enable small traders to compete, said Debnath, while urging the government to implement the slaughter act to ensure food safety.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments