Philippine bank let fund withdrawal despite NY bank stop order

The Rizal Commercial Banking Corp. allowed the withdrawal of the bulk of the funds suspected to have been stolen by computer hackers from the Bangladeshi central bank despite having received an order from its counterpart banks abroad to stop the payment.

This was revealed during the Senate investigation on the US$81-million money laundering activity that has rocked several local banks and put into question the efficacy of the country’s laws to guard against the entry of dirty funds.

During the hearing, Senator Teofisto “TG” Guingona III revealed that, after receiving the suspicious funds on February 5, the publicly listed bank controlled by the wealthy Yuchengco family received a “stop payment” order from the Federal Bank of New York at 5:00pm of February 8 — a banking holiday in the country because of the Chinese New Year celebrations.

“The stop payment order was received by your bank, February 8, 2016,” he told RCBC president and CEO Lorenzo Tan. “On the morning of February 9, the first banking day, you should have seen the stop payment request. But apparently it was not honored because the funds were withdrawn. All the funds were withdrawn.”

Guingona further pointed to documents filed by the Anti-Money Laundering Council with the courts noting that RCBC “responded to the Bangladesh Bank’s stop payment request at 7:45pm of February 9.”

“That was the end of the day already,” Guingona said. “Would you care to explain why the stop payment request — which should have been honored at the very start of the banking day — was not honored?”

To this query, the RCBC chief invoked the Bank Secrecy Law and and declined to reveal specific details about the transaction, but offered an explanation of general procedures pointing to the responsibility of the branch manager to execute the stop payment order.

“Sorry, you’re honor. I cannot confirm or deny this request specific to this transaction,” Tan told Guingona. “But as a general rule, when there’s a freeze order on an account, the branch manager involved should comply with such an order.”

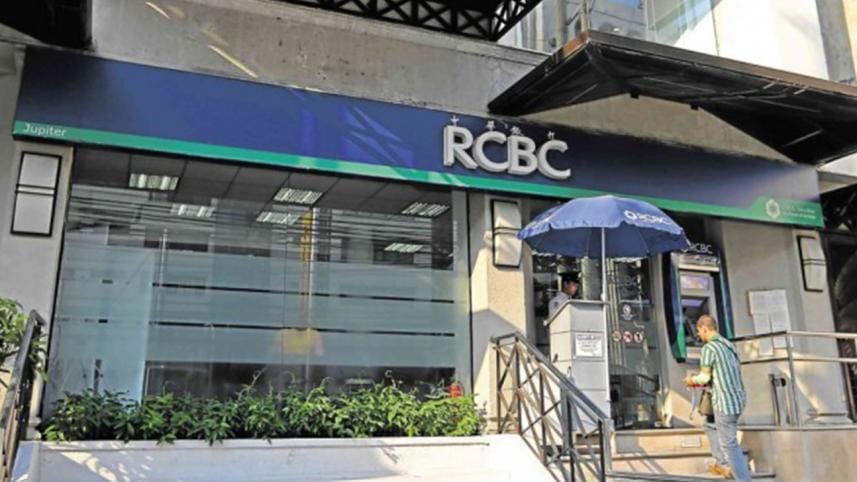

Pressed further if RCBC’s head office sent the stop payment order to Maia Santos-Deguito, the manager of its now controversial Jupiter St. branch in Makati City, the bank president stonewalled and again pointed at Deguito’s responsibility.

“Again, your honor, I’m precluded because of bank secrecy. But as a general rule, these orders are sent by the head office to the branch manager,” Tan said.

Just before posing the question to Tan, Guingona also asked the same question to Deguito in an attempt to ascertain how the funds slipped through the bank’s internal control mechanisms despite indications from its foreign counterparts that the fund transfer effected on February 5 was fraudulent.

“February 9 was a banking day. That was a Tuesday. $81 million was still there in the accounts,” said the senator, chair of the Senate Blue Ribbon committee. “On February 9, all the $81 millon was withdrawn. Did you not have a stop payment request on February 9?”

At this, Deguito, too, invoked the Bank Secrecy Law, telling senators that she was willing to answer questions only in a closed-door executive session, because she has become the subject of a complaint filed by the Anti-Money Laundering Council against her, and that anything she would say in public could be held against her.

“I apologize but questions related to my actions I can only answer in an executive session,” Deguito replied.

Frustrated by both sides’ invocation of the Bank Secrecy Law, Guingona pointed at the inaction of the bank on the request by its New York counterpart to hold the transaction and allowing the funds to be withdrawn by still unknown parties.

“All these amounts that you mentioned were withdrawn on February 9. And the stop payment request was already there on the morning of February 9,” Guingona said. “And yet all these millions of dollars were withdrawn. Had the stop payment request been honored, then $58 million of the $81 million would have been preserved and would not have gone astray.”

During Tuesday’s hearing, AMLC officials told senators that they received a request for assistance from Bangladesh Bank, the central bank of that South Asian country, as early as February 11, after which two Bangladeshi officials flew to the Philippines on February 16.

AMLC then conducted its own investigation on the issue.

The Philippine Daily Inquirer broke the story about the laundering of funds through the local financial system on February 29, and on that day — 20 days after the bulk of the funds was withdrawn from fictitious accounts created at RCBC’s Jupiter branch — regulators asked the Court of Appeals to freeze seven bank accounts suspected to be involved in the laundering activity.

On the next day — 3 weeks after the funds were withdrawn from the bank, converted into pesos, with some being moved to local casinos — the Court of Appeals issued a freeze order. A report from Bangladesh quoted a government official as saying that only $68,000 had been frozen.

The Senate will resume its probe on the issue on Thursday (March 16), with an eye on amending the Anti-Money Laundering Act to strengthen it against future laundering attempts.

Copyright: Philippine Daily Inquirer/ Asia News Network

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments