Yunus for a bank dedicated to microcredit

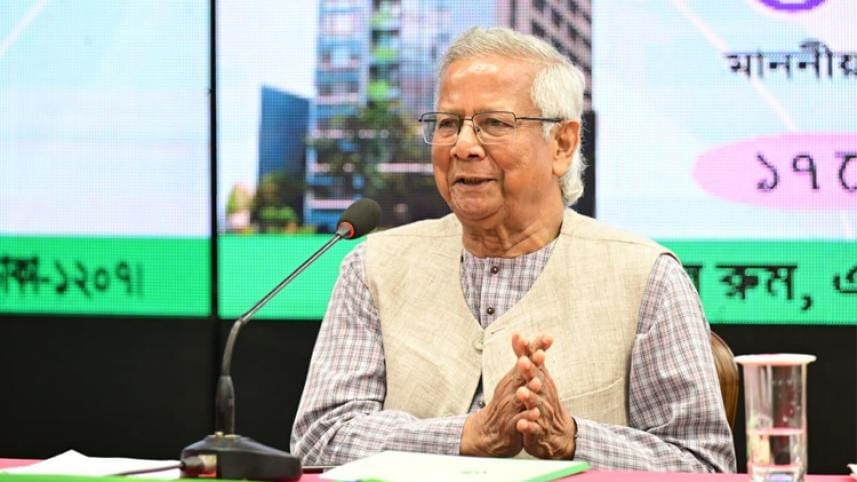

Chief Adviser Prof Muhammad Yunus yesterday proposed the establishment of a dedicated microcredit bank based on the social business model.

While inaugurating the Microcredit Regulatory Authority (MRA) building in the capital's Agargaon, he said the proposed bank would not be a conventional one.

"A new perspective is needed here [microfinance sector], and that is establishing a microcredit bank," said Yunus, who pioneered the concept of microcredit and microfinance.

Yunus and Grameen Bank, which he founded, were jointly awarded the Nobel peace prize in 2006 for their efforts to "create economic and social development from below". Grameen Bank's objective has been to provide small loans to the poor without requiring collateral -- a system known as microcredit.

The chief adviser noted that microfinance organisations currently operate under an NGO-style framework. "If they want to transition out of the NGO-style stage, they must evolve into a full-fledged bank."

He added that a separate law should be enacted for the proposed microcredit bank. "This must be a new kind of bank. The Microcredit Regulatory Authority or any other organisation can serve as its regulatory body."

He said that when such a licence is granted, it must clearly state that it is not for conventional banking operations, adding that it will function as a social business entity to ensure that owners cannot extract profits.

Yunus said the proposed bank would also provide young people with loans in the form of venture capital, allowing them to invest in their businesses and become entrepreneurs. "If the young people get capital for their business from the bank, they will never [have to] run around for a job."

Citing Grameen Bank as an example, he said that microcredit recipients would be the owners of the proposed bank.

Reflecting on Grameen Bank's evolution as a microcredit institution, he described the microcredit system as the "real banking system", contrasting it with conventional banks that disburse loans against guarantees. "Grameen Bank extends credit to the poor based on trust."

The remarks come at a time when, ironically, collateral-based banks -- the so-called "real banks" -- have vanished into thin air. "They are nowhere to be found, their funds have disappeared, and their institutions have collapsed," Yunus said.

"Meanwhile, the microcredit system remains strong. No one has embezzled money, no one has fled the country with funds."

The chief adviser also pointed out that the question of regulatory oversight is not unique to Bangladesh. "Every country that has implemented microcredit has faced challenges.

"I have repeatedly told them [other nations] they do not need to overthink the matter, as Bangladesh has already provided a solution. The Microcredit Regulatory Authority [MRA] has not only served Bangladesh but has also been instrumental in assisting many countries."

The MRA was founded in 2006, with a vision to create a transparent and accountable microfinance sector to help alleviate poverty and ensure sustainable national development.

Yunus also recalled the period before the establishment of the MRA, when there was a push to bring non-government microfinance institutions (MFIs) under a regulatory framework.

As of this March, there are 4.29 crore microcredit beneficiaries from MFIs -- 91 percent of whom are women.

GOVT MULLS NEW LAW

Bangladesh Bank Governor Ahsan H Mansur, who also chairs the MRA, said microcredit has made significant progress.

"Currently, the microcredit sector holds assets equivalent to 10 percent of the banking industry. More importantly, where traditional banking has weaknesses, microcredit has established a strong foundation."

He noted that members' savings have exceeded Tk 68,000 crore, while the accumulated surplus has surpassed Tk 61,000 crore.

Mansur added that the microcredit system will face new challenges as the rural economy expands and agent banking continues to grow. "Right now, microcredit institutions have around 26,000 branches, while agent banking branches have surpassed 20,000. This healthy competition is fostering formal financial integration into rural economies, and microfinance institutions must adapt to these challenges to remain relevant."

To improve the functionality of the microcredit sector, he said the regulatory authority and Bangladesh Bank will work together. "A draft law on microcredit regulation has already been prepared and will soon be presented to the government."

Finance Adviser Salehuddin Ahmed emphasised that the regulations must be user-friendly rather than overly restrictive, ensuring that nothing is imposed forcefully.

He also said the MRA should focus not only on regulation but also on promotion of the sector.

Anisuzzaman Chowdhury, special assistant to the chief adviser, Nazma Mobarek, secretary to the Financial Institutions Division, and Prof Mohammed Helal Uddin, executive vice chairman of the MRA, also spoke at the event.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments