Weak banks may face closure

Bangladesh Bank Governor Ahsan H Mansur's comment that some ailing banks may face closure drew flak yesterday.

"We are trying to keep the troubled banks running, but not all of them will survive," he told a conference titled Recommendations by the Task Force on Re-strategising the Economy.

"We are trying, but it is difficult to keep some banks operational," Mansur said, adding, "We all know that the banks have been systematically looted."

A decision regarding the weak banks would soon be made in consultation with the government and other stakeholders, he said.

"Out of the 11 restructured banks, Islami Bank Bangladesh and United Commercial Bank have recovered and are performing well."

However, his remarks drew sharp criticism from BNP leader Abdul Awal Mintoo, chairman of National Bank, at the conference.

"I thank the government for appointing a knowledgeable person as the Governor of Bangladesh Bank. But he should talk less," Mintoo said. "As long as he keeps talking about shutting down banks, there will be no improvement in the sector."

Acknowledging the financial challenges facing National Bank, Mintoo added, "It is unwise to keep saying the weak banks will be closed. If you plan to shut down banks, why not shut down the entire economy?"

He further questioned the central bank governor's stance on printing out taka: "He always says he won't print more taka to give to the banks. Do we even know how much has already been printed or how much should be printed in relation to the GDP?"

Monzur Hossain, a member of the Task Force on Re-Strategising the Economy, said the unbridled printing of money and the single-digit interest rate on lending have contributed to macroeconomic instability.

The current account balance has shown improvement due to import restrictions, he said.

Prof Main Uddin, former chairman of the Department of Banking and Insurance at Dhaka University, recommended increasing the number of independent directors at banks and prohibiting bank owners from becoming chairpersons.

Syed Mahbubur Rahman, managing director and CEO of Mutual Trust Bank, highlighted governance issues that emerged in 2017 when "an influential family" took control of Islami Bank Bangladesh.

Fahmida Khatun, executive director of CPD and member of the Task Force, presented the keynote paper.

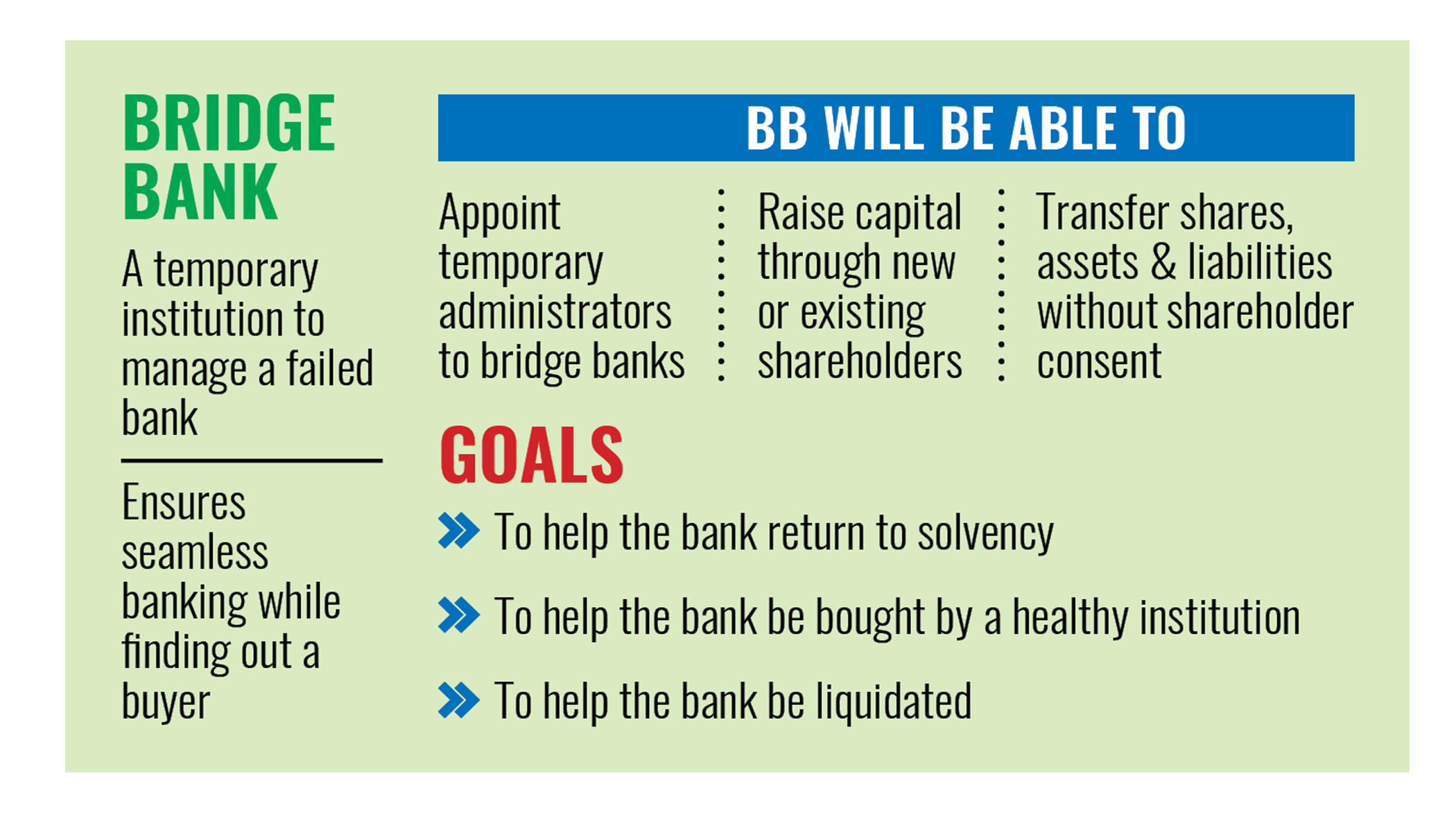

She recommended ensuring proper loan sanctioning, enforcing single borrower exposure limits, halting loan rescheduling, and appointing administrators at the troubled banks.

She also emphasised protecting the independence of Bangladesh Bank, ending bank bailouts through recapitalisation, and stopping the issuance of licences to new banks.

POLITICAL REFORMS

The concluding session titled, Institutional Governance and the Way Forward, outlined specific reform proposals for the interim government as well as recommendations with timeframes for future political governments.

Presiding over the session, renowned economist Prof Rehman Sobhan urged the taskforce to make recommendations that the interim government could begin to implement.

In his keynote presentation, Syed Akhtar Mahmood, a member of the taskforce, recommended that the Bangladesh Investment Development Authority be designated as the core agency to streamline investment promotion functions.

He also proposed modernising the regulatory framework under a regulatory reform commission and improving public service delivery across all sectors.

Dr Iftekharuzzaman said if a reform is to take place, be it in the political parties.

Reform proposals will only be successfully implemented if political parties are willing to pursue them, he added.

Political scientist Rounaq Jahan noted that reform initiatives often faltered with changes of political power.

"Oftentimes, the designs of our development projects are based on relationships between donors and implementing agencies, rather than on the actual needs of service recipients. This approach must change," she said.

Abdul Muyeed Chowdhury, chairman of the Public Administration Reform Commission, and Zonaed Saki, chief coordinator of Ganasamhati Andolon, were among the speakers at the event. The session was moderated by KAS Murshid, chairman of the taskforce.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments