‘We were forced to leave UCB, and the PM knew everything’

Former land minister Saifuzzaman Chowdhury Javed compelled UCB board members to resign and former prime minister Sheikh Hasina was aware of this, according to the lender's new Chairman Sharif Zahir.

"We had no choice but to leave the bank because Javed was a minister at the time," Zahir told The Daily Star in a recent interview. "I realised that it was better to resign than remain silent on the board."

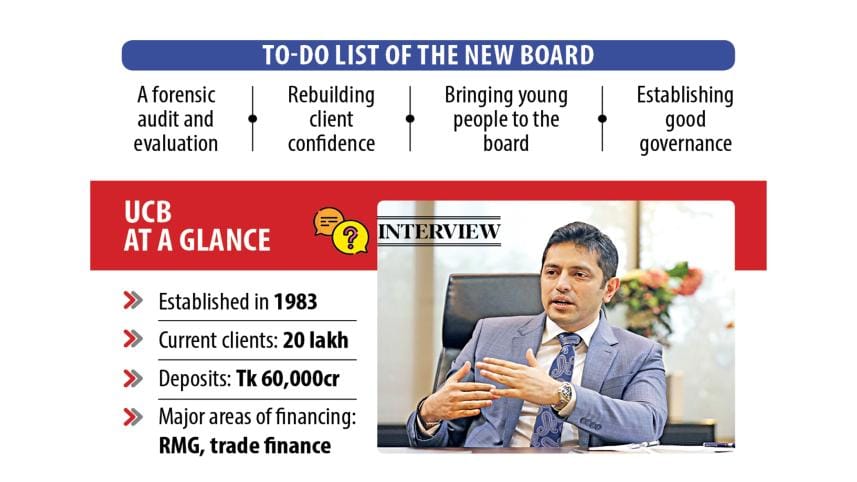

On August 27, the Bangladesh Bank (BB) reconstituted the board of the more than four-decade old private commercial lender UCB. Since 2018, the bank had been heavily influenced by former land minister Javed and his family members.

The BB appointed a five-member board, including two shareholder directors and three independent directors. Sharif Zahir was elected as chairman.

Unlike other recently restructured banks, Zahir said UCB does not have a severe liquidity problem. He said they are now rebuilding client confidence as part of their greater endeavour to establishing good governance -- a process Zahir said was hindered by political influence and misconduct.

For the obstruction, he blamed Javed, who took over the UCB board in June 2018 when he was a minister.

"He forced us to resign and brought his family members onto the board," Zahir said.

It was difficult to speak out on the board because the Awami League government supported them, Zahir said. He said the former prime minister Sheikh Hasina was fully aware of the bank's issues.

Zahir said he complained to the former chairman of the Bangladesh Association of Banks (BAB) Md Nazrul Islam Mazumder about the takeover. Mazumder subsequently discussed the issue with the former prime minister.

"When we met with the former prime minister during a cheque donation programme, she asked us why we were having so many problems within UCB," Zahir said.

"You know everything," Zahir had replied to the prime minister. He said, "No action was taken at that time. It was not possible to fight against the state."

Javed's father Akhtaruzzaman Chowdhury Babu and Zahir's father Md Humayun Zahir were among the founders of the bank in 1983. Akhtaruzzaman Chowdhury was later removed from the board, and Humayun Zahir was reportedly murdered over a "board dispute" in 1993.

Zahir said Sheikh Hasina visited their residence to offer condolences at the time.

When the Awami League came to power for the second term straight in 2014, Zahir said that Babu and his family members returned to the bank board. The bank was steadily growing somehow until 2018 before Javed took over the board.

Regarding the bank's future plans, Zahir said they decided to conduct a forensic audit. An audit firm has already begun their examination.

A forensic audit is an examination and evaluation of a firm's or individual's financial records.

"We will be able to identify the actual scenario of the bank after a proper audit," Zahir said. "This is a large bank with two million customers and Tk 60,000 crore deposits."

He said ready-made garments (RMG) and trade finance are major investment areas for the bank.

The bank is currently working to rebuild client confidence. The board has motivated the management team and restored their confidence in working together, he added.

"We came up with a new slogan for the bank: ''United in Integrity, Growing Sustainably", Zahir said. "We also want to establish good corporate governance."

"The bank is now communicating with large borrowers to ensure their compliance," Zahir added. "We are monitoring the bank's liquidity situation daily, but there are no liquidity problems."

He said the bank is maintaining the statutory liquidity ratio (SLR) and cash reserve ratio (CRR) with the central bank, and the management has been instructed not to fail to meet these requirements.

The private commercial lender is also meeting the 100 percent demand of depositors. "If necessary, we will raise the bank's capital base," the new chairman said.

Regarding the banking sector, Zahir said the rules and regulations are excellent but implementation has been lacking in recent years.

Authorities must address this issue to establish good governance, he said. "The government should grant full independence to the central bank, which would help improve governance in the sector."

He said the primary responsibility of the new UCB board is to develop the bank's strategy. Loan disbursement is the responsibility of the management and risk management committee while the compliance committee makes recommendations to the management.

Regarding UCB, Zahir said they have begun meeting with borrowers to build confidence.

"We want to include the younger generation on our board of directors to expand the bank."

He also said individuals with political aspirations should not enter the banking sector.

"Banking and politics are distinct fields," Zahir added.

Conflict of interest arises when a member of parliament serves on a board of directors. "Those who want to enter business or banking should have the courage and mentality to speak out against discrimination or irregularities."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments