Sugar imports slump amid illegal influx

Bangladesh's sugar imports fell sharply in fiscal year 2023-24 as refiners stayed away from placing orders to foreign buyers in the face of an illegal influx of the sweetener through the borders.

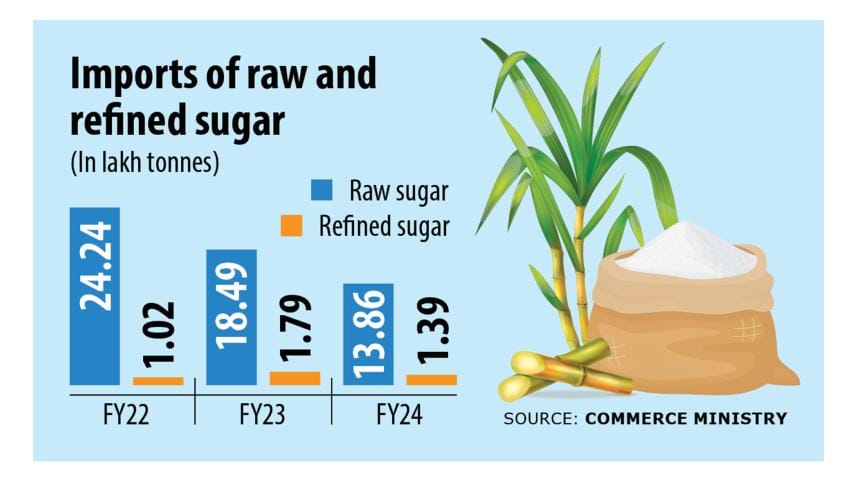

Import of raw sugar by the refiners stood at 13.86 lakh tonnes last fiscal year, down 25 percent year-on-year from 18.49 lakh tonnes the previous year, according to data compiled by the commerce ministry.

"Demand for locally refined sugar declined drastically because of smuggling. Why should we import if there is no demand," said Taslim Shahriar, deputy general manager of the Meghna Group of Industries (MGI), one of the leading importers and processors of commodities.

He said the MGI can supply up to 3,000 tonnes of sugar daily. Now demand for sugar at the mill dipped to one-third of the supply.

"India has been maintaining a ban on sugar export. So, sugar prices remain high in the international market. At the same time, the government maintains high import duty on raw sugar. Taking the opportunity, a section of people are smuggling sugar through the borders," he said.

"This has ruined our sector," he said.

India, the second largest producer of sugar, banned shipment of the sweetener in June 2022 to increase domestic supply amid concerns of poor harvest and spiralling prices. It is yet to lift the bar.

Bangladesh annually requires 24 lakh tonnes of sugar and five refiners meet around 99 percent of the total requirement by importing raw sugar mainly from Brazil.

State sugar mills meet just one percent of the demand.

The MGI official said the amount of sugar being brought illegally through the borders with neighbouring India is estimated to be nearly 7 lakh tonnes.

The Bangladesh Sugar Refiners Association (BSRA) has long been raising complaints over sugar smuggling and security forces on several occasions earlier this year seized the illegally imported sweetener.

According to customs data compiled by the commerce ministry showed that refined sugar imports slumped by over 22 percent year-on-year. The nation brought 1.39 lakh tonnes of refined sugar in FY24 from 1.79 lakh tonnes in the previous year.

Amitava Chakraborty, adviser of City Group, another major commodity importer and processor, said sugar has been coming illegally from the neighbouring countries for the last one and a half years.

"As it is coming without any duty, it is eroding competitiveness of local refiners," he said.

"The illegally brought sugar is substandard in terms of quality and these are sold under the names of local brands. This is also affecting goodwill of the local firms," said Chakraborty

Golam Mostafa, chairman of Deshbandhu Group, said high letter of credit (LC) margins and problems in opening and confirming LCs are other major reasons behind falling import of sugar.

"Besides, import duty is very high," he said, adding that this, together with high LC margins, requires a huge amount of cash from importers.

At present, importers pay tariffs of 58.6 percent to import raw sugar and 67.2 percent to import refined sugar.

This means per kg raw sugar import costs more than Tk 40 in duties, according to the refiners, as they call for reducing the tariffs to around Tk 4 a kg.

The government should immediately remove all duty on sugar and oil. It should bring down the LC margin to 10 percent, added Golam Mostafa.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments