A scammer dies, but the rot in Bangladesh’s banks lives on

Before 2010, Hallmark was a little-known business group. It came into the spotlight over the following two years and ultimately became a household name due to a loan scandal involving more than Tk 3,500 crore.

It was the largest loan scam involving state-run Sonali Bank at the time, which shocked many and sparked a huge public outcry.

One of the masterminds of the scam, carried out using fake documents, was Tanvir Mahmud, then managing director of the Hallmark Group.

He had been serving a life sentence in Dhaka Central Jail for his involvement in the scandal. On November 29 this year, he died while undergoing treatment at Dhaka Medical College Hospital.

He may be gone, but the effects of the loan irregularities still linger. Since then, the country's financial sector has witnessed even larger scams -- one after another -- creating a ripple effect, deepening the crisis, and ultimately victimising thousands of depositors.

Sonali Bank has still been unable to recover the loan, carrying this burden year after year. The banking sector is now heavily burdened by widespread irregularities.

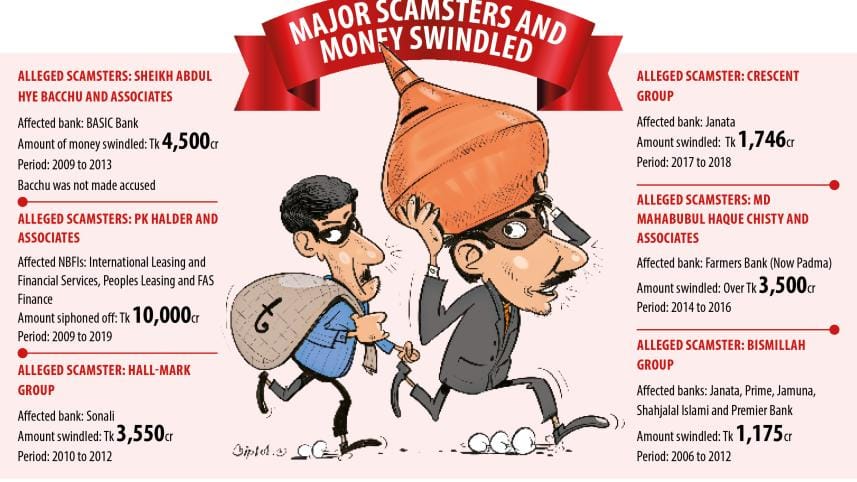

After Hallmark came the BASIC Bank loan scandal, the Janata Bank-AnonTex loan irregularities, the Padma Bank loan anomalies, the PK Halder scam, and the S Alam loan irregularities, which have reached an entirely different magnitude.

Tk 4,500 crore was swindled during the BASIC Bank scam between 2009 and 2013, while PK Halder and his associates siphoned off Tk 10,000 crore.

The Crescent Group swindled Tk 1,746 crore, while Tk 3,500 crore was involved in the alleged scam by Md Mahabubul Haque Chisty and his associates, where Farmers Bank (now Padma Bank) was affected.

Due to the massive scale of scams and irregularities, defaulted loans have reached a record Tk 6.44 lakh crore — 36 percent of total disbursed loans, data show.

Distressed assets, including rescheduled and written-off loans, stand at Tk 9.5 lakh crore.

Not only that, a number of banks are now unable to repay depositors, while at least 16 banks are unable to disburse new loans.

Amid this situation, the interim government has taken the initiative to merge five banks and liquidate nine non-bank financial institutions in the interest of depositors.

The Hallmark scandal is often described as a blessing in disguise for Sonali Bank, as it made the state-run bank far more cautious.

In the years that followed, while massive loan irregularities hit other state-owned and private banks, no major scandal occurred at Sonali Bank.

However, the bank is still bearing the burden of Hall-Mark's liabilities. Sonali Bank has not been able to sell the collateral it collected against the group's loans.

Contacted, Md Shawkat Ali Khan, managing director and CEO of Sonali Bank, told The Daily Star that the bank has identified and taken possession of 134 acres of Hallmark's land. Efforts are underway to determine how these assets can be sold, he added.

"We have already spoken with BIDA (Bangladesh Investment Development Authority) so they can bring in foreign buyers and facilitate the sale. We have also proposed that the government consider taking over the land," he said.

Hallmark's current liabilities at Sonali Bank total Tk 2,500 crore, while the bank has so far recovered only Tk 13 crore in cash.

Khan added that the financial health of the bank has improved due to its cautious approach since the Hallmark scam.

Industry insiders questioned why legal procedures in Bangladesh take so long, as Sonali Bank has yet to recover its loans even after so many years.

They said the country needs more money-loan courts, and that financial-related legal procedures must be completed more quickly. This is because many financial frauds are now occurring, and a large number of cases are being filed in these courts.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments