Rupali Bank to launch new MFS ‘RupaliCash’

State-run Rupali Bank has recently shut down its mobile financial service (MFS) SureCash as the lender is set to launch a new platform, RupaliCash, tomorrow, using its own technology.

The bank discontinued SureCash on September 19 this year, according to officials.

Through the platform, services such as stipend and allowance disbursement, subsidy distribution, and mobile banking transactions were provided.

However, Rupali Bank had long faced difficulties with SureCash after its technology partner, Progoti Systems Ltd, which operated the MFS, decided to change its service model following the Covid-19 pandemic.

Progoti Systems later handed over SureCash's data centre and related systems to Rupali Bank.

The bank then decided to introduce the service under a new brand with upgraded features.

Kazi Md Wahidul Islam, managing director of Rupali Bank PLC, told The Daily Star that among state-owned banks, Rupali Bank is the only one offering mobile banking services.

"Mobile banking saves both time and cost. Keeping customer needs in mind, RupaliCash has been designed with various features," he said.

He added that customers will be able to open eKYC-based accounts, deposit and withdraw cash, transfer funds between wallets, check balances and transaction statements, disburse and receive salaries, recharge mobile phones, and make merchant payments through RupaliCash.

Customers can also transfer money directly from Rupali Bank accounts to RupaliCash wallets without any charge, he said.

"In the future, the service will expand to include savings, microcredit, remittances, e-commerce, credit card transactions, and ATM cash-out facilities," he added.

Rupali Bank first introduced its MFS in 2016 under the name Rupali Bank SureCash, which was later operated with technical support from OSV Bangladesh Ltd, a sister concern of Progoti Systems.

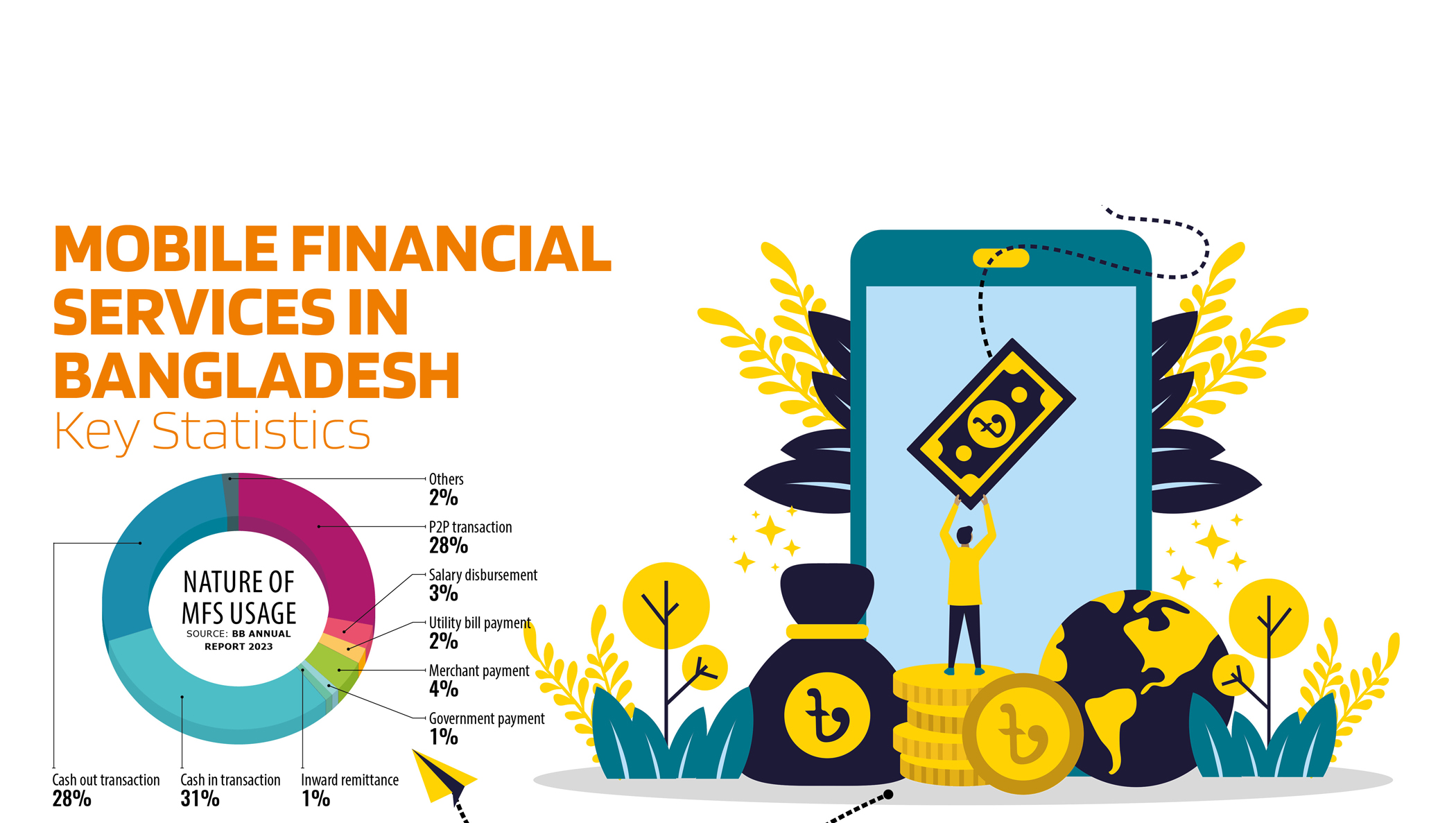

Currently, 13 MFS providers operate in the country. Of them, bKash, Nagad, and Rocket dominate the market, with Nagad still running under an interim licence from Bangladesh Bank.

As of July, the total number of MFS accounts stood at 14.58 crore while transactions amounted to Tk 1,48,566 crore, according to central bank data.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments