Nearly two-thirds of TIN-holders don’t submit tax returns

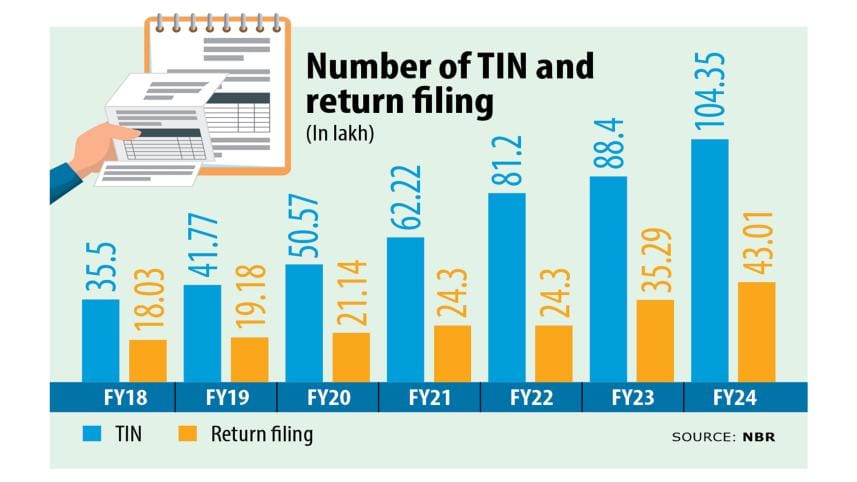

Bangladesh recently reached a milestone registering one crore Taxpayer Identification Numbers (TINs), yet nearly 59 percent of these individuals did not file tax returns in the just-concluded fiscal year of 2023-24.

The number of registered taxpayers is gradually increasing but tax return submissions are failing to keep up with the size and growth of the economy, for which collection of tax required for public expenditure remains lower than the potential.

According to data from the National Board of Revenue (NBR), there were 1.04 crore TINs as of last month, when the fiscal year ended.

Meanwhile, only 43 lakh tax returns were submitted, up 22 percent year-on-year.

Bangladesh has one of the lowest tax-to-GDP ratios in the world, even though it posted high economic growth over the past decade.

"The increase in the number of TIN holders is a positive development. Overall, the tax net has not yet been adequately expanded in Bangladesh," said MA Razzaque, research director of Policy Research Institute (PRI).

But the number of tax returns being submitted is very low. Bangladesh still lags behind Southeast Asian countries such as Vietnam, Thailand and Malaysia in this regard, he said.

Many taxpayers do not submit tax returns to simply avoid going through all the paperwork and out of apprehensions over being harassed by the tax administration, Razzaque said.

The economist suggested reducing individual contact between the NBR officials and taxpayers through automation.

"The NBR should ensure automation in auditing to reduce the scope of corruption and harassment," he said.

At present, filing of tax returns is mandatory for all with a TIN.

Currently, a TIN is required for availing around 40 services, so many people secure it but do not submit tax returns, according to the NBR.

Analysts blame inadequate monitoring and enforcement, the absence of regular taxpayer surveys by independent agencies, and the slow pace of automation of the tax administration for the low number of tax returns being submitted.

In a report prepared recently, the NBR said around 5 lakh people do not submit tax returns as they only needed the TIN for land transfers while around 4 lakh people availed TINs to seek specific services.

Over 2 lakh people with TINs have already passed away and some 3 lakh people availed TINs to migrate abroad for jobs and other purposes, according to the NBR.

Another prime reason is a lack of awareness among taxpayers.

Besides, a huge number of firms that registered as companies have become inactive.

The NBR found that Bangladesh has around 1.37 lakh inactive companies under the Registrar of Joint Stock Companies and Firms.

A large number of people availed TINs to get trade licences but those firms later became dormant.

Shams Uddin Ahmed, a former member of tax policy at the NBR, said the culture of tax payment needs to be developed gradually.

The NBR has initiated various steps to motivate taxpayers, said Ahmed, hoping that interest among taxpayers in doing their share in building the nation would increase in the coming days.

There is a lack of understanding among tax officials about new modes of digitalisation and innovative business models, he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments