NBR waives VAT on locally produced edible oil, essentials to stabilise market

The National Board of Revenue (NBR) has waived value-added tax (VAT) at various stages on edible oils, including mustard, rapeseed, canola, and rice bran oil, as well as other essentials, to stabilise the domestic market.

The tax administration issued a notification in this regard yesterday, which was made public today.

According to the notification, VAT will be exempted at the production stage of rapeseed oil, colza seed oil, and canola oil until June 30 this year.

Mustard oil will also be exempt from VAT at the production stage, with no time limit specified.

In addition, VAT exemptions at the business level apply to a range of domestically produced essentials, including biscuits, salt, flour, semolina, chilli powder, both solid and powered forms of coriander, turmeric and ginger, rice bran oil, sunflower oil, rapeseed oil, colza seed oil, canola oil, and lentils or pulse-based food grains.

The NBR has also introduced VAT exemptions on liquefied petroleum gas (LPG) and natural gas at the business level under specific conditions.

However, importers selling directly to consumers will not qualify for the exemption.

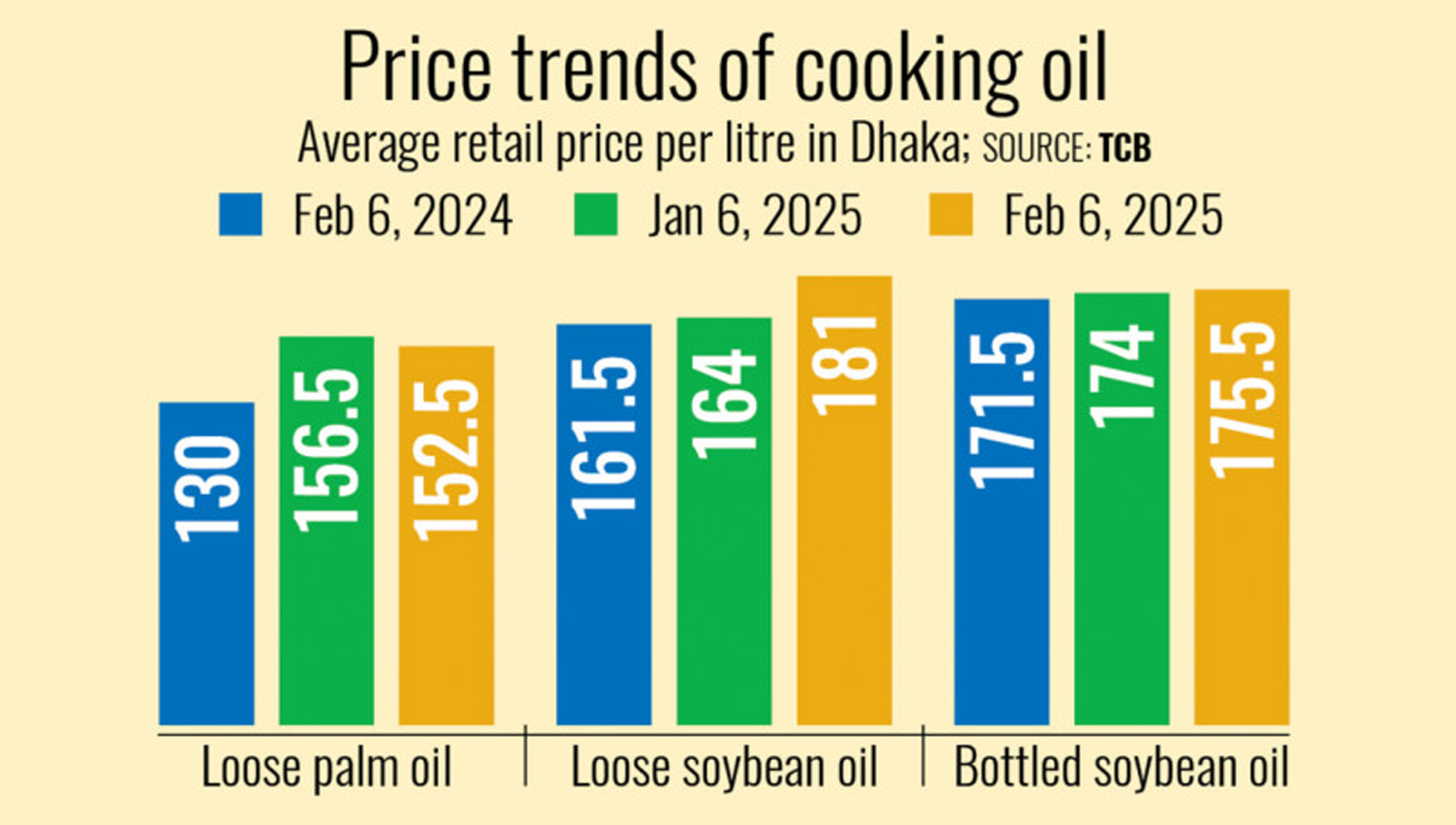

"The NBR has taken this step to stabilise the domestic market, particularly the edible oil market," said a senior NBR official, expressing hope that it would ease the burden on consumers.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments